This is a quick note to mention that I’ll be speaking at the Tools of Change (TOC) Frankfurt Conference this October on the eve of the Frankfurt Book Fair. Conference details:

- Tuesday, 9 Oct. 2012, 8:30 a.m. to 6 p.m.

- Frankfurt Marriott Hotel

- Hamburger Allee 2

- +49 (0) 69-7955-0

- Directions

You can get a 20% discount if you use the following code when registering:

TOCPartner20TSpeaker

I’ll be speaking about the jobs publishers are hired to do. Without giving too much away, here is my synopsis of the talk:

We’re inclined to “categorize” or “segment” media according to its attributes. We think of visual, auditory or written forms as distinct. Within each of these definitions of media we further sub-segment according to the way they are packaged. As in books, periodicals, or TV vs. film and albums and singles. These definitions are convenient because they describe the product and the product has evolved into a distribution chain and a therefore a market. It becomes therefore analogous to think of a book market and a TV market and a periodicals market as if these are what people actually desire.

But what people desire are more basic things. They desire to feel good or to be comfortable or to escape into fantasy or to be aroused. They have thirsts for knowledge or flights of fancy or needs for belonging. Authors and story tellers have sought to serve these needs for as long as we’ve been humans, regardless of the medium. When you step back and ask what the real “markets” are you realize that we’ve categorized according to technical and business means of delivering these needs.

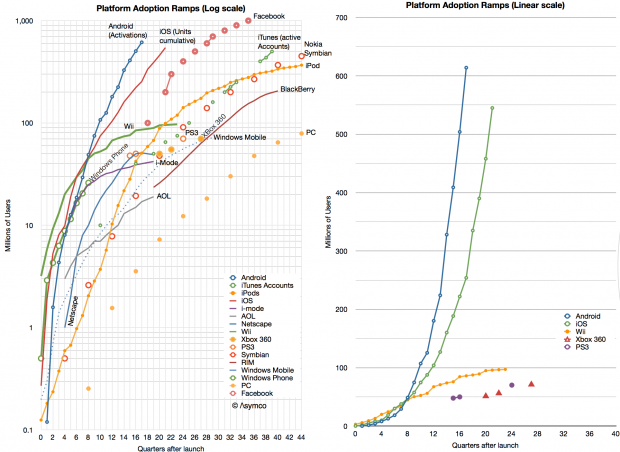

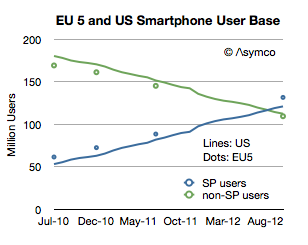

Business theorists have a word to describe this categorization: segmentation according to product attributes. It’s a common practice to define markets according to products rather than what these products are hired to do. The great Harvard marketing professor Theodore Levitt used to tell his students, “People don’t want to buy a quarter-inch drill. They want a quarter-inch hole!” The idea that you can categorize by what consumers want to get done rather than what you are selling them is not new but it’s still a very hard thing to get your head around. It’s become known as “Job to be done” segmentation and has changed product planning for many firms. If you apply this method to your industry you realize that the products you sell are in competition not with other products like them but with completely new products. A newspaper may be in competition with Angry Birds and a TV show with FaceBook and a Movie with a cinematic themed video game.

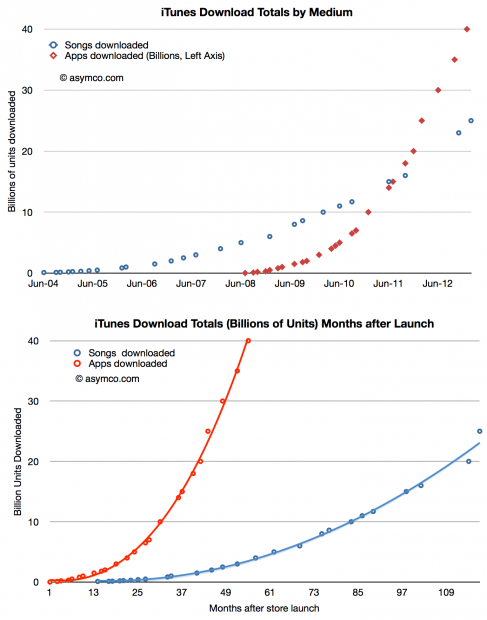

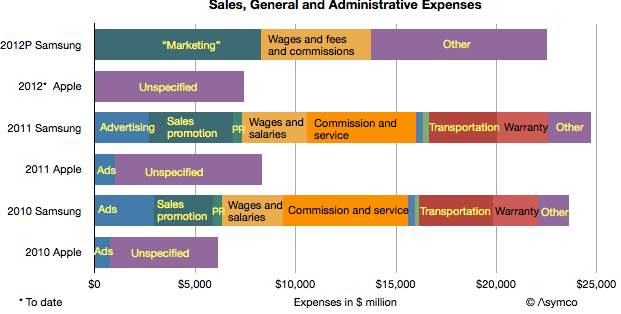

If you take the history of story telling and job to be done analysis into consideration you realize that technology has always played a part in how stories are told and re-told. This technological progress is accelerating and we are now in an era where apps are the new medium which can encompass much of any of the previous story telling mediums. Apps are so flexible and so easily distributed and consumed that they threaten to converge multiple media types. I’ll explain how app economics are affecting not just games, but all forms of publishing.