This is a transcript of an Asymetric podcast. It was lightly edited for legibility.

Judd Rubin: Three continents, one conversation, this is Asymetric. We are very excited to have Balaji Srinivasan with us today. Balaji, you’re a busy man, Horace you’re on the run as usual, so why don’t we dive right in. Thanks for joining us today.

Balaji Srinivasan: Good to be here. Good to see you, Horace.

Horace Dediu: Likewise.

Balaji: I know you from online, from Twitter, or at least, I know of your work. It’s always interesting for people to understand how they’re maybe thought of by folks who are maybe a little bit on the periphery. And I, we’ve, always thought of you as the most quantitative Apple analyst, I guess you and [John] Gruber would be the two people who, if you’re in the Apple ecosystem, might be the most perceptive commentators outside of Apple itself.

Horace: And John’s a qualitative guy, right, so that makes sense.

Balaji: Yeah, exactly. And I’m not like a huge, I mean, it’s funny, certainly I have a lot of Apple equipment, but I wouldn’t consider myself an Apple fanboy, per se. I converted to Apple when they supported BSD in OSX, because it was a better compute experience.

And, for the last, almost 20 years, the typical developer/engineer/founder, whatever, set up has been a Mac laptop locally, and then all your compute is on AWS or a Linux box or something in the cloud.

Horace: Yeah, me too, actually, because when I started my university work, it was all on Unix, and this was in the days of VAX computers, Digital Equipment, and I just loved that interface at the time of DOS. This felt like, you know, ages ahead. And then I moved from a console to a workstation, which would have been a large screen using the X windowing system and that was my career for five years.

I wasn’t even on a PC anymore, I wasn’t using a Mac, but in 2000 when they switched, roughly around that time they switched to being, like you said, BSD. And I was like, okay, Mac is the way to go. Anyway, we don’t want to talk about necessarily Apple, tell us what you’re working on these days.

Balaji: Sure. I’ve actually got the crypto plan for world domination that I thought I might discuss with you. Which is essentially how if you’re a crypto maximalist, so to speak, how I think crypto is the most important threat to the Big Five.

And essentially the plan for the next decade for how crypto goes after, not just FinTech, but Messaging, Log-in, Social, Search; Crypto Phone, Crypto OS, compilers, databases, advertising, actually reinventing CPA (cost per action), hosting, data centers, creator monetization, and then, on the back end, equity, compensation, privacy, and then most importantly: values.

I actually think that people are underestimating the scope of how big of a deal crypto is and that the Big Five don’t really get it. The Big Five, meaning, Google, Apple, Facebook, Amazon, Microsoft.

And there’s pieces of their empires that I haven’t yet figured out how crypto might disrupt. Amazon’s physical logistics, for example, but there’s much more of it that is crypto vulnerable than I think people think. And your audience might be interested in this. Some of this is new, even, for maybe my audience.

So we could go area by area. And push back.

Horace: Yeah, the one thing I would caution on, is this usage of the word disruption, because I’m also a student of Clay Christensen. To what extent what I challenge you to answer is, to what extent might these Big Five find [crypto], possibly sustaining?

So if they would say, ‘Oh, well, thank you very much. We’ll take it from here.’ So, I agree that there’s an opportunity here to disrupt, but many times people just assume change is always disruptive, but change can be sustaining as well. So, please tell us.

Balaji: So, actually, on that point, there’s a colloquial usage of disrupt, which just means a change. And then there’s the more technical, the Clayton Christensen version, which is, it starts out as sort of an inferior product in some ways, but it’s 10x on one axis, it’s sort of underestimated. And then it takes the bottom end of the market, and then zooms up to the top in such a way that the incumbent finds it difficult to adopt it because it attacks their margins and so on.

Right? That’s assuming the kind of, more technical —

Horace: That’s what I mean, yes. That’s low end disruption. There’s also new markets where it basically carves out for itself a new niche and it does things that nobody’s asked it to do. Or markets that are non-consuming, like, you know, emerging markets or something like that, and grows from that base as opposed to low end.

But, yes, generally speaking, that it comes in and is not good enough initially.

Balaji: Yeah, so I think that this fits, as I’ll go through each of these examples, I think each of these fit both the sort of colloquial usage, as well as the more technical usage. But let me go one by one and just talk through these points.

So first, at a high level, I’m actually pretty confident that, with the exception actually of Facebook and Twitter, I think crypto is kryptonite to large companies because they don’t understand it. And in particular, they’re sort of frozen by antitrust and they can’t take on more regulatory risk, even if they had the personalities internally to do so. I actually give a lot of credit, even if I think Libra was misguided in some respects, in terms of implementation, I give a lot of credit to [Mark Zuckerberg] for trying to get into crypto relatively early and putting out a project. Even if, in many respects, I think the parameters were flipped, as I can get into, to simply push through that relatively early, starting in 2018, when the other companies didn’t get there is because he has a founder’s mentality still.

And I think Twitter is actually the dark horse here where it’s the furthest ahead on Bitcoin, specifically, as opposed to crypto more generally, that’s an internal distinction in the community that I can talk about. But I don’t think that Google, Apple, Microsoft, Amazon actually get it because they’re not founder led.

And also because they’re under this regulatory microscope.

Horace: By the way, just a funny story. So I’m here in Germany because I’m at an event for e-bikes called Eurobike, or just bikes in general. So I’m a fan of Micromobility, I’ve been talking about it for a couple of years now. I get the same impression. I’ve spoken to people at those companies that they’re not seeing it, they’re not feeling it. Their entire mobility focus is still automotive. It’s not that there’s a cognitive problem. They understand the idea, but they can’t actually implement it, it’s this innovator’s dilemma thing.

Balaji: Yeah. I mean, it gets to the fundamental thing, right? Which is that a founder is able to say, ‘Hey, we were doing X for such a long time and X got us to where we are, but now we’re doing, not X. We’re doing the opposite of that.’

And they have the credibility to turn the entire organization, in particular, to impose short-term costs for long-term benefit to cannibalize or disrupt, in the colloquial sense, an existing product for a new one.

You know, Satya [Nadella, Microsoft CEO] is actually the exception. I would put him, if I rank order the existing companies by their crypto friendliness…

What’s interesting is it’s the $100 billion and $10 billion and $1 billon companies that are much more crypto friendly than the trillion-dollar companies.

