In the latest, (Fiscal Q3, Calendar Q2 2025) conference call, Tim Cook made a welcome announcement: “We also recently marked a significant milestone. We shipped the 3 billionth iPhone since its launch in 2007.”

This was welcome because the company has not been providing iPhone unit shipment numbers since Q4 2018. What it has meant is that the number of iPhones sold and their average selling price had to be estimated. Active iPhones were occasionally provided but quite rarely.

With this update, the veil has been party lifted. I, as well as you I’m sure, rushed to assess how well we have been estimating the iPhone economy over the last seven years. Prior to Tim’s data dump, my own estimate for total iPhone shipments was 3.104 billion, including the last quarter. [Keep in mind that the 3 billionth iPhone may have shipped in the beginning of the quarter which amounts to more than 50 million units prior to announcement so my error of 104 million is minus perhaps 50 million.]

In the worst case, my error amounts to about 3.4% over the entire lifespan and perhaps 5% over the estimate period. That is perhaps not criminal since, after all, what’s 100 million iPhones between friends?

I adjusted the estimated average selling price to reflect this error and shaved essentially one quarter’s worth of shipments from the data set. In other words, my estimate would have been that 3 billion was reached in March rather than June. Mea culpa.

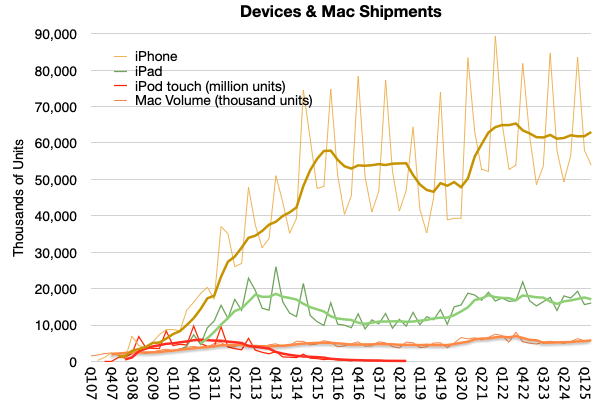

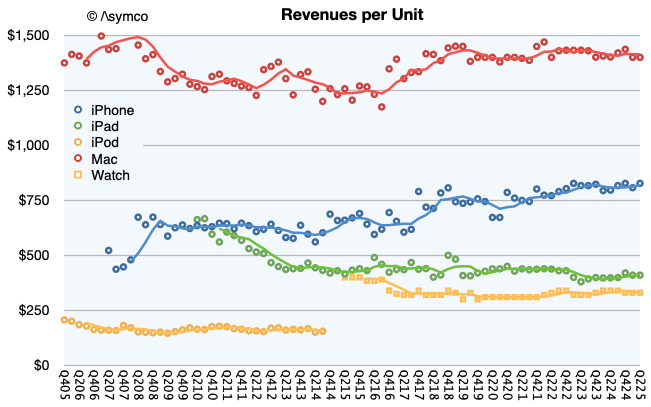

The new view into the entire iPhone shipment history is shown below. Also below is the impact of adjustment in the revenue per unit (i.e. average selling price.)

Note that I used trend lines to show the four-period (12 months) running average to remove the seasonality. Perhaps there is something to be read in the pattern. I would say that there are some notable surges as during the initial uptake, during the first “supercycle” in 2014, the surge during Covid and perhaps the “China recession” of 2018.

Clearly we are not at the highest sales levels today, as the Covid surge will take some time to grow into but at the same time the volumes are not decreasing. You can see the contrast to the iPod touch when an alternative was available, namely the iPad. The demise of the iPhone has been greatly exaggerated.

