John Gruber puts things in perspective:

The key bit: “At the critical juncture […], when they should have gone for market share, they went for profits.” I think this encapsulates Jobs’s philosophy since taking over Apple in 1997. Take the high end of the market first, establish a brand and presence, then steadily start to expand.

I’ve long argued that Apple is in the phone business to win significant share (i.e. greater than the share they have had in the PC business). Since the phone market is vast (1.2 billion phones sold in the last four quarters) iPhone volumes must be as well.

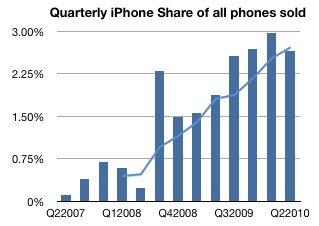

So how has share evolved, and what can we expect? This is a graph of quarterly share for iPhone including a four period moving average:

The trend is clear to see. With seasonal variation due to the launch cycle, the share is likely to increase over 3% and keep going. How far can it go? That’s a strategic decision for Apple’s management. If we are to take Steve Jobs’ word that their plan is not to be a niche player in any market they target then I have to conclude that Apple is aiming above 10%.

The volume expansion in the US due to the end exclusivity is only the latest in a series of distribution deals that Apple has brought to bear: International expansion, dropping exclusivity in other countries and broadening the portfolio (including earlier models in current line-up) are all natural and obvious moves in a broader market push.

Pricing might be considered another lever that Apple could use, though that seems unnecessary today.

I conclude that growth in iPhone sales of 50% per year seems entirely possible for the next few years. Such growth would allow Apple to reach 10% of the world’s 3G subscribers by 2013. That would still be only 4% of all phones and 20% of smartphones.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.