So Shopify, for example, gets it, right? Coinbase. Stripe, I think, is coming around. So the ones that are sort of like the sophomores or the juniors, as opposed to the seniors, are going to, I think, use this to slip stream. And I think this is a disruption again, you know, I know you’re from the Christensen club, so I may use that colloquially, so poke at it.

I think this is a change or an alteration or a forcing function, whatever you want to call it. That is actually on par with the desktop to internet transition. That you can think of this as, just like you went from on disk to online, the transition from online to on chain involves a similar number of cultural and technical changes that render the current generation, basically like the Borlands and DEC Alphas and so on of the previous generation.

Horace: So tell us how do you think that… You gave a lot of examples, of things going on chain —

Balaji: Yeah, so let’s go to specifics. Let’s start with the obvious, which is FinTech. One of my colleagues, friends, Chris Dixon runs the crypto fund at a16z. He observed a while ago that many Unix command lines became apps.

For example, GIT became GitHub. That’s an obvious one, but had these command line chat apps that effectively became Facebook and IRC and Slack and so on and so forth, right? Command line apps turned into full-blown UXs. Crypto is actually the reverse in some ways where every FinTech app can be turned into a crypto command line. For example, Affirm or PayPal or Funbox, or, many of these things that essentially are doing cashflow transformations of some kind can be written as a few lines of code in Solidity. Which is Ethereum’s programming language. And that alone is actually kind of a big deal where you can write that down and then just start piping arbitrary amounts of money through it, between countries, where it really is the internet of money. Any user can route money to any other user, if both users have a crypto address, if they have a Bitcoin address or an Ethereum address for the purpose of smart contracts.

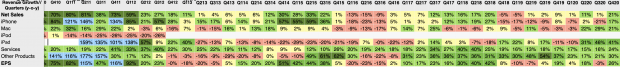

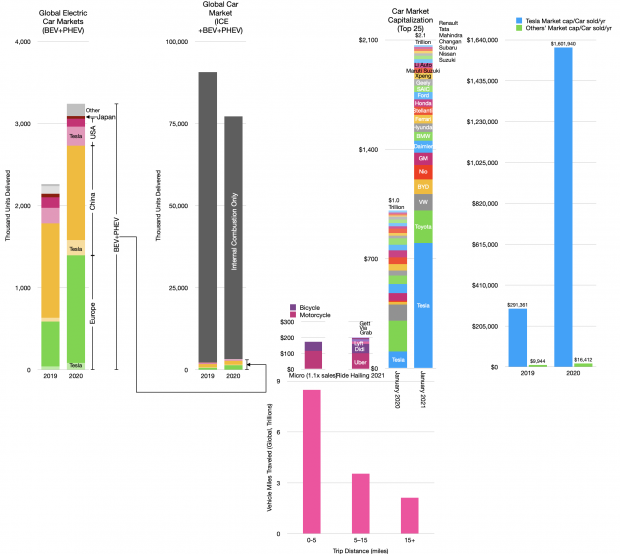

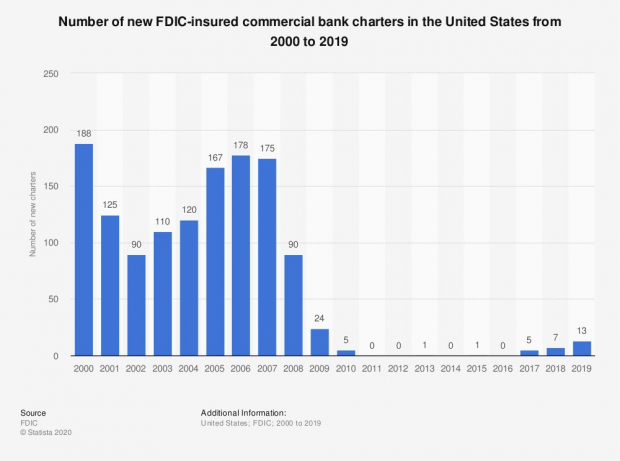

And so that’s just a fundamental backend change. And one way of thinking about it is over the last 10 years, since the financial crisis, Dodd-Frank basically stopped the issuance of new banking charters. Were you familiar with that? Did you ever see the graph of that?

Horace: No. No, tell us.

Balaji: So, you’re a graph guy – I’ve got a chart on this somewhere on Twitter, but basically the way that they dealt with the banks’ failure during the financial crisis is to effectively reward them by eliminating their competition entirely by refusing to issue new bank charters for almost a decade. And, here’s the graph over here.

The state’s solution to the financial crisis was to stop issuing commercial bank charters for almost a decade and to reward failure by regulating away competition via Dodd-Frank.

The network solution was FinTech and now DeFi.

The reason I bring this up is FinTech is a front end, Blockchain is a backend. Over the last 10 years… You’re probably familiar, at least to some extent, with the FinTech side of things. Imagine if, when I sent you a message via Gmail, that behind the scenes, Google printed out the email, put it on a Pony Express, took it to you cross continent, scanned that and put that into your inbox.

And it looked like it was digital, but it actually had this antiquated pre-internet backend of a two or three-day delay in there, but the company did the best it could to obscure that. You know, all of those hacky steps in between, yeah? That’s a good analogy for what FinTech is, where it’s this shiny web-like front end, but on the back end, you’re dealing with pre-internet mechanisms for settlement where it’s often FTP or flat files or some horrible Cobol-era file format. It just wasn’t set up for the workloads that we have when you actually press on that. Right? Once you set it up and you give people the expectations of being as performant as a Facebook or a Twitter or a Gmail, and you start putting huge workloads through – that the financial system doesn’t anticipate, you get things like the Robin Hood issue of earlier this year.

Horace: Yep.

Balaji: Right? You make people think that it can handle internet-like workloads. But it can’t, it just kind of simulated that. Taking that Gmail analogy a little bit further, with Gmail, every email that I send you is basically non-fungible. In the sense that each one is just a different set of characters. But if it was fungible, if it was money where every dollar is the same as every other dollar, Google could… when I hit a button to send you a hundred bucks, Google could just extend you effectively a hundred bucks on credit where it’s assuming I’m good for the hundred bucks. Right?

