RIM shipped 10.6 million Blackberries and 200,000 PlayBooks in the last quarter. Management noted that their sell-through was significantly higher for Blackberry (13.7 million) but seems to be very weak for PlayBook as the prior quarter saw 500k units shipped. Additional PlayBook units this quarter probably mostly went into new channels in Asia and there were no additional sales into North America or Europe.

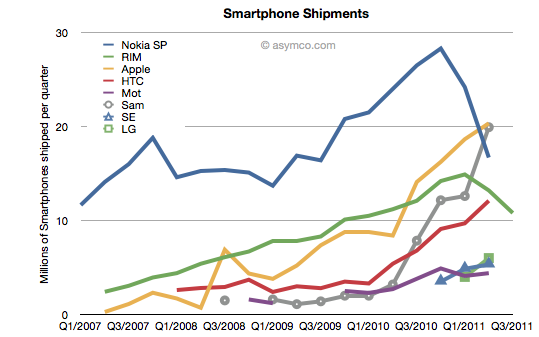

The figures for units are very poor. How poor depends on the frame of reference. Consider the shipment chart below:

In terms of the competition, 10.6 million units is less than half what Apple or Samsung sold in its prior quarter. It’s also less Continue reading “RIM and the lamentation of the analyst”