In March 2016 Ben Bajarin and I put on an event called SUBSCRIBE where we asked, among other things,

- How will the online services business models evolve?

- How will hardware affect software and services and vice versa?

- How will users, usage, and capital connect?

Now is a good time to look back on that event.

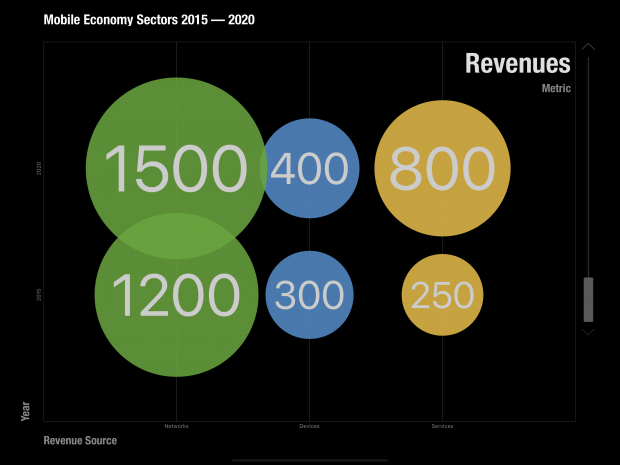

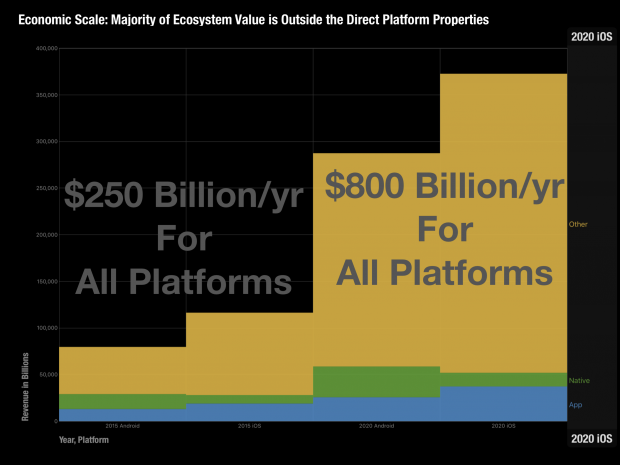

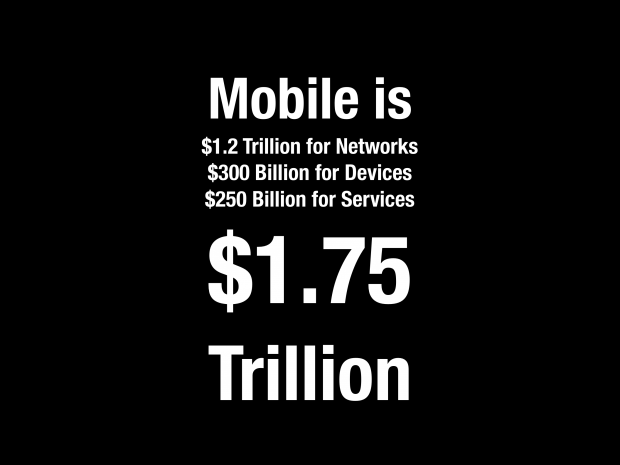

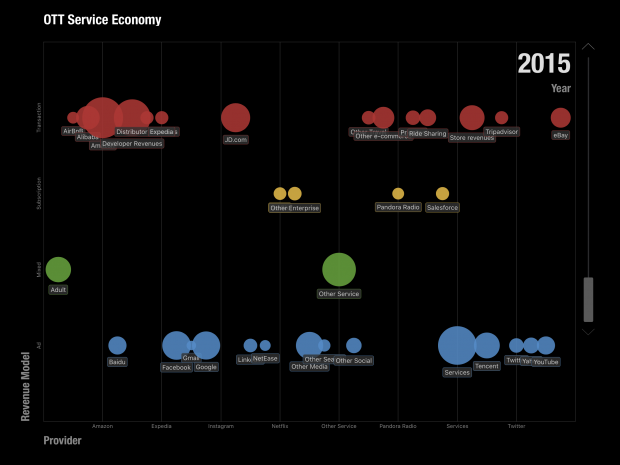

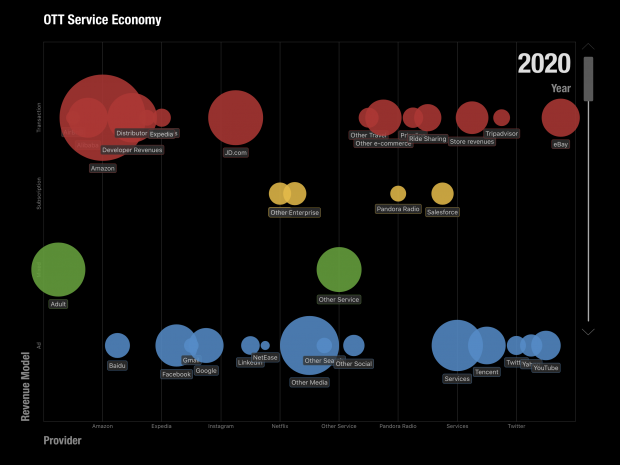

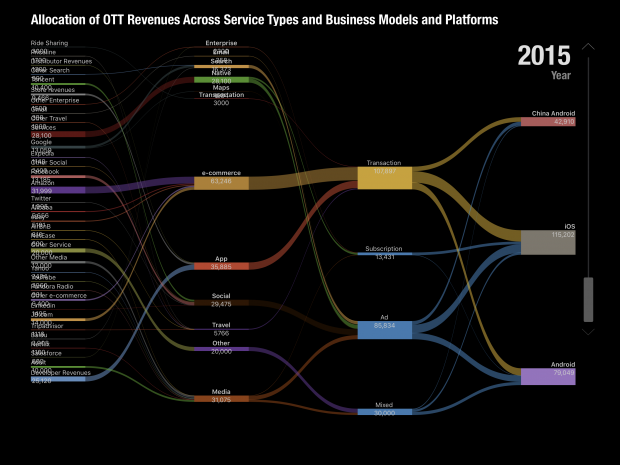

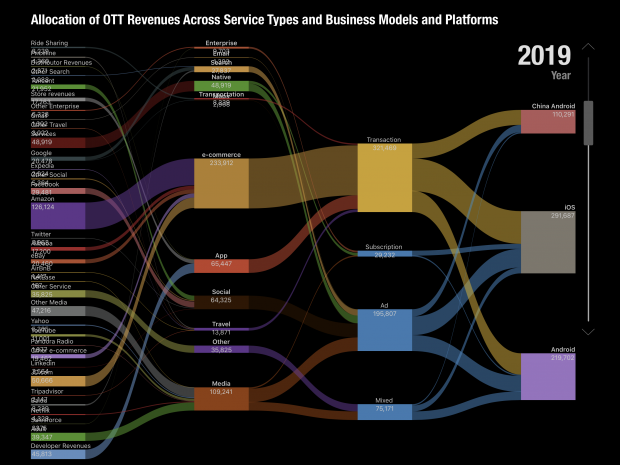

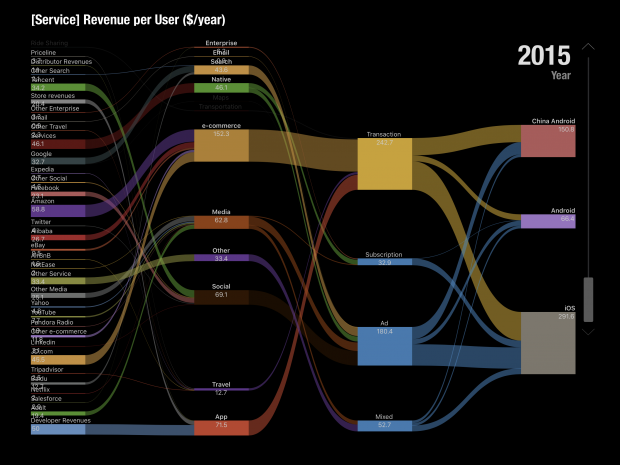

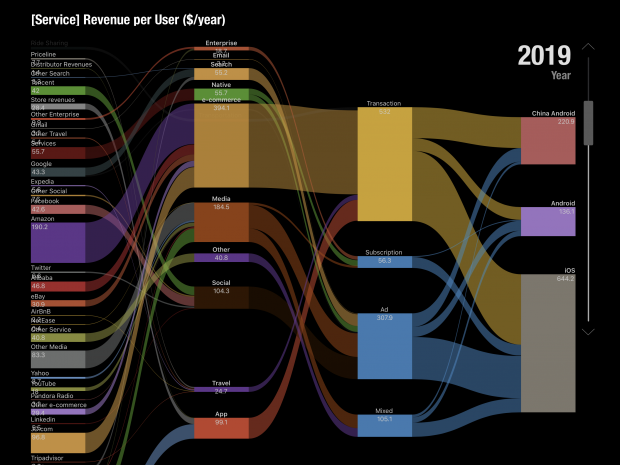

For the keynote I prepared a model which predicted the mobile ecosystems for iOS, Android and Chinese Android over the next 5 years (to 2020). The methodology involved taking a measurement of the revenues of the top internet service companies, building up the categories these companies occupied, estimating how much of those revenues are through mobile distribution and then splitting the result among the three platforms of iOS and the two Androids.

Adding to that the “native” app and content revenues for each platform would yield the Ecosystem total value. Applying a growth rate would offer some visibility into the future.

The following images are screen captures of the Perspective presentation.

Of course there are several potential errors in this methodology. The categories were not all inclusive. I used Social, Media, Search, Maps, email, Messaging, e-commerce, Travel, Enterprise, Storage, Transportation, Travel and Other as the top level categories. There are many products and services who would end up in Other. Moreover, these categories were anchored by the top companies in each category and the share of the top names was not always clear. Finally, the growth rates for these categories were based on historic trends which could change either way.