And that is essentially the mechanism by which a lot of FinTech companies operate where they’re like a central buffer that makes users think that this stuff is instant and fast, but it’s actually not on the backend. Okay, so FinTech is a front end. Blockchain’s a backend, where it’s a genuine innovation.

So it’s almost like this flanking thing where bank charters were cut off. FinTech built all of these fancy front ends on top of banks by doing deals with banks, by now, more recently starting to get licenses in Utah and places like that. And then blockchain, the crypto space, built a completely different set of rails where they essentially, over 10 years, got people to accept these things as money-like.

And now they’re coming together where, with Robin Hood, with Square, most FinTech companies are aware that crypto is a big deal. It’s not going away. And the reason many of them have a hard time getting their head around it is that it flips basic assumptions.

What Satoshi did with Bitcoin is he flipped absolutely basic assumptions. Where the concept of Bitcoin starts with the idea that deflation is actually good if it’s coming from productivity. The typical macroeconomist would say hyperinflation is bad, but deflation is also bad. A little bit of mild inflation is good. This is what you’ll read in every Econ 101 textbook.

Horace: Yep, that’s true.

Balaji: And so Satoshi said, actually, no, that’s not the case.

You want to have users be able to hold their own funds and you want to have a fixed monetary policy that gives certainty for investing in the future. That can’t be monkeyed around with, by the Fed open markets committee, to bail out banks and stop transactions and so on. That meant so many flips of fundamental premises.

Number one, digital gold being good rather than bad. Number two, that users should be able to custody their own money rather than having it at banks and they should be able to take that risk. Number three, that transactions by default should all be able to go through. So it’s like a default approved as opposed to a default sanctioned and so on and so forth. They basically just flipped fundamental premises.

And when you flip fundamental premises, you can often get to just a completely different environment, completely different worldview, completely different set of solutions. I mean, it’s like land animals versus sea animals or like Google’s culture versus Apple’s culture, right?

I mean, now they’ve become more similar but Apple for a long time, it used to be very private internally and Google was very public internally. Both of them worked on their own terms, but were just fundamentally different in terms of their premises and axioms.

Horace: Let me get back to this example you gave us, of online as a way to do fundamental transactions. Now, one of the things that, and this seems very much, like you said, behind the scenes, because from the front end the consumer is given an illusion of technical competence. But in the backend, it’s actually still jury rigged.

Now, the thing that I would ask is what does that mean and how does it feel different for the consumer? Because if you fix the backend, then yes, it’s much more robust and clean and probably safer. But I think that the way it affects behavior is not so much that people feel different about that interface, but rather that they will do more of it.

In other words, that, like you said, it was about volumes that caused the cracks to appear in Robin Hood. So to me, the question, the reason, let’s say I’m not skeptical, but I’m slightly reluctant to dive headfirst in on crypto is that I’m asking all the time is: How does it feel different for the end user?

And the end user would have to have some sort of emotional response to this change and say, ‘Wow, this is really amazing! Now it’s much better.’ Or, ‘Now I can do things that I couldn’t do before.’ So what I would posit is that the change you speak of would allow the users to suddenly say, ‘You know, I may do a wire to pay for a very large sum, but now I would do it a hundred times a day. Or I would do it to pay my friend, or I would do something financially that I never did before.’

And I, by the way, I feel this pain a lot because I live in two countries and you probably do as well, and you have to always transfer money and it’s an absolute nightmare. And it’s almost confiscatory in the way they steal money on the way, to try to transfer funds internationally.

So do you see this driving new user behavior or is it simply that you fixed something that was broken?

Balaji: Absolutely, excellent question. Let me give a few points on that. An interesting thing Evan Williams once said, in a sort of counter-intuitive way, was that the way to get people to adopt an app is to not do something totally different, but to take something they’re already doing and just cut out steps. Make it just faster, simpler, etc.

You know, people were blogging and then they did Twitter. People were blogging and then they did Medium and made it simpler, with front end editing. And that’s one view, that technology is incremental. But the other view is it’s transformative. Wait a second – our lives are so different than the past.

And here’s how I reconcile those, then let me get to specifics. If you go from physical mail to email, just sending point to point email, to a group email with reply all. To a group email with reply all where you add attachments of images to a Facebook thread, to then real-time chat in something like Slack or Discord where you’re attaching images.

Each one is an incremental step over the previous one. But if you were to think about how expensive it would be to do a Facebook thread by physical mail. You’d have, I don’t know, a thousand friends and you’d be printing out the thread each time and sending postcards to each of them, with someone saying LOL…

If you would just diagram that out and see how many packets were moving back and forth between those thousand participants of which maybe 95, 99% of them are, actually, not even participating. So therefore they wouldn’t even go and send in their postcards. And you’d say how much of a cost that would be on the legacy postal system?

At a certain point, when it’s a million postcards to be one simple Facebook thread that we take for granted that has some images and a reply and maybe a link or something like that. Well, then the quantitative difference makes a qualitative difference.

Horace: Absolutely. Yup.

Balaji: Right? And in the same way, that’s basically what’s happening with crypto. And one way of thinking about it is – and this is now changing, but in the first 10 years, what crypto was best for and by the way, within crypto the term ‘crypto’ is an overarching thing that encompasses… There’s just different people who have a beef with the term. One group, are those people for whom, you know, crypto used to mean cryptography, right?

And the second are those folks who think of Bitcoin as its own area, as distinct from crypto in general. I think crypto is the right term for the space as a whole. I think, in particular, cryptocurrency and blockchain is to cryptography roughly as the internet is to software. Software is not synonymous with the internet. Computer science is not synonymous with the internet, but it’s certainly the most frequent deployment and monetization point for it. And, in the same way, I think many cryptographic concepts will be deployed and monetize within the blockchain and cryptocurrency space.

On the second thing, just to finish this little tangent for a second, Bitcoin people think of Bitcoin as the only real cryptocurrency and everything else is a scam and a fraud and blah, blah, blah.

Which I don’t believe. And I don’t think Satoshi Nakamoto believed that, but this is something you’ll probably hear more and more of.

But just in terms of that term, ‘crypto’ is basically thinking of the space as a financial and technological and efficiency related movement. There’s also a very strong overlap, which I’ll get to on the ethical aspects and how it’s actually a pro-freedom movement. And those overlap. And a Bitcoin maximalist would be like purely on the pro-freedom side, or in their mental model of it.

