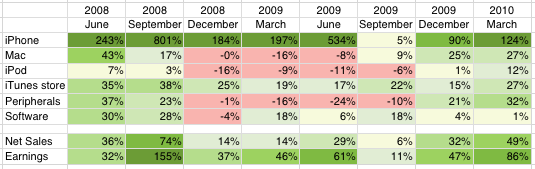

Apple’s growth and its disconnect with valuation has been a common theme on this blog. For another look at this conundrum I present here a table of Apple’s year on year sales growth by product line and its top and bottom lines.

I color coded the values so that a darker green signifies higher growth (and red, negative growth)

I call this the growth scorecard.

What does this scorecard say about the previous 24 months?

- Earnings never grew slower than 30% for any quarter except for one quarter when the comp was ridiculously high at 155% (on the back of iPhone 3G launch).

- Throughout the recession Apple grew sales.

- The worst growth performance was on peripherals which is Apple’s smallest business

- The fastest growth was the iPhone, now Apple’s largest business.

- The iTunes store grew sales consistently throughout the previous 24 months.

- Growth has been positive (green) across all lines for the past two quarters and has been accelerating.

My estimate for the current (June) quarter is that Net Sales will grow by 47% y/y and Earnings will grow by 60%.