Imagine it’s late 2005. Apple’s fiscal year just ended and they reported their performance. You’re an analyst whose job includes forecasting the company’s performance for next year. This is a weighty responsibility. Your forecast will be blended with those of your peers and used as a “consensus” average. That consensus for the next year will be used to measure the current value of the shares in a ratio called the forward PEG or Price/Earnings/annual earnings Growth. You are supplying the earnings and hence growth forecast while the market offers a price. As a stock is meant to measure future earnings, your forecast is a crucial and frequently cited figure about whether a stock is priced fairly.

There is some comfort in knowing that there will be many others who will offer such a forecast and your contribution is thus not the only way investors can calibrate the price. However, you should think hard about what you are predicting as it also will reflect your skill in predicting such a visible company.

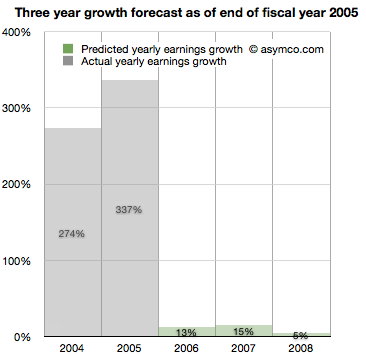

Apple just had a tremendous two years. 2004 and 2005 saw EPS grow at 274% and 337%. This is largely due to the runaway hit iPod. Given all that is known about the company, what will you put forward? While you’re at it can you also forecast two years forward, namely provide a growth forecast for 2006, 2007 and 2008?

Here is what you and your cohorts publish as a consensus:

You go with a 13% growth for 2006, 15% for 2007 and 5% for 2008. The chances are, you reason, that the iPod will not carry the company’s growth much longer. The competition is sprouting all over and Microsoft is rumored to be launching its own music player.

You go with a 13% growth for 2006, 15% for 2007 and 5% for 2008. The chances are, you reason, that the iPod will not carry the company’s growth much longer. The competition is sprouting all over and Microsoft is rumored to be launching its own music player.

It makes sense to be conservative and offer a modest growth of 13%. At the same time you can rate the stock a buy as it is still growing. The stock just doubled in the last 12 months and the law of large numbers says that growth cannot last at the same rate as we’ve just seen.

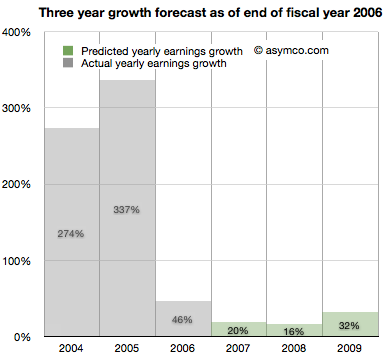

It’s now late 2006. Apple just closed out another big year. Contrary to your forecast last year, the company grew at a rate of 46%, more than three times faster than you expected.

It turns out the iPod still has some legs and the company’s Mac business seems to be growing. Looking forward you take your 15% growth for 2007 and increase it to 20% and suggest 16% for 2008 and 32% for 2009.

There are rumors of Apple getting into the phone business.