Okay. Just coming back up the stack. So, end-user benefit basically in the first 10 years, crypto benefited what I’d call the power users and the marginalized. The people who are at both ends of the spectrum. It’s the exact opposite of the bell curve.

It’s not the person in the middle. It’s a person at the extremes. And so that’s why I like the example of, ‘Hey, I’m buying coffee at Starbucks. You know, this crypto thing doesn’t seem like too much of a benefit.’ It’s actually a good point. And the reason is crypto is good for transactions that are very large, very small, very fast, very international, very automated and/or very transparent.

So those six things: large, small, fast, automated, international, transparent.

Your Starbucks [order], maybe it’s 10 bucks or 15 bucks, whatever, for coffee and bagels or something like that. You know, big city prices nowadays. That’s not a very large nor very small transaction. It’s not millions of dollars. It’s not a cent. It doesn’t need to be very fast because to clear it, settlement can happen over a day or something like that. It doesn’t need to be ridiculously fast. It doesn’t need to be very automated because with both you and the clerk, there are humans monitoring the transaction on both ends.

It’s not very international. You’re both literally in the same coffee shop and doesn’t need to be very transparent. There’s no reason for either of you to have that receipt on chain. So everybody thinks about coffee payments because that’s maybe the most frequent thing that people actually buy on a daily basis.

There are not too many other things. People used to buy a newspaper on daily basis, but they don’t really do that anymore. They may have a subscription, but they don’t consciously buy it. So relatively a few other things you buy on a daily basis. You don’t buy a chair on a daily basis. You don’t buy a computer on a daily basis.

So they think about their coffee purchase, but that’s actually sort of the opposite. So where crypto is actually really good – let’s start at the power users first. The power users can be split into two overlapping groups, which are engineers and investors. Both of them are trying to do things like, for example, move a million dollars across the world to Japan in a day to do something, right?

The engineer might be doing that because they’re moving money around on the back end of Airbnb or Uber or PayPal or something like that. They’re pooling capital from lots of users and trying to do something with it. Take the profits from one area and move it to another. Accept all of these wire transfers in different currencies and convert them into USD within Airbnb’s main account, something like that.

Brian Armstrong, founder of Coinbase, saw what a big deal this was as an Airbnb payments engineer. He realized it was not a solved problem. That’s actually how he got into Bitcoin originally. So as an engineer, you understand it from that perspective. An investor understands it from a similar perspective where you want to do an international wire and, you know what? It’s actually still a pain to do that.

Wires get lost. There’s [the matter of] correspondent banks. It’s a huge pain to do a wire trace or something. But you know what’s really simple? If both sides use USDC, which is the stable coin I helped launch, but it’s the number two stable coin in the world. Maybe the number one, if you think of it, as in terms of legal stable coins, you can go to a website, stablecoinstats.com.

Right now, it’s $26 billion outstanding in USDC and over the last 24 hours, it was $694 million in volume. Okay. That’s quite a lot of wire.

Horace: Impressive. Yeah. That’s striking.

Balaji: That’s striking. The whole space is bigger than people get from the outside.

A good metaphor is crypto is a country. It’s a fractal country of a hundred million people, which is bigger than most people realize. Cambridge had a study on this last year. It’s probably bigger than that now, but it’s a hundred million people who hold some crypto, according to the surveys, spread across countries.

And the key is you have to have that sort of value flip right in your head to think of it as money. It’s basically like, do you think of the yen as money or not? Do you think of the ruble as money? And if you do, then you can participate in the Japanese or the Russian ecosystem. And if you do not, then you do not.

But crypto is like a country that is exponentially expanding. And there’s a million people at the core and then 10 million people around that and a hundred million and it’ll keep growing. And then once you’re part of this economic environment, all these other people accept cryptocurrency as money, all of these things become possible.

And once the other person, on their side, accepts USDC as a dollar equivalent, well, I can hit enter. And just like how sometimes you’ll send somebody a file and you’ll talk to them on the phone for a minute or 30 seconds, and they’ll be like, ‘Oh, okay. I got the file in my inbox, done.’

You can now do that with an international wire transfer with USDC. You can hit enter, and they will see it on chain in a few seconds. Now, at first, all that’s doing is it’s similar to the transition from mail to email, where you go from a two to three day delay to seconds. But then over time that increases the metabolism of business.

For example, I sold a company, Earn.com, to Coinbase several years ago.

One of the things we did there was kind of a V1 of this where we would accept Bitcoin from somebody in Greece or Japan, let’s say $10,000 worth. And then we were able to issue a thousand $10 amounts of Bitcoin to a thousand individual people in different places for microtasks.

And the thing is that, because I could get that $10,000 wire or wire equivalent from them same day, you didn’t have to know whether they were good for the money.

Horace: I think it’s unbelievable. But let me bring you back to the Big Five and the questions [from earlier in the discussion]. We just did FinTech, I think convincingly, the next question is how does this, which yes, it will increase metabolism, but how –

Balaji: How does it disrupt the Big Five?

Horace: Yeah. In particular, those examples you gave: messaging and platforms and coding and all these other things.

Balaji: Let me just tie up one last point on the previous thing, if you don’t mind. I mentioned [crypto] is good for the power user and the marginalized.

So the power user – the dev or the investor wants to move millions of dollars around the world with the keystroke. The marginalized, that’s somebody who just wants to hold on to a bank account equivalent. That’s somebody in a Venezuela or a place where the currency is being inflated. Or Nigeria, where people are being pushed out by the police.

But it’s also anybody who’s de-platformed or canceled or ostracized, or basically locked out of the financial system for whatever reason. Like the OnlyFans.com thing recently, [which is an] obvious example of something where… That’s what cryptocurrency sells, where the banking system can’t just lock you out.

And what’s interesting is sometimes these are the same entity at the same time. Something like binance.com, for example, is both a power user of crypto but it’s also marginalized where it’s sort of on the margins of the legal systems in the world.

A couple of other quick points on this before I move on.

One thing people often talk about is, ‘Where are all the use cases for crypto?’ Well, now there are many of them are out there. You know, I’ve actually got a post on this: And What Has Blockchain Ever Done For Us?Crypto has transformed crowdfunding, it’s transformed international wire transfers, it’s transformed gold.

