During the latest shareholder meeting Tim Cook revealed that Apple TV sales were above $1 billion in the last fiscal year (ending September 2013). The company later clarified that this figure includes device and content sales.

This poses a problem. In previous statements the company cited device (unit) shipments rather than value. The statements made to date suggested that cumulative volume of 3rd (current) generation Apple TV totaled 6 million units as of January 1, 2013.

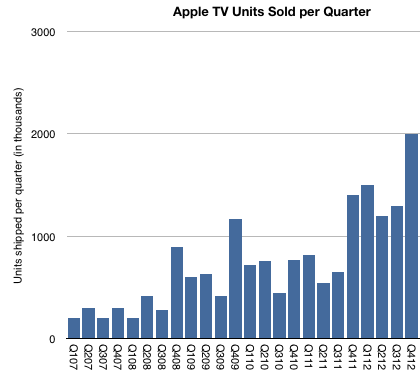

The following graph includes an estimate of quarterly Apple TV sales based on comments made to date.

As there were no additional comments during 2013, the “Billion Dollar” quote is all we have to go with for the year. The problem with trying to separate content from hardware is complicated by several factors: Continue reading “The billion dollar hobby”