The online services ecosystem (all platforms) was thus estimated to be $450 billion in 2015, growing to $820 billion by 2019 and $914 billion by 2020.

The mobile split would vary by segment but would be roughly 75% by 2020 (25% would not be mobile). The final assumption was based on the split among the existing mobile platforms. I put a multiple of roughly 50% for iOS and 35% for Google Android and the rest for China Android.

Multiplying all these assumptions gave me a figure of $275 billion for the iOS portion of the global online services market in 2019. (Incidentally, Android was estimated at $207 billion and China Android $110 billion.) Note that this does not mean this was an expectation of Apple’s revenues or that this was the opportunity of Apple obtaining any percentage of this revenue. It was simply the value of what would transact through iOS, a platform which would act as a commerce enabler. This was to be the size of the iOS “ecosystem” or co-dependency between Apple and the companies delivering through its platform.

Ecosystems are a powerful idea. As I recall, this term applied to mobile was coined by a Palm executive in the late 1990s when he referred to the value of all the apps built for the Palm Pilot. The biological term refers to the system of multiple species living in close proximity. It implies an equilibrium as each species benefits from the others and the environment. There might be predators and prey but biodiversity is the successful construct.

The idea of an ecosystem for a platform was also the core strength of Microsoft’s Windows which created the network effects around it and it has been the goal of every platform since. The nature of computing and networking implies that these systems grow faster and are more resilient than the more traditional value networks of other businesses or industries.

Now this ecosystem was something we wished to highlight in 2016 as a core strength for Apple. It was not considered as such at the time and I thought putting a figure of $275 billion in 4 years’ time was a way to highlight the potential. Time since has proven us right.

This week Apple highlighted the result of another research team who attempted to measure the iOS ecosystem. Their conclusion was that billings and sales facilitated by the Apple App Store Ecosystem in 2019 was $519 billion. More than twice the amount I had so optimistically forecast four years earlier.

The authors also emphasize that this is a conservative estimate and should serve as a baseline.

I feel partly vindicated about that figure as my attempt at a figure was intended to highlight the scope of the ecosystem and it is better to have underestimated it than overestimated it. The authors’ methodology was also similar in being bottom-up summation of components by categories of services but the information available today is enhanced by the new data Apple made available on subs and Services revenues and install base.

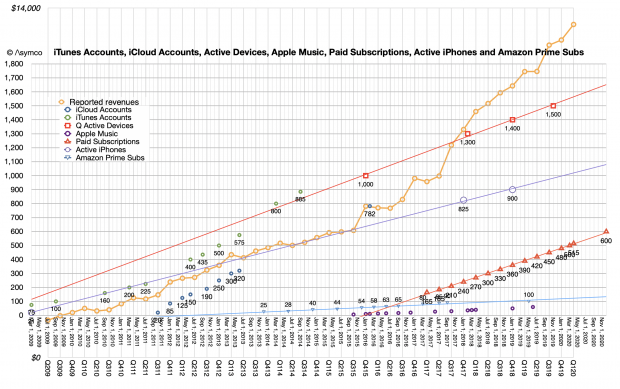

Note that in the graph below the salient data points of subscribers (red triangles) had not begun until 2017 causing the acceleration in Services revenue (yellow line). Note also the additional square points representing install base.