Just those three applications are worth trillions of dollars, but there’s way more. If you go to defipulse.com, it’s transformed loans, it’s transformed derivatives. Many of these applications are actually out there and already at substantial scale.

But a very important point is speculation was installation. Without people speculating that this thing could be big, it wouldn’t have had a price. Without it having a price you couldn’t treat it as money. Without it being treated as money, you couldn’t build all of these apps. The loans wouldn’t work because it’d be just sending zero for zero.

The thing about crypto, in particular, is it has the opposite emergence mode from social networks. You know, we’ve now been tuned to such an extent to DAUs (daily average users) and MAUs (monthly average users) and whatnot, that we sort of forget in the 2000s, that those were metrics that people scoffed at and poo-pooed because social networks were piling up all the users, but where the money, you know?

Even as late as 2012 or 2013, there was an article, something like why Facebook will never make a significant profit. And just a few years later, [people were saying] ‘Oh my God, they’re so evil, They’re dominating the world.’

The New York Times had an article in the early 2000s, Google’s Toughest Search is For a Business Model, right. And of course, Amazon.bomb.

And you’ve seen all these kinds of things. With Facebook in particular, it piled up users. It made money, actually, pretty early on, but Twitter, Pinterest, Snapchat, this entire model of piling up users before making money was, and is, a common one. Now people understand it so much that they think that’s the default emergence mode of new technology,

But crypto flips that. Where it piled up the money before it had the users. Making money, almost in the literal sense, before the users came. So it flipped it around. And so instead the question people were asking is, ‘Oh, where’s the utility?’

Now it’s actually coming.

But I wanted to point that out. It’s the opposite of the social network model, MAUs and DAUs, there’s a totally new set of metrics you need for crypto, which are not daily active users, but daily inactive holders – that is people who are holding for the long-term and are committed to it.

So that’s macro, let’s go to specifics. So I mentioned FinTech. Pretty much every FinTech app is going to get backend blockchain-ified. Unless there is some prohibition within the country on that. And if that is the case, it’ll probably get out-competed internationally, even if it has a captive market at home.

And the reason for that is, if you think about an email address, it is something which is uniform across geographies. I don’t need to look up the postal code of this, or the zip code of that. With an email list, you don’t need to know whether somebody is in Nigeria or Switzerland or India. Just hit enter and you send it. That uniformity alone is something that blockchain addresses give you. It’s way easier to do a cross-border deal with somebody in Japan and Brazil or Nigeria with the smart contract than it ever was before.

In fact, one might even argue international business didn’t even really exist before smart contracts and cryptocurrency. And the reason I say that is if a Brazilian company wants to acquire something in Bangladesh – –

Judd: You need locals.

Balaji: Yeah. You know, what you might do is say, all right, there’s not too much law on the Brazil – Bangladesh interface, but there’d be U.S. – Brazil and U.S. – Bangladesh. So let’s set up an intermediate there and work through the precedents on both sides and get A plus B and B plus C.

The other country you might use for this is China, but if we actually go down to brass tacks and think about what the obligations are for each side and how the legal systems interact, you sort of need that centralized intermediate, the U.S. and China are the only two countries that do so much business worldwide.

There’s probably a Chinese enterprise in Bangladesh, probably a Chinese one in Brazil, and so you could make the things add up and the laws add up and the property rights add up. But that’s something that only works at scale. For large companies doing those kinds of transactions, you can make it work and you’d probably set up a U.S. or Chinese intermediary to help make it work. To lubricate it.

But if you wanted to do it direct – how do you do direct? These people don’t speak each other’s language? They certainly don’t know or trust each other’s legal system. So all kinds of weird peccadilloes. But on chain, everybody can read the same code. So, essentially, the pooling of money, the friction of diligence, the consistency and uniformity of naming, all of those things are 10x improvements just from a developer-investor standpoint, the power user standpoint with FinTech.

So all FinTech gets disrupted by blockchain. That’s very clear to me, it’s already happening in some ways, but that’s very obvious. All right, let me pause there and get your thoughts, feedback, and then I’ll move on to the next one.

Horace: Yeah, exactly. I love the way you framed it in those six categories of applicability.

Most people don’t experience small transactions or international or transparency’s not a concern of theirs. But that allows me to classify this as the type of disruption where it would allow things to happen which normally wouldn’t happen. It would allow, like you said, inter[national] deals to happen in ways that no one would even think of doing today.

And as a result, it’s sort of a new market disruption. It would unify people who are now divided by country boundaries. It would unify them in, as you said, this new country, this country of coin, [of] which they would be all effectively citizens that would somehow communicate and understand each other so much better, because they are not divided by these artificial boundaries. And I think that would, if you said the exponential growth is current[ly happening], then it would encompass a substantial part of the globe. And that in itself is so powerful that we can’t even fathom the consequences of. But it’s effectively, in the FinTech world, I think what you’re saying, and I’m sort of reading ahead of it here, so what you’re saying is that once that platform or that foundation is laid, you can imagine a lot of new things emerging and that will build new empires. Is that where you getting at?

Balaji: Yes. I actually think crypto is to America as America was to Europe. Like you can, and let me explain what I mean by that. It’s actually-

Horace: No, I get it, yeah.

Balaji: And just like you had, so why is that actually a good analogy and not just simply verbiage? If you know different kinds of distance metrics, the most obvious distance metric is the great circle distance on the surface of the earth between two people.

That’s just the distance as the Crow flies. You know, on the surface of globe. There’s another distance metric, which is the geodesic distance between two people in a social network. You could have, for example, you and I right now are closer geodesically than we are geographically. And then there’s people outside who are closer geographically than geodesically. People I don’t know, or haven’t spoken to, but they’re within a mile of me or, or within a mile of you.

And so those metrics, they actually have typologies associated with them. Just like you can have a cartography of continents, you can have a cloud cartography of who is close to who in the social network. In many ways, you’re probably closer to people in Cupertino and New York and various financial capitals around the world than you are to people who are a mile away physically.

And that is something, when you start visualizing what that cloud continent looks like, with all the nodes colored by what coins they hold, you know, a big orange for Bitcoin and blueish for Ethereum and so on and so forth. You start getting a visual that looks a lot like the European incursion into the New World.

