Google Nexus S is real, gets leaked by Best Buy [U] | Electronista.

Can you imagine Microsoft launching a Microsoft branded phone to compete with its Windows Phone licensees? When Microsoft launched the Zune, their licensing model (PlaysForSure) was quietly folded up.

A Google phone makes little sense, but then again Google does not seem to care much about its ecosystem or relationships with Android device vendors. They even claim that they have no idea how many phones are being built using Android and, except for activations, have no way of measuring the number sold.

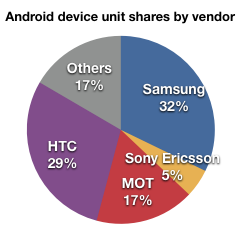

From their point of view, if Motorola feels it’s unfair to have to compete with a Google branded Samsung (or HTC) designed phone then too bad. There’s lots of white label vendors lined up to make these with or without anyone’s blessing.

In fact, the biggest opportunity for Android growth seems to be the large unlicensed (and illegal) grey market which seems to be rapidly expanding.