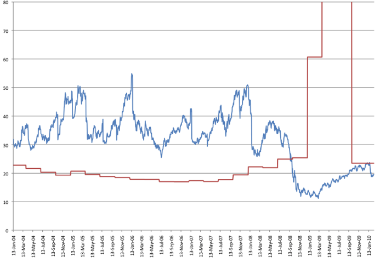

Following up on the Apple Valuation Entry, I went to the data and pulled the historical P/E for Apple back to include all of 2004 (in blue) and did the same with the S&P P/E (in red).

Following up on the Apple Valuation Entry, I went to the data and pulled the historical P/E for Apple back to include all of 2004 (in blue) and did the same with the S&P P/E (in red).

A few notes:

- Apple’s P/E was consistently above 30 until mid-2008

- Apple’s P/E was consistently and substantially above the S&P until mid-2008 by at about 10 to 30 points.

- A reversal occurred at that point with S&P P/Es reaching record highs (actually at over 120 in May) and Apple’s reaching record lows of 11 at a time when the S&P P/E was over 60.

- Since the reversal, Apple’s P/E has been consistently below the S&P’s and indeed has stayed near historic lows while the S&P is returning to historic averages.

This reversal happened during a time of recession when, in contrast to most companies, Apple kept growing. The spike in the S&P P/E is due to a dearth of earnings, while Apple had increased earnings, sometimes to new records.

As a “premium” brand it’s perhaps perplexing that Apple seems to be acting as a counter-indicator to macroeconomic conditions.

Expectations for Apple to decline in times of economic contraction did not come true and as recovery seems near, Apple appears to be discounted.

In other words, when times are bad, Apple surprises and does well so therefore when times are good Apple should do badly.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.