While a lot of the credit for Apple’s success is rightfully assigned to the iOS franchises, the OS X business has more than quadrupled in five years. This has happened without drastic price fluctuations. Neither holds for the overall PC industry which has seen both volume and sales decline while prices have eroded along with profitability. On top of that, growth has nearly evaporated.

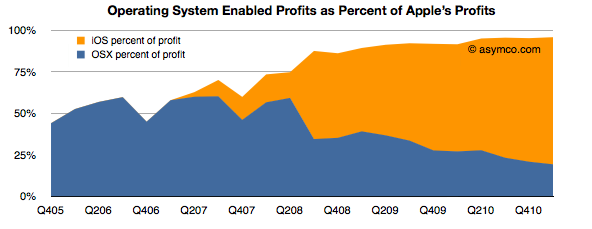

Even with this success, as a percent of total value created, the Mac accounts for a mere 13% of Apple’s profit. Including software as part of the OS X franchise implies that OS X is enabling about 20% of Apple’s profits.

iOS, on the other hand, is accounting for more than 75%. These two platforms combined amount to 96% of Apple’s profits (up from 50% four years ago).

That’s $9.8 billion from integrated platform-based devices. One can be very confident that this profit would be negligible without the software differentiation only Apple can offer.

So $10 billion is a lot of profit to obtain from a business enabled by operating system platform software. How can we get a handle on this size? How big is this? We could compare this with another operating system business: Microsoft Windows.

Microsoft’s Windows and Windows Live Division obtained sales of $4.445 billion in the last quarter with an operating income of $2.764 billion.

So although Windows earned about twice what the Mac earned[1], iOS and OS X together enable 3.5 times the profits of Windows.

The end of an era is the end of growth in one dominant business model. The PC era was epitomized by the concentration of profits in a dominant operating system vendor. That growth has slowed if not ended. The post-PC era is being kicked off by a new business model where profits are being concentrated in a hardware+software+service integrator.

—

- Or you could read this as: The Mac generates half the profits of Windows while iOS devices generate 2.3x Windows profits.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.