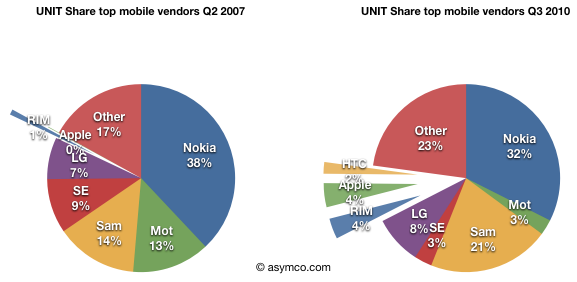

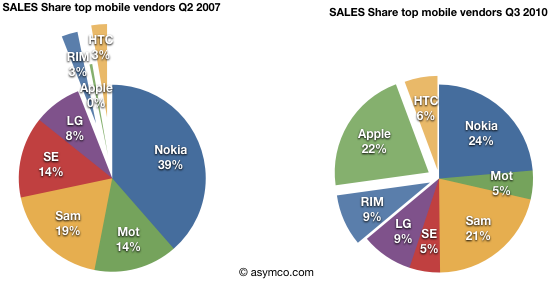

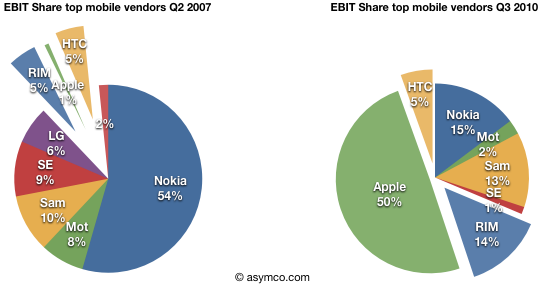

Pie charts showing 13 quarters of mobile phone market evolution between the largest vendors. Pure play smartphone only vendors are shown with exploded wedges.

The disruption continues.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.