Without, of course, any Native Americans or anything like that, it’s sort of the pure expansion of different demographics into this new region where people are spending more and more of their time. And VR will make this more than a metaphor. It’ll actually be like physical space.

Now the one thing I would edit on your point is that when I said crypto’s a country and you said without internal boundaries, there actually is a lot of crypto tribalism. So it’s actually an interesting thing where just like there was the New World and the Old World, there’s a crypto world and the fiat world, and there are conflicts within the crypto world and there are alliances with folks in the fiat world.

So it’s actually an interesting analogy to the age where the French and the English and the Spanish and so on all slugged it out for the Americas. Again, without the native population there, it’s sort of the pure version of that. So with that as an analogy, it’s something where you can build things from scratch. All these ideas that were infeasible in the Old World, like democracy or so many innovations that the U.S. had in terms of governance and —

Horace: The federation, the transportation networks, the frontier, the way the U.S. was constructed, mostly accidentally, allowed it to become a superpower.

And I think the continental scale of it, which again was accidental by acquisition of territories peacefully and not peacefully, but generally Europe was stuck in a centuries old grid of monarchies, feudalism and all the other baggage they had carried. It just wasn’t able to have a frontier mentality. I sometimes think that that conquest of land, that the open horizons is reflected in the dynamism and the ability to invent that followed.

Balaji: Yes. This is Frederick Jackson’s Turner’s frontier thesis, and one can argue whether these changes were all good or all bad. I think there were some both good and bad innovations that came back from the New World to the Old. For example, The French Revolution, they were in part inspired by The American Revolution, but had a much worse result.

Communism actually, there were a fair number of Americans that were involved in it. There’s a book by Kenneth Ackerman, for example, Trotsky in New York, where he raised money in New York. Also Lenin was basically released by the German government. Even the New York Times had something of this, like Lenin was a German agent.

So some of that stuff that came back to Europe from the Americas, that’s not that well-known, but it’s also not that obscure. You can Google around and find it. Some of that stuff that came back from the Americas was not good, but some of it was. The modern railroads and the history of how many technical innovations came back from the U.S. to everywhere else. From mass production to, I mean, in some ways bad, but the atomic bomb, nuclear power, all of these things that you would not have had without that fresh new, clean slate to build things and have influence back [the Old World].

And I think that’s very similar to what we’re seeing in crypto, where in many ways it’s already changing the financial system. The most obvious is every government in the world, every bank, knows what CBDCs (Central Bank Digital Currencies) are, at least in concept. And China is shipping a digital Yuan. Which means that a post on a message board by a pseudonymous guy 10 years ago has shook the entire world, and is already a topic for not just discussion, but active execution by the governments of a billion people.

And that’s, that’s-

Horace: Just while we’re on this cultural aspect, what is your opinion on who Satoshi is? I’m curious as you seem to know —

Judd: Are you Satoshi?

Balaji:. No, I’m not Satoshi. I wouldn’t tell you if I was Satoshi, but I’m not Satoshi.

Judd: What if we asked twice?

Balaji:. What’s that? What if you asked twice? Ha ha. No, I mean, Satoshi Nakamoto had a very important combination of skills.

First, he was a world-class programmer. The thing about something like Bitcoin is computer security. The late Dan Kaminsky, who was a friend of mine and absolutely a genius in computer security had an article in 2013 where he said, I tried to hack Bitcoin and I failed. And this was very exciting.

The point that he made was that, in most applications, security can rightfully be a little bit of an afterthought. That’s to say that in the early years of the web, maybe not so much today in 2021, but in the early years of the web, you just needed to stand up a site and get users. And you could sort of assume that there wasn’t that much to be hacked and people didn’t care that much. And so people would optimize for growth over security, because if you have growth and no security, then you can hire engineers and add the security later. But if you have security and no growth, you have no money, and it doesn’t matter. Nobody cares if it’s secure.

And the thing that’s different about cryptocurrency is that security is a fundamental characteristic. If it’s hacked, even once, if you can duplicate coins, inflate coins, and that’s a persistent issue and an unfixable issue, then the value goes away.

So security wasn’t an afterthought. Satoshi built the code like you’d build the code for a space shuttle. Where it was just a different mentality from the very start. And so, first of all, he’s a genius programmer. But, second, he clearly had a deep humanities background to build something — I mean, with many kinds of inventions, there’s Newton and there’s Leibniz. You know, there’s an idea in the air and there’s simultaneous invention of some kind.

But Bitcoin wasn’t like that. It really was something where one person’s genius shaped the world and it took a while for people to catch up. And it wasn’t like there were a lot of contemporaneous Bitcoins with similar ideas. It was something where it was kind of out there and it took a while for people to get it. And even still today, people don’t get it because it flips premises.

And unless you’re actually reasoning from first principles… people will quote Econ 101 as if it’s like some kind of inoculation against this thing that’s at a trillion dollars [in market value]. It’s similar in my view, by the way, the American, just to digress on this for a second, the American school and maybe the international school of macroeconomics, I think is similar to like Soviet economics where the Soviet Union had all of these prizes that were given out for Marxist economics. But it didn’t amount to a hill of beans because their premises were actually wrong. Some of it was good. Like, I think Kantorovich did linear programming. Some of the math was useful, but it was something where the premises were wrong. And one of the reasons for that is that with macroeconomics, you can’t actually run experiments very easily. Because the maximum that we know in macro is something like communism doesn’t work. In the sense if you compare a North Korea versus South Korea or China before Deng Xiaoping to Hong Kong and Taiwan and Singapore, or East Germany versus West Germany. You take ethnically similar populations, you partition them, run the experiment for 40 years, communism impoverishes one side of the country versus the other. We’ve now seen that multiple times. So that’s the extent to which you can see that within macroeconomics and so in that sense you’ve got controlled experiments, but that’s not actually the fundamental principle of macroeconomics.

It’s something more like John Lanchester wrote this in London Review of Books, you know, almost a decade ago. And Tyler Cowen wrote about it. The fundamental principle of macroeconomics is governments aren’t households. Meaning governments can print money, meaning governments can seize things at gunpoint, and so on and so forth.

And this type of stuff, this kind of discussion goes to philosophical roots. It goes to economics. It goes to history. It goes to policy. It’s inseparable.

