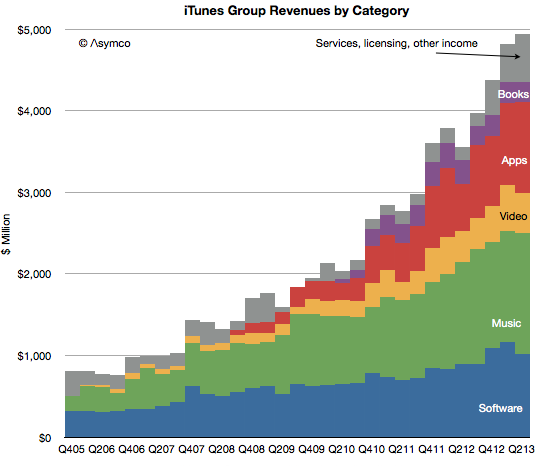

In the latest quarter the iTunes group top line grew by 25%.

Additional newly reported items:

- Quarterly revenues dipped slightly to $4 billion (second highest after $4.1 billion last quarter).

- iTunes Stores billings (i.e. gross content revenues) were $4.3 billion

- Reached the best month and best week ever for App Store billings at the end of the quarter.

- iTunes billings translated to quarterly revenue of $2.4 billion, up 29% from the year ago but flat q/q. Company reports “strong growth in revenue in both content and apps.”

- New content added includes HBO GO and WatchESPN available on Apple TV. Apple TV catalog now includes over 60,000 movies and over 230,000 TV episodes.

- Users have downloaded more than 1 billion TV episodes and 390 million movies from iTunes to-date. They are purchasing over 800,000 TV episodes and over 350,000 movies per day.

- iOS developers have now created more than 900,000 iOS apps including 375,000 apps made for iPad. Apps created grew by 50,000 overall and 25,000 iPad apps.

- Cumulative app downloads have surpassed 50 billion.

- App developers are being paid at the rate of $1 billion per quarter.

- App developers have been paid over $11 billion for their sales through the App Store (half of which was earned in the last four quarters.)

- There are now over 320 million iCloud accounts

- There are 240 million Game Center accounts

- Almost 900 billion iMessages have been sent

- Over a 125 billion photos have been uploaded and over 8 trillion notifications were sent.

Some observations and estimates:

- Music revenue growth remains at around 15% while video revenue growth remains around 25%

- Apps continue to accelerate with a near doubling of revenues

- Book revenues are contracting as pricing pressure is being felt

- The software group grew moderately at 15% as Apple’s apps are reaching saturation within the iOS user base and as Mac sales stagnate.

As a reminder, you can order the iTunes Business Review from the Asymco Store.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.