iTunes (including software and services) revenues in Q1 topped $4 billion and were 30% higher than (re-stated) 2012 Q1 revenues. Accompanying this revenue figure were additional data points from the company:

- Cumulative app downloads have surpassed 45 billion

- Payments to developers reached a cumulative total of $9 billion

- Payments to developers were $4.5 billion in most recent four quarters

- Now paying $1 billion to developers every quarter

- 800 apps are downloaded every second

- iOS app revenues doubled since year-ago quarter

- App Store accounted for 74% of all app sales in the quarter (citing Canalys)

- App stores reach customers in 155 countries (850k Apps, 350k iPad apps)

- iTunes music downloads are available in 119 countries (35 million songs)

- Movies are sold in 109 countries (60k titles)

- iBookstore is available in 155 countries (1.75 million titles)

This data allows for a few inferences:

- Nearly 70 million apps are downloaded every day

- The average revenue per game is about 23 cents

- Gross app revenues are about $16 million per day (of which 11 million is paid to developers.)

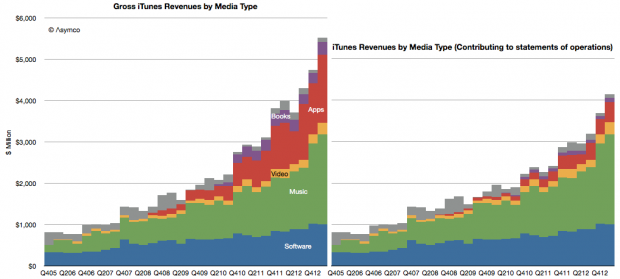

- Gross iTunes revenues were $5.4 billion last quarter of which I estimate:

- …App revenues were $1.6 billion

- …Music revenues were $2.2 billion

- …Video revenues were $287 million

- …Book revenues were $312 million

- …Apple’s software generated $1 billion

- In addition, I estimate that Services generated $100 million

Note that there is a difference between the amounts transacted through the store and what the company reports. The difference is shown in the following graph

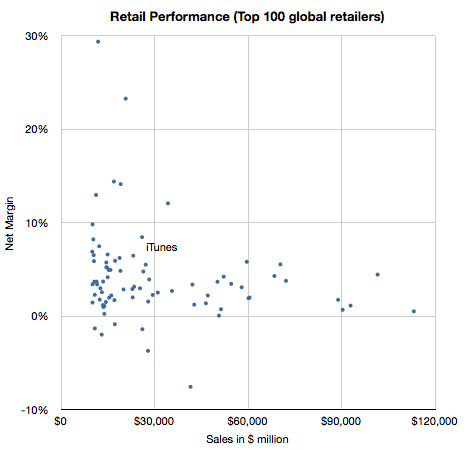

To mark it’s 10th year, I wrote a segment for Billboard Magazine describing what iTunes has become. I suppose it’s easy to become numb to these numbers, but there is perhaps one way to look at iTunes that is still compelling:

Selling $20 billion a year would put iTunes in the top 20 US retailers and top 50 Global retailers.

Not bad for a 10 year old.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.