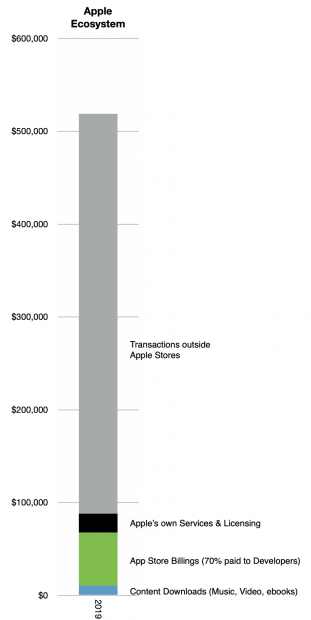

According to one estimate, in 2019 Apple’s ecosystem was approximately $519 billion. This includes both transactions that Apple handles, such as paid apps, as well as purchases and other economic activity that happened through apps in which Apple is not involved in the transaction, such as Uber, Bird or Bond rides.

A fraction ($48 billion or 9.3%) of this total is reported as part of Apple’s financial statements as “Services Revenues”. The rest ($471 billion) is reported on other financial statements, typically businesses which use apps to book sales. These are app revenues are not even accounted as “Payments to Developers” as they are not paid directly to any developer.

The attention to Apple’s terms and conditions with developers only apply to transactions in the area shown in green below. The grey area is all outside the App Stores and attracts no attention.

The attention paid to Apple’s new services including the “+” brands of TV, News, Arcade, Music and now Fitness and the new bundling thereof refers to the area shown in black above.

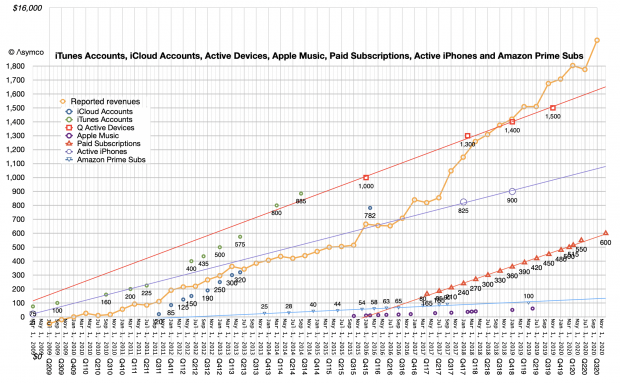

The Green and Black areas are also captured through subscriptions whose quantity is charted with triangles below. Note that the latest quarter saw an acceleration in the accumulation of subscriptions, putting the 600 million target set for end of this year closer than expected. Note also the change in slope of the yellow line as the triangles were added.

These two charts are an attempt to illustrate what is a huge set of activities. Apple’s product lines may be something we can grasp in terms of objects for sale and price points, and feature sets, etc. But the Ecosystem that sits on top of these devices is not comprehensible.

There are literally millions of apps, services, and ways of delivering and capturing value. There are millions of people employed in what amounts to an economy bigger than the 25th largest in the world (Belgium (1)). It’s half a trillion dollars of activity.

Given the growth of the underlying Services segment (~15%), it’s probably going to double in 5 years to $1 trillion. Apple will certainly benefit as even if only 9% of that is booked as direct revenues, the rest will create resilience in the user base.

The power of an ecosystem isn’t what Apple is able to skim from it but rather that millions of other people will want to encourage and preserve its existence as their livelihoods, hopes and aspirations will depend on it. This goes beyond loyalty of end users (which is extraordinary) as it’s a loyalty of those who co-invest in it. All participants in an ecosystem become partners in its preservation.

Apple is not the only technological ecosystem out there, but I’m willing to bet that it’s the most vibrant in terms of creative effort, economic value and growth.

This ecosystem is a thunderous declaration of value which is largely unheard by investors or analysts. While looking at the potential for growing the direct revenue with “+” Apple services, the indirect, qualitative added value of services which never hit Apple’s income statement are ignored. Like the ignored value of a satisfied customer, how much is the value of an economic co-dependency?

- Although it’s inappropriate to compare a company’s market capitalization (which is a measure of asset value) with GDP (which is a measure of economic activity) an “economy” like the value of all transactions in an ecosystem is comparable with GDP.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.