According to Gartner, mini notebooks constituted less than 18.0% of the total mobile PC market in the second quarter of 2010, down from 20.0% of the total market at 2009-end. Gartner expects mini notebooks market share to drop to approximately 10.0% by 2014.

However, worldwide PC shipments are projected to total 367.8 million units for the full year 2010,

via Near-Term PC Growth Not Visible – Yahoo! Finance.

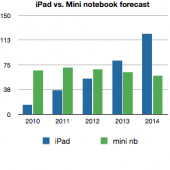

Speculation about the iPad production ramp indicates that the iPad will ship about 14 million units this year and 36 million next year. Projecting a forward growth rate of 50% and adding the Gartner forecast above gives us the graph on the left.

The iPad (plus competitors) will likely overtake the sales of mini notebooks as soon as 2012. The collapse in netbook sales is likely to be much more rapid than Gartner suggests.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.