I truly believe, and many others in the company believe, that there will come a day that the tablet market in units is larger than the PC market.

Tim Cook Discusses Q1 2012 Results – Earnings Call Transcript – Seeking Alpha

Question is when?

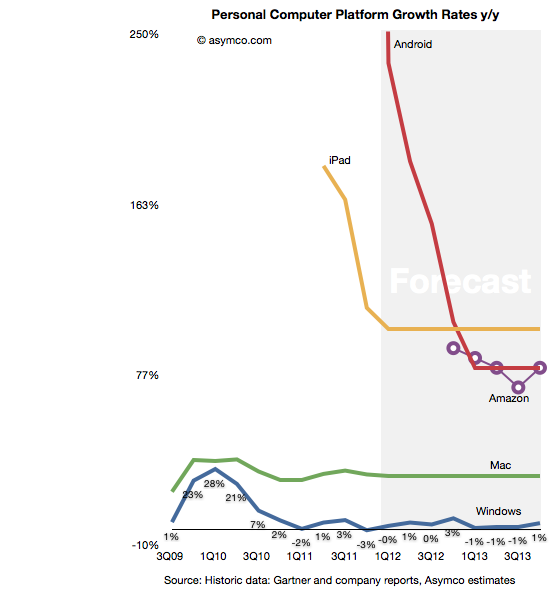

I began by projecting growth rates of various market participants including the leading Windows PC makers (HP, Acer, Dell, Lenovo and Asus), the combined “others” and the Mac. I also added the iPad, Samsung’s tablets, other Google sanctioned Android tablets and Amazon. I also projected a split between traditional and tablet Windows shipments.

The underlying assumptions are:

- Mac growth continues at 25% as it has on average for a few years

- Windows grows slightly in 2012 with the introduction of Windows 8 late in the year. However I anticipate Windows 8, including tablet versions, to mostly be upgrades with slow enterprise take-up within this time frame.

- The tablet versions of Windows begin shipping in Q4 2012 with 7% of total Windows shipped. The ratio reaches 20% by end of 2013.

- iPad growth will flatten for ’12 and ’13 at 100%, similar to iPhone’s historic performance.

- Android tablet growth will be significant in the current year and follow iPad growth pattern though settling at 80% during ’13.

- Amazon growth will be approximately 80%.

Building the platforms combined growth bottom-up gives the following forecast for the next two years (and historic growth shown for perspective.) Continue reading “When will tablets outsell traditional PCs?”