The iPhone portfolio is now larger than ever. It’s arguable that, for the first time, we can actually call it a portfolio vs. the [n, n-1] pair of products that’s been available to date. A year ago I even argued that the n-1 variant of iPhone was more of a cognitive illusion than a real alternative.

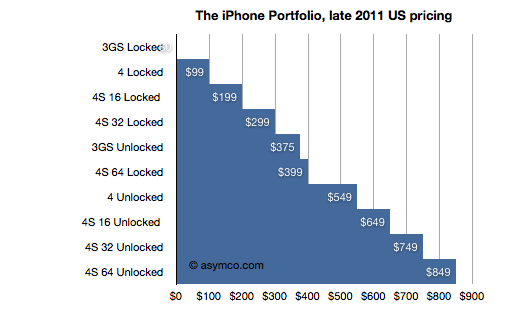

But that all changed last week. For the first time since launch, there is a real portfolio. The iPhone is now available as five different variants with 10 different price points. Prices and options may vary by country, but I took the US portfolio as the baseline and illustrated it:

Including all the pricing options It’s a very regular pattern. It reminds me of the iPod which, at one time was sold at every $50 increment point from $50 to $500. The logic behind this pattern is that “there is now an iPhone for every budget”. Of course, as with any purchase decision, each of these price points has trade-offs. Considering product performance or in terms of option value, the buyer has many things to weigh.

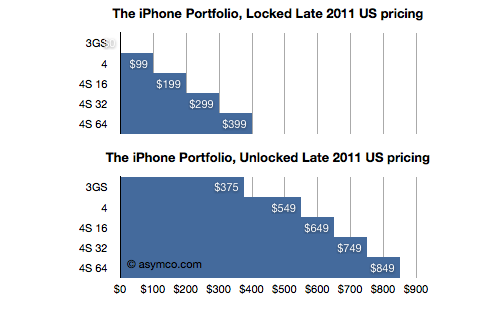

To simplify, I divided the options into two subsets: Locked and Unlocked.

We can now see the premium for unlocking (or, the discount for losing the freedom to use the phone on another network, as the case may be). We can also compare unlocked prices to unlocked prices for competing products.

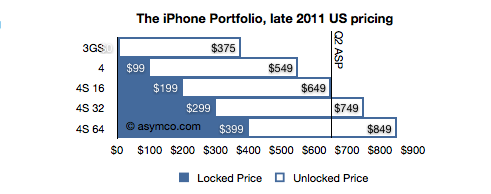

To assess it further, I combined the two charts above into one, superimposing the unlocked price onto the locked price.

In this last chart it becomes clear that buyers who purchase an unlocked phone are paying $450 more (the white areas), regardless of the phone’s spec (except for the 3GS where the difference is only $375). For locked phones, the $450 discount is, presumably, the value of the change of carrier (GSM only) option for a buyer.

But there is more to this picture. The unlocked price is also the price that Apple sells its product direct to consumers, many of which will be traded in secondary markets world-wide. Many will be sold in countries where Apple does not have distribution agreements with any operators. Because Apple needs to avoid channel conflict, they cannot price the unlocked product lower than they sell it to their channel. As a result, the unlocked price must be very nearly the price that operators themselves pay (excluding any volume discount).

We can actually confirm this because Apple publishes the average selling price (ASP) that Apple obtains from the iPhone. I made a line in the last chart at the price Apple got in the last quarter. It falls very nearly around the mid-point in the portfolio (and thus assuming the mode equals the mean and median in the distribution of sales.)

There is one further implication in this. I think it’s a safe assumption that the ASP for the new portfolio will be largely unchanged. Although Apple introduced the lower price for the 3GS ($375), it also added a more expensive 64G option. The lowering of ASP with the 3GS may be offset by the additional high-end sales, especially early on.