Horace: But just to build on that, the way I would say it, governments typically have a monopoly on violence. What it boils down to is that they can do these things, which are not allowed by households, is because they have armies.

Balaji: Yes.

Horace: They have police forces that effectively are armed. Citizens may or may not be armed, but generally never could match the firepower of the state. So this is — the monopoly on power is monopoly on violence, at this moment.

Balaji: That’s right. And the thing about that is that the modern school of macroeconomics is backed not by mathematics, but by guns. Actually, Paul Krugman, in an interview with Joe Weisenthal said, fiat currency, if you like, is backed by men with guns. It’s like Mao’s thing, “power comes from the barrel of a gun.” Whereas, and so once we’re honest about that, we’re like, oh, it’s not Econ 101, it’s AR-15. Right? And so once you realize, okay, that’s actually the backing. These fancy formulas, it’s just like the Soviet Union, the Marxist stuff was backed by AK-47. Right?

So once you realize that, okay, well, I’ll give you another one, which is Bitcoin is backed by SHA256. So Bitcoin is actually backed by cryptography and mathematics versus violence. And that’s just a fundamentally different set of premises. So the reason this is inescapable to talk about is that you can use JavaScript without really knowing much about history. But to understand the problem that Bitcoin solves, you really do need to understand history and philosophy. And that’s why Satoshi was-

Horace: Yeah, exactly. I was going to bring you back to Satoshi. So he’s a humanist and he’s also a programmer par excellence. But you also speak of him in the past tense. Why do you do that? Is he not still with us? And what’s happened, what will happen with his share of Bitcoin?

Balaji: Well, nobody knows. It’s something, which is interesting, where it shows that with good enough OPSEC, to my knowledge, nobody’s actually, de-anonymized him.

A lot of people suspect that Satoshi was close to Hal Finney, who was an early extropian and programmer, but nobody knows for sure. Some people think it’s Nick Szabo. I don’t think it’s Nick because Nick has never published code to my knowledge. So I don’t think he could have done it himself, but Nick has published ideas that are clearly influential on Bitcoin. But the reason we speak of it in the past tense is for him to authenticate a message he’d have to do so from the private keys that are associated with early Bitcoin addresses that we know belong to him that only he would hold.

He could trivially do that. And he has not done that in last seven years. And Hal Finney actually died of Lou Gehrig’s disease, I believe, around that same time. So it sort of connects that Hal Finney might be Satoshi, but it’s not known. And nobody really wants to poke into it because in many ways what Satoshi did, it’s amazing that it was a human being who did it, like a single human being. And I think it really was a single human being because something like that is just sort of hard to do as a team. Satoshi… the fact that he has disappeared means that Bitcoin is “decentralized,” or rather it is one of the forces that makes Bitcoin feel decentralized.

It is something where there’s no identifiable leader, yet it has massive global adoption. Now, you can argue, well, the core developers and the miners and the reference client, and so on, are points of centralization. Each of these are tested over time. I think mining centralization just got tested. People had made the point, oh, China could take over mining, but China just cracked down on mining.

It was a huge drop. If you looked at the Bitcoin mining charts, the hash rate dropped from, I think, around 180 exahashes to like 80 exahashes. That’s a huge drop. The biggest drop I think ever in Bitcoin history. And all that happened was what you’d sort of predict by looking at it. Transactions slowed down for a little while, and now it’s back up to 140 exahashes.

So China, which is probably the largest and most organized and ruthless and technologically competent state, all the things combined, took a hard swing at Bitcoin mining, actually pushed it out of the country. Bitcoin kept ticking. So Satoshi’s absence has helped decentralize it because everybody can imprint their own thing on it.

In this sense, Bitcoin is like Linux where ferocious competitors like Google and Facebook still collaborate on Linux. And the reason is Linux is a demilitarized zone where one party’s contributions cannot be deleted or removed by the other parties. It is a true commons where you can give, but not really take back.

And that’s what Bitcoin is like: a truly decentralized technology where every user is a root user. Nobody else can de-platform you, nobody else can take away your funds. It is something where you have parties that can be highly dis-aligned, but aligned on BTC. Very, very powerful thing.

And a big part of that comes from Satoshi’s absence and disappearance.

Horace: Okay. Take us home then, back to the Big Five. How do we think about all this building up to something much more visible.

Balaji: All right, so the first 10 years, we can very much compare the current era to the year 2000 for the internet where you had infrastructure, you had Yahoo, you had AOL and you had the early broadband connections.

You have the first billionaires, you had everybody knowing what the internet was, but a lot of the applications of daily use didn’t yet materialize. And there were a lot of people who’d use the internet to check news or send email, but you could basically get away with a completely offline life, even in the year 2000. By the year 2010, that was not true.

And by the year 2020, it’s flipped the other way around. Now you need a phone in many places in Asia to get in with your vaccine passport and so on and so forth. And so I think that’s similar to where crypto is today. Where the infrastructure is being built out. We have the exchanges, we have the mining, we have the coin developers.

We have the first billionaires. We have widespread awareness of it. But yet today, you can still live a completely crypto free life. I do not believe that will be true by 2030. And I believe it will be totally flippened by 2040, where it’ll be crypto first for the entire financial system. But let me go to specifics, okay?

So we talked about FinTech. Every loan, every mortgage, it’ll start with all the digital stuff first because that’s which is easiest. The stuff that has an offline correlate to it, like mortgages, will be harder because you have to have so-called crypto oracles recording the transfer of things offline. But all the FinTech stuff, that’s kind of obvious.

Okay, then messaging. The big thing about crypto is it allows for provably, encrypted end-to-end encrypted messaging. See when, nothing against WhatsApp, but it just tells you that it’s end-to-end encrypted. They could have a bug in the implementation. It’s not easy for the user to verify that. You know, it feels the same as Facebook Messenger.

It’s trusted [as] end-to-end encryption, but then you can get backdoors and stuff put in. Whereas with crypto messaging… You know, it’s funny, when you say cryptocurrency is taking two concepts that seem to be totally distinct like encryption and money, they have, of course, come together since the advent of HTPS and credit card payments on the internet twenty-five years ago.

But crypto has put them directly together in a very powerful way. In the 1990s and the 2000s people talked about this thing, they still talk about it, called the public key infrastructure problem, which is if you could assume that everybody had public and private key pairs, you could imagine this magical world where all of these privacy preserving things were possible.

