When describing the process of disruptive innovation, Clay Christensen set about to also describe the process by which a technology is developed by visionaries in a commercially unsuccessful way. He called it cramming.

Cramming is a process of trying to make a not-yet-good-enough technology great without allowing it to be bad. In other words, it’s taking an ambitious goal and aiming at it with vast resources of time and money without allowing the mundane trial and error experimentation in business models.

To illustrate cramming I borrowed his story of how the transistor was embraced by incumbents in the US vs. entrants in Japan and how that led to the downfall of the US consumer electronics industry.

Small upstarts were able to take the invention, wrap a new business model around it that motivated the current players to ignore or flee their entry. They thus successfully displaced the entrenched incumbents even though the incumbents were investing heavily in the technology and the entrants weren’t.

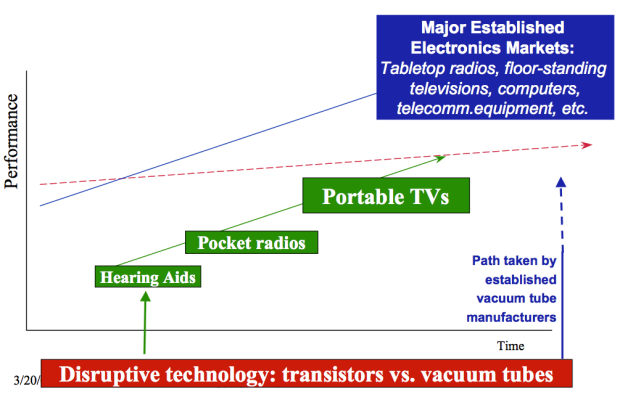

In the image below, the blue “path taken by established vacuum tube manufacturers” is the cramming approach vs. the green entry by outsiders who worked on minor new products which could make use of the rough state of transistors at their early stages of development.

The history of investment in transistor-based electronics shows how following the money (i.e. R&D) did not lead to value creation, quite the opposite. There are many such examples: The billions spent on R&D by Microsoft did not help them build a mobile future and the billions spent on R&D by Nokia did not help them build a computing future.

There are other white elephant stories such as IBM’s investment in speech recognition to replace word processing, the Japanese government spending on “Fifth Generation Computing” and almost all research into machine translation and learning from the 1960s to the present.

But today we hear about initiatives such as package delivery drones and driverless cars and robots and Hyperloops and are hopeful. Perhaps under the guiding vision of the wisest, most benevolent business wizards, breakthrough technologies and new infrastructures can finally be realized and we can gain the growth and wealth that we deserve but are so sorely lacking.