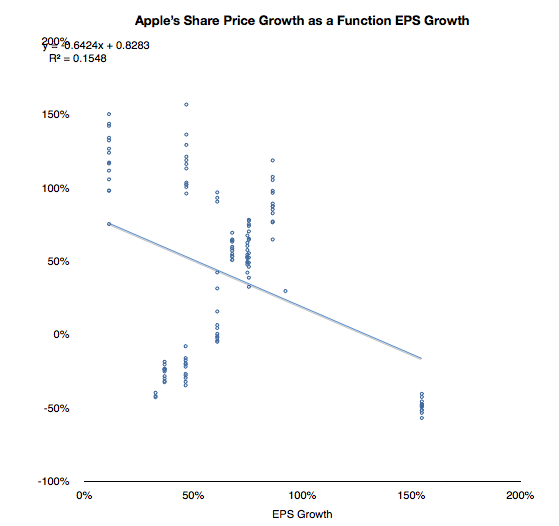

As I have tediously repeated in this blog, Apple’s share price has been de-coupled from its earnings for many years. Consistent earnings growth above 70% is not seen as valuable. As the chart below shows, there is no correlation between EPS growth and value growth.

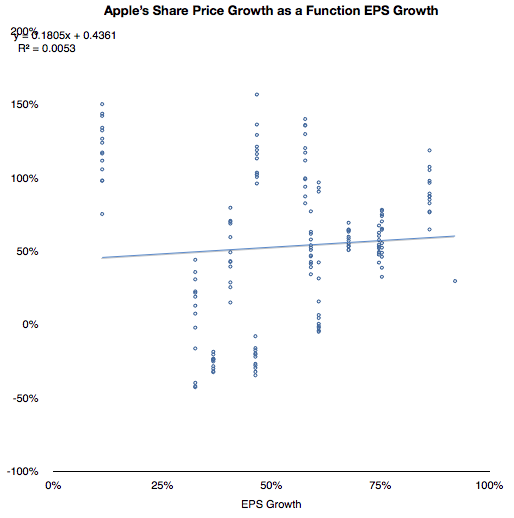

With the outlying quarter when 154% growth was matched by a negative 50% price change, the correlation does not look much better:

If we cannot correlate share price with growth then what is being valued? This has been a vexing problem because growth is the traditional, and logical, metric of valuation. Share prices, by definition (net present value of future cash flows) reflect future potential. That potential is more sensitive to growth than to anything else.

But I’ve been leaving one factor out of the share price definition. Share price is NPV of future cash flows plus current assets.

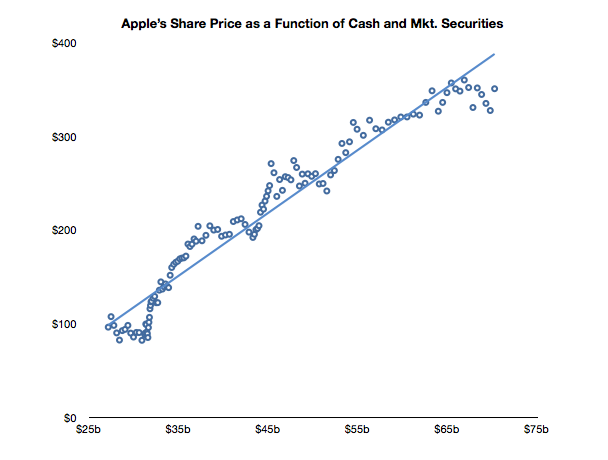

Since future cash flows are being thrown out of the equation, the company must be valued as a multiple of its cash. Does this relationship hold true?

In the chart below I show the weekly closing price of the shares and the corresponding value of the interpolated cash (and marketable securities) per share over the last two and a half years.

A strong correlation can be observed. The R squared value is a healthy 0.94. Of course this is not to imply causation. Correlation is not causation, but it is a hint.

Can predicting the cash per share be a strong indicator of future stock price? Perhaps. As long as this relationship holds, then having a reliable earnings model would still give us a solid predictor for the share price. Not because we can use EPS forward estimates multiplied by P/E but because we can estimate cash flows and the increase in retained earnings.

Of course, the market “is being irrational” because it values on the basis of the present only (not its future.) But who are we to argue? This valuation has held since October 2008.

As far as the market is concerned Apple’s future is irrelevant. Its value is defined as a constant multiple of cash.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.