We’ve been very, very focused on China. China, we’ve had incredible success with iPhone. Over the past few years, we’ve gone from a few hundred million dollars of revenue in greater China, to last year $13 billion. So we really’ve been focused on trying to understand the market there and then taking those learnings to other markets. As it turns out–and not very many people agree with me on this, probably–but what I see is that there’s a lot of commonality in what people around the world want.

Transcript: Apple CEO Tim Cook at Goldman Sachs – Apple 2.0 – Fortune Tech

People do want the same things globally, but due to various constraints they typically don’t get the same things at the same time.

One of the most important constraints on the purchase of iPhones is the state of 3G (or, more broadly, mobile broadband) networks. An iPhone is a mobile computer whose primary value is derived from high bandwidth data communication. Because this bandwidth is not universally available, the iPhone faces a restricted addressable market.

The good news is that 3G networks are being adopted very quickly. The International Telecommunications Union reports that 20% of mobile users have “active subscriptions to mobile broadband” (1.2 billion out of 6 billion). That’s encouraging but the subscription rate varies widely by country. Ideally we should look at the data on a country-by-country basis.

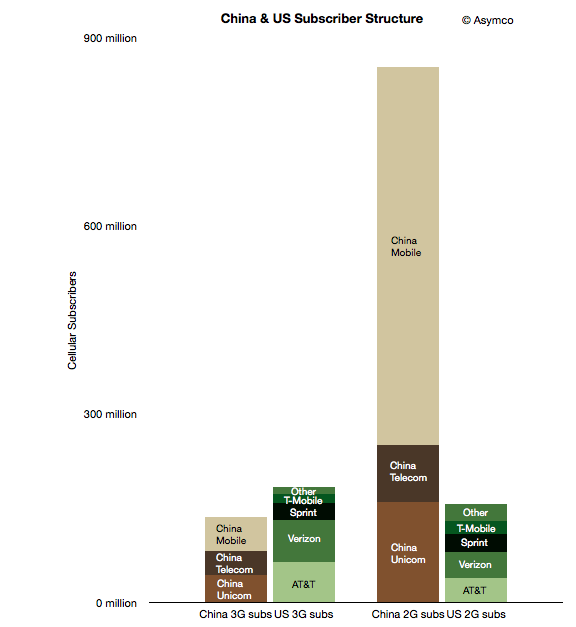

To start, I took a look at two countries which may form an interesting sample: the US and China. The following chart shows the subscriber structure in the two countries grouped by 2G/3G subscription and by operator.

The two left-most columns represent nominally addressable iPhone markets. The two right-most columns represent currently unaddressable markets. Note that