I wrote the initial guide almost exactly six years ago. Also known as “The 10 Commandments of Automotive” it’s time to re-visit it to see how and if anything has changed.

The rules listed are empirical observations. The patterns show how things are and have been and hint at what can and cannot change. Capacity utilization and capital allocation are perhaps the most basic root causes for how the system operates.

Capacity utilization has meant that incumbents needed to produce large quantities even if they were not doing so profitably (1st commandment). The capital invested in plant and equipment had to be amortized. This meant it was difficult to enter with a low volume strategy. Indeed all entrants that succeeded did so with “people’s cars” (2nd commandment) which were destined to mobilize entire nations if not continents.

As production orientation absorbed all attention, innovation in production determined the cycles of dominance. First Ford, then GM, and finally Toyota refined the production system (3rd commandment.) Eventually every producer would adopt the “best practices” but the innovator would have years if not decades of competitive advantage.

The political implications of the automobile became a dominant question as it effectively terraformed its environment. Cities, ancillary industries and even our climate were affected. This meant infrastructure, tax policy, land use policy and financial systems became dependent on automobiles. In return governments began to regulate, creating a symbiosis between government and automakers. (4th commandment).

New technologies were plentiful but they all got absorbed by the industry. Mechanical, chemical and material sciences, computation and communications were all sustaining. (5th commandment.) New fuels, microprocessors, wireless technologies; these immense evolutions did not change the structure of the industry.

As new countries became prosperous they not only adopted cars but they adopted car production. The Europeans were first with the technical invention but the US was first with mass production, followed by Western Europe, Japan, Eastern Europe/USSR, Korea, China and now RoW. (6th) Each new entrant had the advantage of hindsight and would be more efficient, at least for a while.

Low volumes were left to “luxury” brands which survived by solving a different job than transportation, namely that of status signaling. Eventually the low- and high-end merged into brand holding companies. Capacity was traded and cross-ownership, joint ventures and “badge engineering” was widely practiced. Governments kept competition at bay for national champions, mostly. (7th commandment)

Cars grew to over 1.2 billion installed base and, including commercial vehicles, reached 100 million units of production/yr. The problem that arose was that the infrastructure could not keep up. Urbanization was growing faster than motorization and land became scarce. Cars need land. Lots of land. For roads but also for parking (3 spots for every car in use, at least.) As global prosperity increased and as prosperity meant a car the struggle to find room for these modes of transport grew intense. Most users now found the car to be a constraint rather than a liberation. (8th commandment.) Parking and congestion were problems highly evident to the motorist but the externalities of exclusion of public space and emissions became highly evident to the governors who, you remember, are in a symbiotic relationship.

Clearly the pressures were building for drastic improvements in how transportation would be allocated. My response was to promote micromobility, the idea that small is better and smallest is best and that the tendency of the industry to supersize its offering in the face of increasing constraints was classic innovator’s dilemma. Incumbents could respond by rapidly changing their portfolio to include a wider variety of form factors and while they broadened the portfolio (e.g. Audi went from 4 models in the 1960s to 40 in the 2000s) they did not go below a certain line (the 500kg line). They also did not modularize their production system. Production (body-in-white, paint, engine and final assembly) remain in-house while parts are outsourced. (9th commandment) This was peculiar to me and indicated a deeper structural issue.

Instead of a pivot downward, the industry keeps chasing size, mass, volume, power, range. Most trips are short but all the engineering goes toward the long tail of highly improbable distances and loads. (10th) Always the answer to this dilemma is that you build what customers demand. Well, which customers are you asking? Under what circumstances are you framing the question? Well, never mind, let’s build electric versions of the same cars.

These constraints determined the outcomes for the industry for a century and are predicated on decisions allocating limited resources and capital based on we might call classical microeconomics; but all within a bigger political and indeed geo-political context.

So what has changed?

This classical model has one potential flaw: The assumption of capital as a limited resource. An odd thing happened in the last decade. Capital has not only become really cheap, in many cases it has reached a negative cost. This is evident in negative interest rates. When I observed this I thought something fundamental was broken. If there is so much capital that people are paying you to keep it for them then a lot of this “classical microeconomics” begins to break down.

The firms that are husbanding capital can be “disrupted” by those who squander it. Those who observe discipline and pursue efficiency can be defeated by those who are undisciplined and inefficient.

Holy cow!

This entrant’s guide is a rationalization of what governs one of the largest activities we engage in. And yet it may be undermined by an imbalance. The evidence is in the capitalization (and hence free capital availability) to entrants who have little to offer except a dream. The incumbents who thought they could sustain through technology transitions are being out-spent and having their access to what is still limited (raw materials or components) curtailed.

Need more proof? Tesla has single-handedly doubled the value of the automobile industry in a year when overall volumes and sales shrank.

That means that either there will be twice as many cars as we have now or they will be twice as expensive or they will be twice as profitable. And all that will happen really soon. We can’t have twice the cars since there will be nowhere to park them. We can’t double the price unless we double our wealth. We can’t make them twice as profitable unless we disable competitive forces and change the production system.

Or, it could be that half the assets (all the other automakers) are worthless.

Something has to give. The paradoxes multiply.

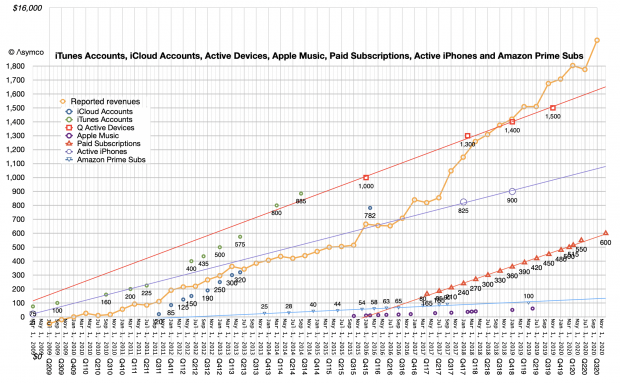

Into this will, one hopes, step Apple. Things are about to get really interesting. Stay tuned.