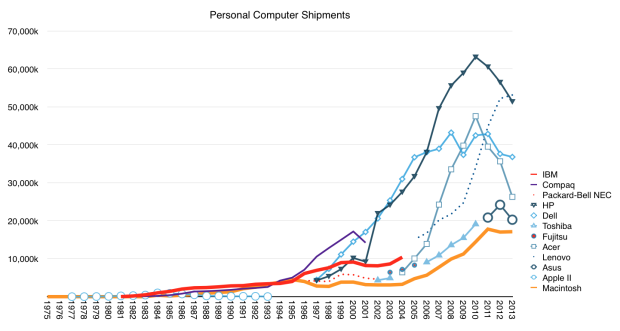

IBM did not invent personal computing but their “PC” became synonymous with the category. Having entered the market in 1981, the IBM PC quickly became the top selling brand. From 1984 to 1993 IBM sold more PCs than any other vendor, conceding the spot to Compaq which remained on top only until 2000. No PC vendor remained at the top of the sales leagues longer than IBM. HP had the second longest run but that run was broken last year as Lenovo (who acquired IBM’s PC business) surged.

As the graph above shows, the period of time when IBM was dominant was characterized by far lower volumes. In 2004, the year IBM exited, they sold about 10 million units. ((as the graph shows, if we consider Lenovo as taking over from there, they did a very good job extending the legacy.)) It was a decent performance but one that did not keep up with the Dell and HP/Compaq race to the bottom in pricing and subsequent rise in volumes.

However, throughout its position of strength, IBM was a reluctant PC maker. IBM never controlled the PC platform the way they had controlled their mainframe and mini-computer businesses. Their falling out with Microsoft over OS/2 and their attempts at differentiating with the PS/2 architecture show how uncomfortable the situation was. Their exit in 2004 must have come as a relief and, in retrospect, they should be congratulated for having exited the market well before it began deteriorating. First came pricing and margin collapse and later total volumes began to decline. Most of the remaining vendors are today in various states of distress. Lenovo is growing but incumbents like Dell, HP and entrants have come and gone (Fujitsu, Sony, NEC, Toshiba). Potential disruptors like Asus and Acer have found no long-term success with PCs.

This is because without control over the platform, PC hardware is nothing more than a commodity, with negligible margins, intense competition and an inability to control one’s destiny.

One company making computers did manage to control its destiny. By continuous refinement, the Macintosh survived and even thrived as the market pivoted toward mobility (and hence requiring integration that values design). Indeed, Apple now ships over 17 million Macs a year. More than either IBM or Compaq did at their peaks. It’s not in the top five globally but has a very profitable niche.1

As a matter of fact, through 2013 Apple shipped a total of 156.5 million Macs, 50% more than all IBM PCs ever shipped. Apple also shipped more than twice as many iPads and five times more iPhones. And it’s not just popular with consumers. With iOS Apple manages to reach 98% of Fortune 500 companies and 92% of Global 500.

At the same time, even though IBM exited the hardware business, it remained a powerful force in computing. IBM pivoted to primarily being a service company with a vast client base and increasing global reach. It essentially moved up the value chain to become an integrated services provider to business customers. IBM’s reach in breadth and depth of services is extraordinary.

This dramatic turnaround–Apple moving to a device leadership position and IBM moving to a service leadership position–created the conditions for today’s announcement of a strategic partnership–an event which is astounding to those who witnessed the 1980s and 1990s. Were it not for the tenacious independence of Apple and the business model agility of IBM, neither company would be around today to leverage one another.

There is drama in this industry and this latest chapter has a plot twist which any poet would envy.

- It’s very likely that it captures more operating profit than the top five vendors combined. [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.