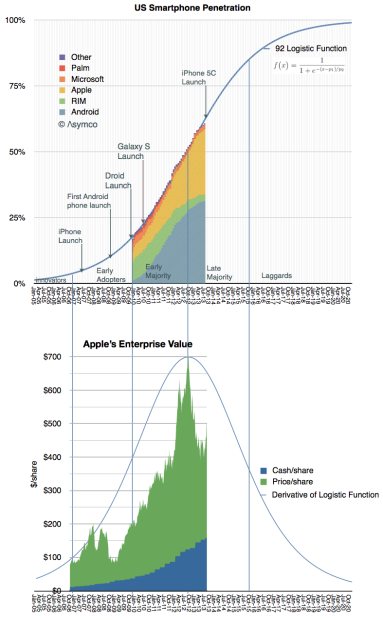

The analyses of adoption of smartphones in the US and EU5 are remarkably consistent with each other. They also turn out to be consistent with the valuation of Apple.

I show the stages of adoption overlaid with the derivative of the Logistic Function and Apple’s enterprise value. The derivative of the Logistic Function shows the speed of adoption, peaking at the inflection point when adoption ceases to accelerate and begins to decelerate.

The peak in Apple’s enterprise value happens to fall at the exact point of inflection in the adoption curve and hence maximum growth.

It could suggest that the market perceives the value of Apple to be entirely reflective of the US market.

But I can’t imagine anyone would be so foolish as to believe it.

One can only conclude that it must be just a coincidence.1

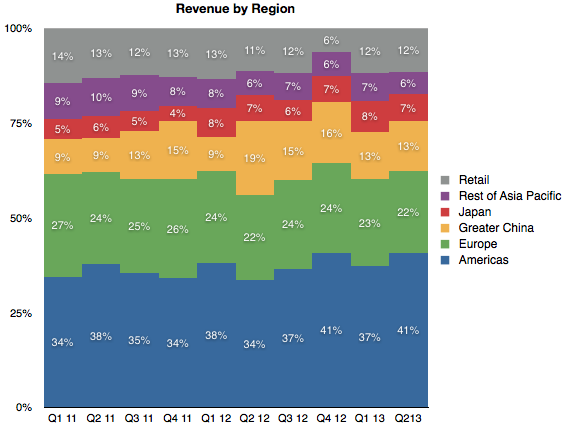

- Apple’s revenues by region:

[↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.