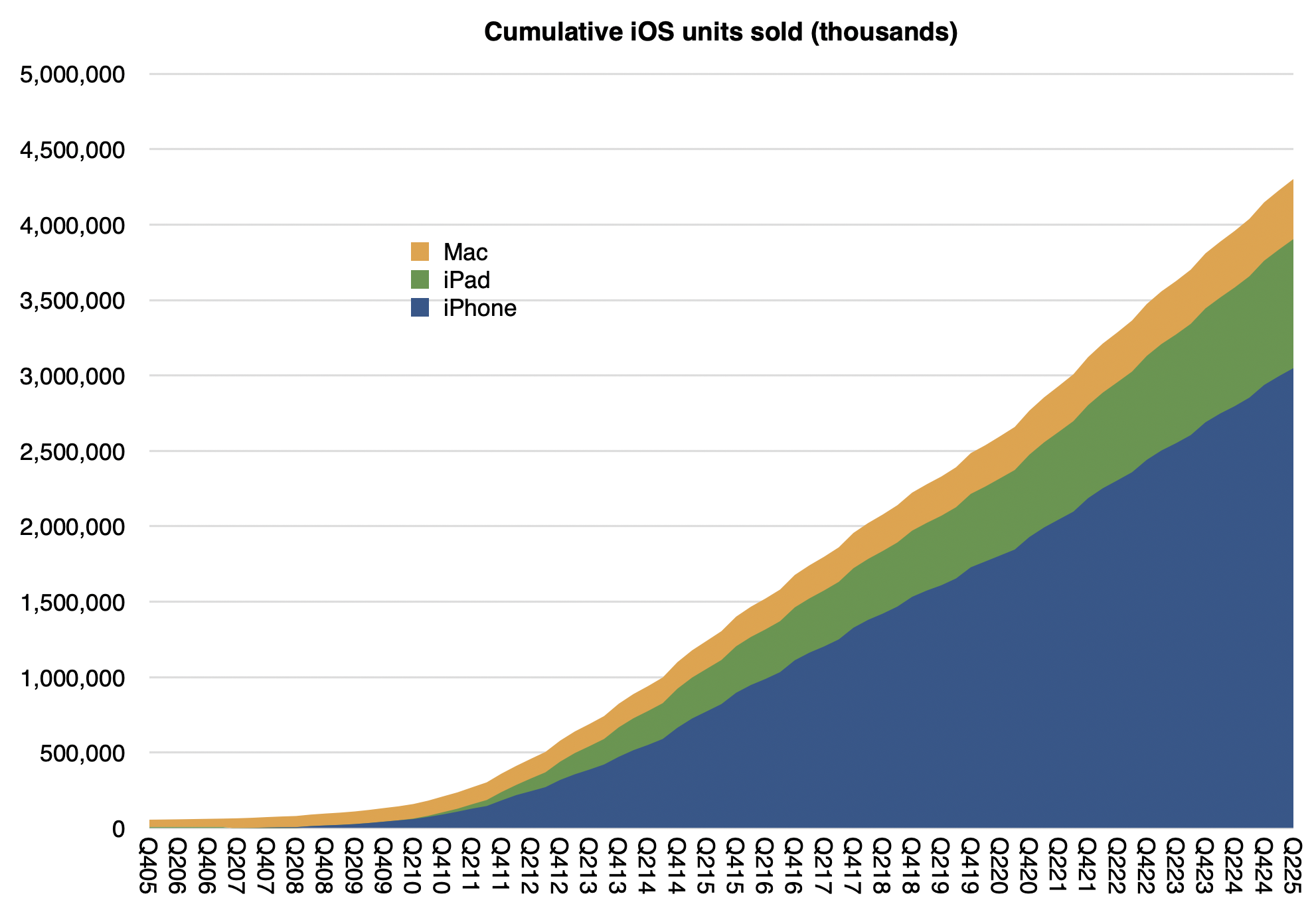

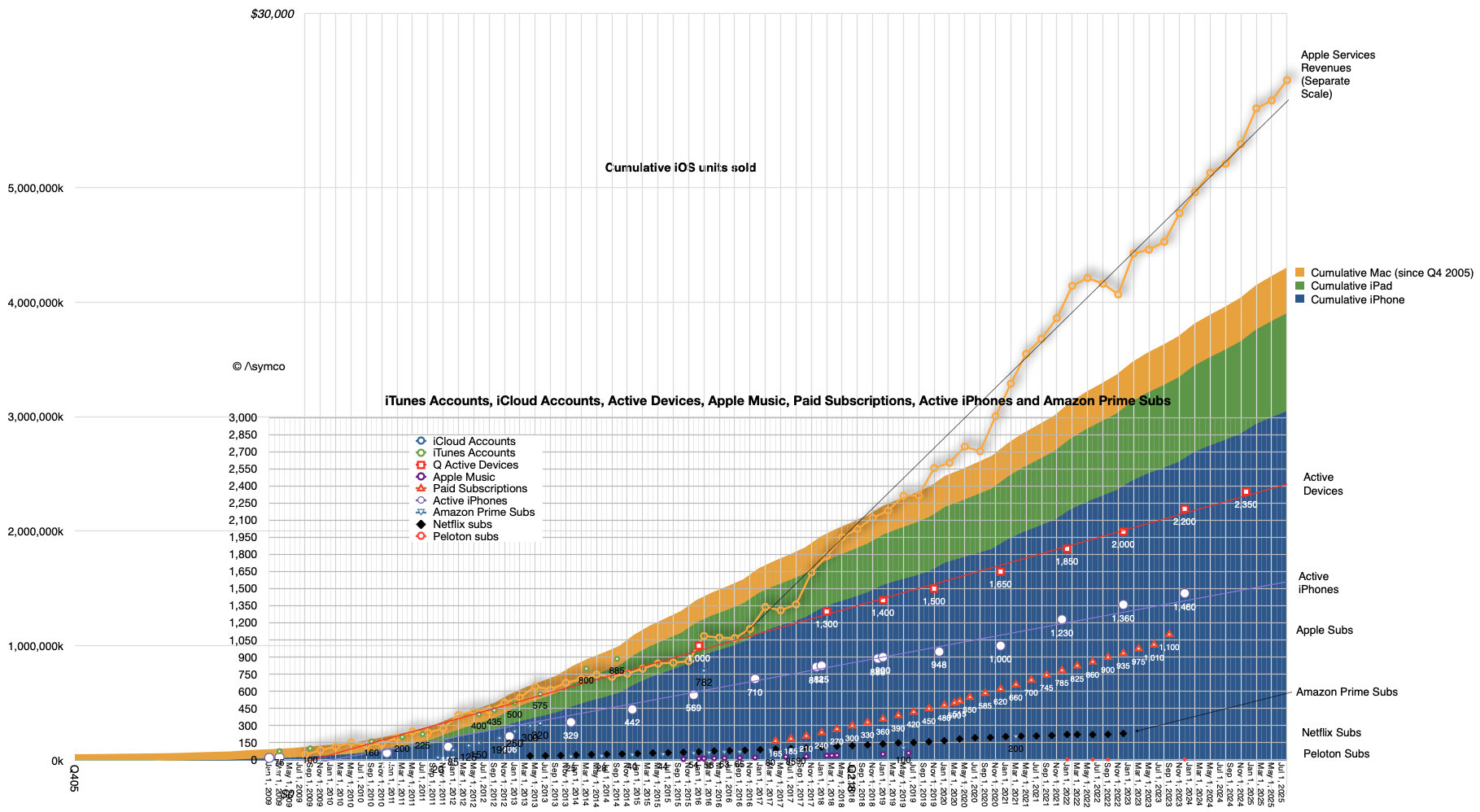

Note also that I also included the iPad, Mac and the iPod touch for comparison. You can try your hand at reading the patterns there. For the record, my cumulative Mac estimate (since Q4 2005) is 398 million1 and the cumulative iPad is 855 million. Here are the iPhone, iPad and Mac cumulatively with a current total of about 4.3 billion:

Not shown are iPods (touch alone is about 114 million), Watches (probably at least 250 million) and Vision Pro (single digit millions) or wearables and home. If we did include those, it’s a safe bet that Apple has shipped over 5 billion devices.

