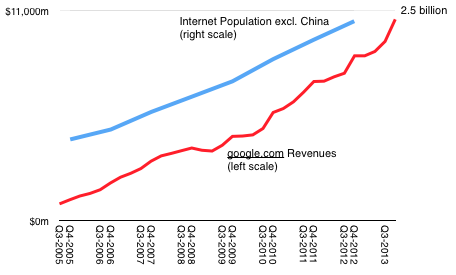

From 2005 through 2012 Google site revenues1 have risen at a rate consistent with the growth in global Internet population excluding China2. The Internet population and Google.com revenues for the period 2005-2012 are shown in the following graph.

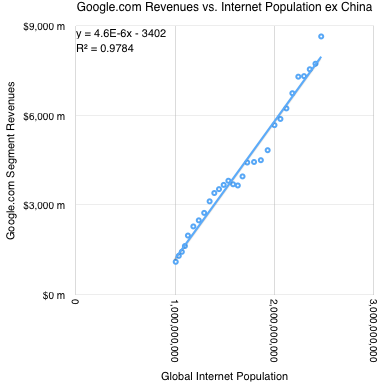

The correlation is shown in the following graph:

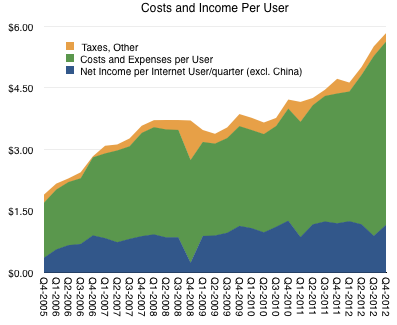

Taking into account costs and expenses, on a per-user basis profitability per user (assuming all non-Chinese internet users are Google users) is shown below:

The simple conclusion is that Google earns approximately $1.2 per user per quarter (net income is the blue area above). This figure is relatively constant with a slight increase (~20%) over 3 years.

If the company does not alter its business model then the future potential of the business could be measured as a function of Internet (ex. China) population growth.

How hard can that be?

The next post will answer this question.

- Google revenues are reported as “Google.com”, “Network”, “Motorola” and “Other”. For this analysis I am including only the Google.com revenues [↩]

- Internet population is calculated as a combination of penetration as reported by the ITU and population data from the World Bank [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.