During my talk at the first Apple Investor Conference in January I said that I would pay very close attention to the Machinery, equipment and internal use software line item from its PP&E during the next quarterly report (it appears on Page 13 in the latest report).

The reason I consider this important is because capital spending has provided reliable foreshadowing of iOS device production. This is itself because Apple invests in the equipment used in the manufacturing processes for its devices. The more spending on equipment, the more production capacity is brought to bear and the more units are produced. Since iOS devices tend to be supply constrained, the more units are produced then the more are sold.

The first quarter of the fiscal year saw a very small increase in CapEx which caused me to “backload” spending later in the year. By watching this spending, we can assess approximately when and for which products is investment allocated. If the spending happens early then we can anticipate an early update to the iPhone. If it happens late then we can anticipate a late release. So has the ramp-up begun as of the second quarter (first calendar quarter)?

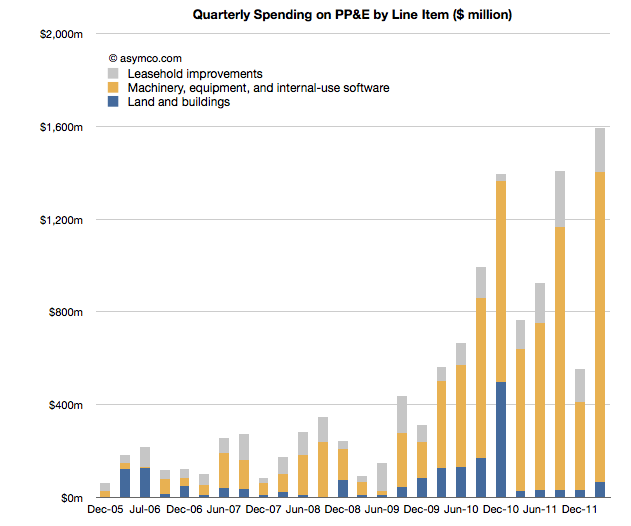

The following chart begins to give us the answer. It tells the story of spending by tracking the change in asset values:

Stripping out the Machinery and Equipment portion (in yellow above) and overlaying the following quarter’s iOS shipments yield the following composite graph: Continue reading “Up to eleven”