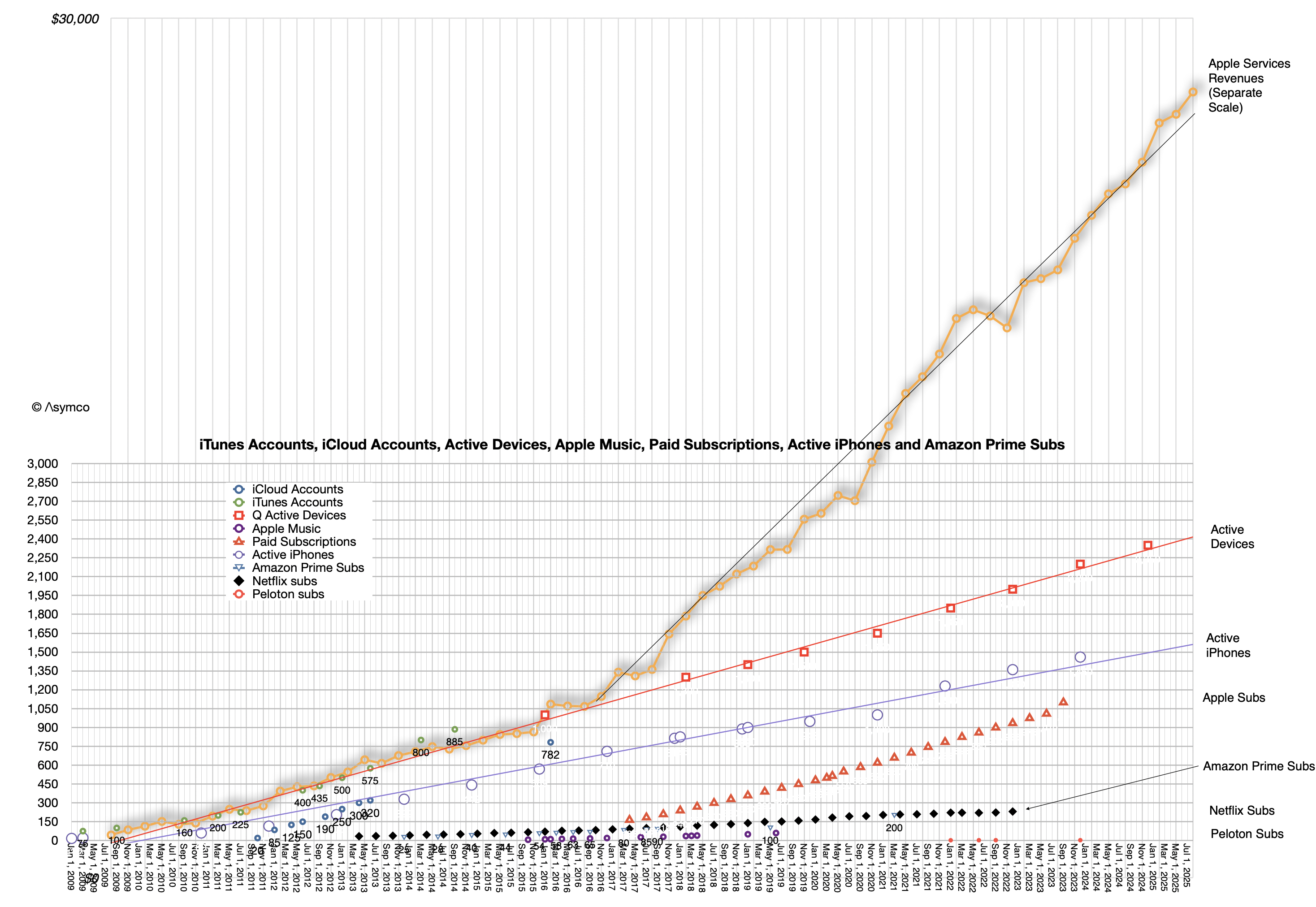

Interesting, but not as interesting as how many are active (in use at least once a month.) For that estimate we have another set of data:

The linear extrapolations for active devices, active iPhone and, on a separate scale, actual Apple Services revenues can be seen. Also subscriptions, as long as they were available, plus other data sets for comparison such as Amazon Prime subscriptions, Netfilx and old Apple Music and iCloud account data.

At the risk of overloading an already busy graph, it might be interesting to show cumulative devices vs. active devices:

The top of the area graph seems to be not too different than the top of the red dotted device line. What might be instructive is to calculate the ratio between these two: the active devices and the cumulative devices during the period from 2016 (when 1 billion active were reported) and the beginning of this year when the last figure was reported (2.35 billion active devices on Jan. 30 2025).

Again, excluding wearables, iPod touch, Apple TV and Apple Vision Pro we have these ratios:

| Date | Ratio of Active devices to Cumulative iPhone, iPad and Mac sold |

| Q417 | 0.66 |

| Q418 | 0.63 |

| Q419 | 0.60 |

| Q420 | 0.60 |

| Q421 | 0.59 |

| Q422 | 0.58 |

| Q423 | 0.58 |

| Q424 | 0.57 |

What this suggests therefore is yet another way to forecast the value of Apple as an enterprise. We already know that the prediction of active devices, revenue per device and margin is sufficient to forecast the company’s earnings. These all seem to be quite linear and thus predictable. Now we can add the relationship to devices sold as yet another way to calibrate or test assumptions.

After diligently doing so, simply multiplying the results by a random number called the P/E ratio (aka “sentiment”) allows you to predict the share price at any point in the future.

Have fun.

- It would be interesting to consider that if, as it’s been often claimed by Apple, half of Mac users and half of iPad users are new to the products, then there would be 200 million new Mac users and perhaps 400 million iPad users. ↩︎

Discover more from Asymco

Subscribe to get the latest posts sent to your email.