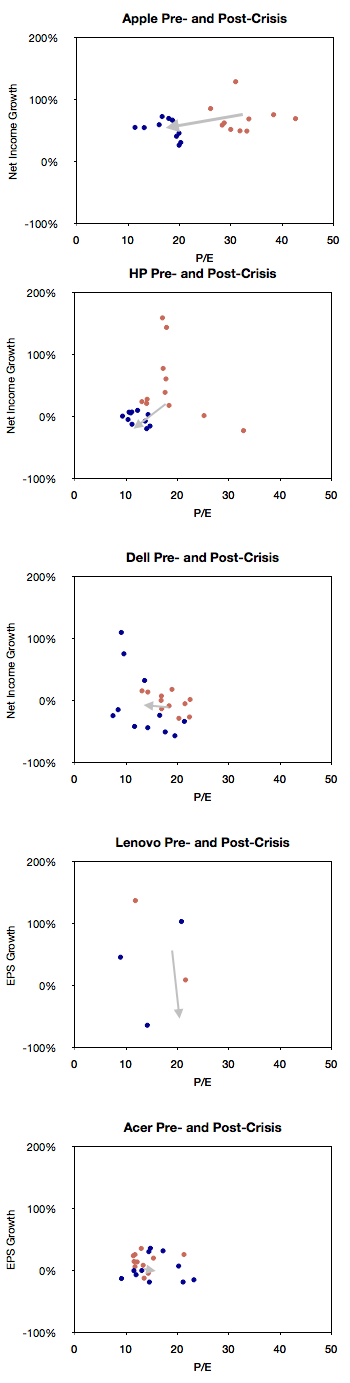

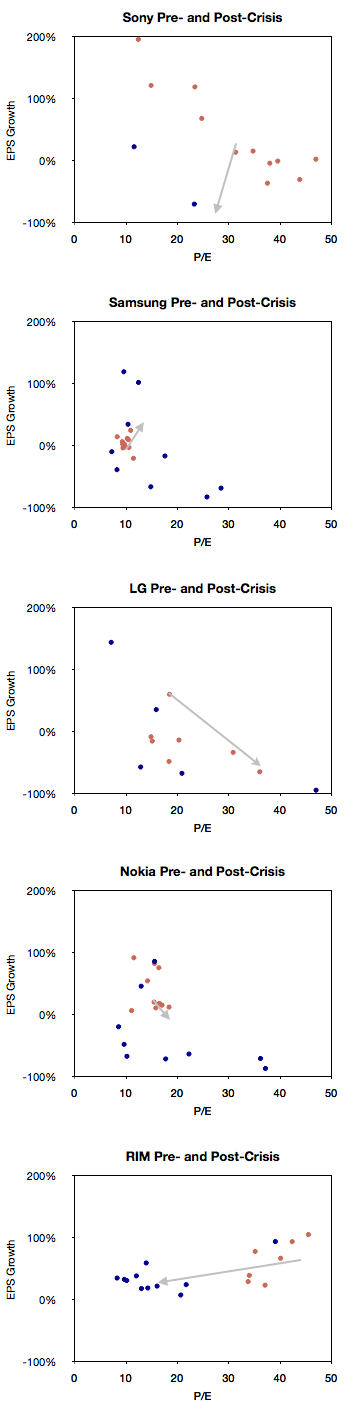

Following the presentation of growth/PE of comparable companies in the previous post, here are charts showing the Growth vs. P/E as a scatter plot. I highlighted the quarters pre-crisis as red dots and the quarters post-crisis as blue dots. I also added a vector line showing the migration of the average (centroid) of the pre-crisis values to post-crisis values (11 points averaged in each case).

Note the relatively strong separation of data (pre- and post-crisis) for the following companies: Apple, HP, RIM, HTC, Microsoft and Google. Of these the sharpest separation was that of Apple.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.