Thanks to Symbian, the EU5 countries (France, Germany, Italy, Spain and the UK) had an earlier start in the conversion of phone usage from non-smart to smart devices. According to published comScore data, in July 2010 the EU5 were at 26.6% penetration of smartphones and the US was at 22.8%1.

However, with the aid of mobile operator subsidies, by the beginning of this year, the US caught up. According to comScore EU5 reached 57% penetration in March 2013 while the equivalent figure for the US was 58%.

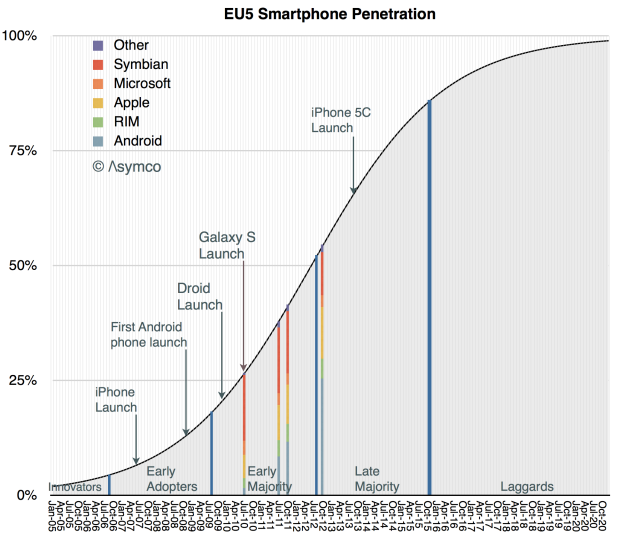

Using the logistic curve model introduced last week, it’s possible to get an approximate categorization of the adopters of the technology:

As with the previous analysis, the graph identifies the following dates:

- The Innovators’ period ended in the EU5 approximately in September 2006. (The equivalent period ended in the US in February 2007.)

- The Early Adoption period ended in the EU5 in August 2009. (US: December 2009).

- The Early Majority period ended in the EU5 in August 2012. (US: September 2012)

- Late Majority will end in the EU5 in November 2015 (US: November 2015)

Therefore if we want to suggest that saturation happens near 100% then the answer to the question in the headline is “the end of 2020.” If we want to suggest that saturation is the end of the Late Majority then the answer is “two years from now.”

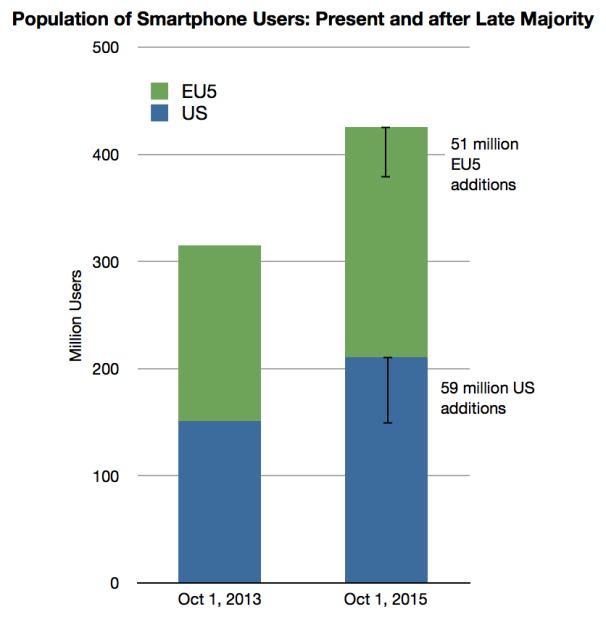

One final observation: the two markets appear to be converging thus placing the analyst in the comfortable position of forecasting the adoption of smartphones for a total population of 425 million people2.

If we define saturation as the end of the “Late Majority” period then the number of new-to-smartphone users remaining for the combined EU5 + USA markets is 110 million of which 59 million will adopt in the US and 51 million in Europe. They will all join ecosystems in the next two years.

Plan accordingly.

- The population is defined as adults using phones for themselves. Meaning it excludes children and phones purchased by companies. [↩]

- see previous note [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.