This figure of more than half a trillion dollars of value transacted through iOS should give some pause. It it a very powerful figure that can be combined with the other data from Apple:

- More than 1.5 billion active devices

- More than 1 billion iPhone users

- More than 500 million paid subscriptions

- More than $1/day iPhone hardware revenues for Apple

The half-trillion per year on services implies between $335 and $520 in spending per user (likely closer to $500) per year. This would be in addition to the approximately $365/yr in hardware spending per user (which Apple books as hardware revenue). In the case of the iPhone there is yet more: the cellular network service which may average $350 per year.

To simplify, the “average Apple user” spends $1/day for each device, $1/day for the network and $1.4/day on items bought through the device. Adding a margin of error, that’s between $3.4 and $4 per day each user spends. Oh, and there are about a billion such users.

The total spending enabled by iOS thus is close to $1.4 trillion/yr.

That’s a significant amount. It’s bigger than many industries. There are only about 12 countries with higher GDP (Spain is about the same.)

How does Apple benefit from this?

Apple captures 30% of billings through its App Store. My estimate for these billings were $67.9 billion in 2019 which means App Store billings were 13% of the 2019 ecosystem. Apple’s 30% cut of Billings amounts to 3.8% for the whole ecosystem. It’s hardly an oppressive number.

If Apple only captures 3.8% what use is this to Apple?

The last decade has seen Apple emerge as the world’s largest company in terms of market capitalization, and not doing so with a wild multiple of revenue or earnings, quite the opposite. It did this by creating the world’s greatest customer base. Not in absolute scale. Android and Facebook have larger customer bases with multiple billions of users.

No, Apple’s one billion users are simply the best billion users. They are the most likely to stick with Apple and they are the most likely to buy more from Apple and—this is crucial—they are the most likely to buy everything else. Those other companies whose sales come from Apple customers have been taking note. They know that Apple customers are desirable customers and choose to target Apple customers, as much as they can. Associating your company with Apple makes a lot of economic sense.

I will admit however that my argument that Apple created a customer base is contrived. The fact is that Apple creates products and services and those products are the root of its power to attract the right customers. By choosing to create the best products it coincidentally chooses to create the best customers. The power flows from product not from pricing or positioning. This is a lesson lost for many.

Developers and regulators might feel Apple’s massive power is perhaps too much. In the last decade, the narration around Apple has shifted from Apple being perpetually “doomed” to it being too dominant. Although I’m sure there are some who will try to conflate the two declaring that dominance will inevitably result in doom, most critics of Apple went from laughing (at it) to crying (about its practices).

The argument that Apple should change its practices developed to price as it does, distribute as it does or design as it does because it was too successful or is “unfair” is getting the causality wrong. Dominance won’t be altered by a few points of percentage change (on a tiny fraction of ecosystem transactions). Fairness won’t be altered when there are thousands of business models and many remain to be invented. Case in point is pornography which is not permitted on the App Store but which exists in abundance thorough other access methods.

The argument is that Apple should be more generous. That it should decrease the “cut” it takes for distribution. Or that it should not enforce revenue split for the customers it exposes to others.

But this is problematic on many levels. The playing field for all developers needs to be level. The customer must be respected and access to that customer should be constrained or certainly metered. Abuses must be policed and that requires leverage.

These practices are inter-dependent and the effect multiplicative, not additive. Apple has a monopoly on iOS and on MacOS and WatchOS and iPadOS. It does this to control the experience, security and safety of the user. It’s that control which created the customer in the first place. It should naturally control access to its hard-earned customers.

It does not monetize the distribution of content or apps unless the developer/creator directly charges for the product or service. Distribution is not cost free and to offer it for free is a subsidy which would create additional market and innovation disincentives. The loyalty of Apple users is evidenced by the 600 million paid subscriptions (end of year estimate) that are booked through the App Store. Developers benefit directly as a result.

One could argue that the abundance of services which don’t distribute through the App Store is evidence that the system works as intended. Apple’s App store front is its property and it reflects its core values.

Being on the shelf in the App Store means you operate on the terms of the shelf owner. If the rules are not agreeable then the half trillion dollars of ecosystem activity is testament to the availability of alternatives.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.