Now many of your [listeners] may not know what public and private key pairs are. Roughly speaking, a public key is like a sealed envelope that you can give out and people can then put a message in there and seal it up and send it. And only you with your private key can actually see what’s inside that envelope.

They can send you messages that only you can decode. There’s many other uses for them, but that’s one way of explaining them. The thing about it is, when you talk about everybody having a private key and public keys that are out there, well, you could do secure messaging.

For example, if your public key is out there next to your Twitter account, I could just take that public key. I could gin up a message. I could post that to you publicly, but only you would be able to decrypt it. The reason public key, private key, the whole public key infrastructure problem has been hard to solve is you need people to keep their private key available and secure at all times. So if you want to keep it available, you can just put a post-it note on your desktop computer, but it wouldn’t be secure. If you want to keep it secure, you could go and put it in a lockbox somewhere, but it wouldn’t be available. You’d forget where it was.

To have something be secure and available at all times is actually very expensive. It’s like your wallet, it’s like your cell phone. It’s something which, you’ve got eyes on it at all times. And that’s something which basically has to be on your person and you need a strong incentive for doing it.

And so the big thing that crypto has done is it’s made that incentive literal. It’s money. If you lose your private keys, you lose money. And so because of that, everybody, millions of people, hundreds of millions, billions of people will have private keys that they can encrypt messages with. And so that will unlock end-to-end encrypted messaging in a provable way where you don’t have to trust WhatsApp, or what have you.

And that’s going to become more and more important as you’re seeing, for example, Apple ran all these billboards on privacy and, I’m not sure what your stance is on that, but the CSAM thing, if you saw that, recently was basically cracked. Where people were able to put fake caches on people’s devices to make it seem as if they had CSAM on there, but they didn’t.

And I think you’re going to see more and more of this, where there’s a lot of advertising based assertions of privacy that are then eroded by some action and people will not want to take the Big Five’s word on trust. They already don’t. And they’re going to want provable end-to-end encrypted messaging.

We already saw this earlier this year, where there was an exodus in part from WhatsApp to Signal over some rumors that’s WhatsApp’s new terms of service were making it more feasible to eavesdrop on you. And I’m not sure how true that was or not, but you’re actually starting to see consumer demand for privacy, which people didn’t think existed.

Let me pause there. That’s messaging, let’s talk about that.

Horace: I think therefore the, let’s say, the disruptive technology, as opposed to business model, is trusted encryption. And I think that what you’re saying, effectively, is that the incumbents are going to struggle to implement. That’s why I’m struggling. I’m thinking of it as a competitive question.

But if the struggle seems to be what you’re suggesting, this is asymmetric or contrary to the way they would implement this new demand for privacy.

Balaji: Yeah, here’s the thing. A lot of people tried to separate blockchain and cryptocurrency.

They were like, ‘Oh, this blockchain thing is a great database, but this crypto thing it’s weird and unregulated and volatile and it’s bad. And so let’s do it without that.’ And they tried to do enterprise blockchain where eight banks would get together and have some shared database. And that actually was the worst of both worlds solution where it had all the complexity of enterprise and all of the technical complexity of blockchains.

And the thing is that every application of blockchains will involve a crypto component. So the reason that big companies will find it hard to adopt this is… Why do people have these public and private key pairs? Because they have cryptocurrency, probably because they have an Ethereum or a Bitcoin address or a wallet locally on their computer. That is the prerequisite.

That installation is like having a web browser locally on your computer. And from that you can access internet. If you have a crypto wallet on your computer, you can access the financial internet. And if you do not, you cannot. And so these big companies, because they haven’t yet grasped the nettle of how important it is to have Bitcoin and Ethereum integration in their messaging and payment apps, will not get that until too late.

They’ll try their own in-house solution because they understand open source, but they don’t understand open state. You know, they understand open source in the form of GitHub and open source code and whatnot. But open state is yet another level where it’s not just a source code that’s public, it’s a database that’s public. The Bitcoin blockchain is public. The Ethereum blockchain is public. Every user is a root user. It’s shared state. It’s the next step after open-source. They just don’t get that culturally. And by the way, I wouldn’t call it trusted end-to-end encryption. I’d actually call it something slightly different, which is verifiable end-to-end encryption.

It’s end-user verifiable. So that’s the big difference. Trust only if you can verify.

Horace: So that gets us to messaging. Potentially you get a situation where unless they buy the whole concept, as you said, the implementation has to be coin plus blockchain. So it’s not just blockchain. It has to have this, sort of, pain.

Well, I call it pain because it’s like you suffer if you lose, you know, it’s verifiable

Balaji: Yes. That’s right.

Horace: And, so I think what you’re getting at culturally in terms of what’s asymmetric about this technology is that it’s not just utility, it’s utility plus consequence. And that consequence or consequential nature, I think, is what is difficult to absorb for, not just the Big Five, but almost any larger platform company or technology as we know it.

We get into a state of triggered, let’s say, consequences, which are negative. And people are just squeamish about it. And I think that you can’t be a manager in these companies and say, ‘Man, the consequences of this, I mean, we could get sued, you know?’

Balaji: Exactly.

Horace: Am I getting close?

Balaji: Absolutely. Because, you know, what’s more scarce than financial budget? Risk budget.

Horace: Yes.

Balaji: Yeah. These giant companies have cash cows and are under regulatory scrutiny. So they don’t have the risk budget.

They don’t have the appetite for risk. And it’s actually true that their risk is greater than that of a small company on doing this because they’re under the microscope more. That doesn’t mean it’s impossible. [Jack] Dorsey has managed it with Twitter, but that may be because he’s just under the level of scrutiny, where the Big Five are under that maximum scrutiny.

But even Facebook has actually said, ‘You know what, we’re going to take the hit on this.’ I give them props for trying in the space. Simply as a founder, it’s actually a non-trivial thing to do, but it is one of these things where the short-term incentives are so strong to not take a risk. And you really need CEO buy-in to do it.

I mean, as I said, Satya did a decent job on this, where Microsoft was relatively early on Ethereum support on Azure, and so on. And there’s some of that. There’s some of the public cloud stuff they’re doing, like the safe things. But putting it into Google Pay or Apple Pay or things like that, or buying it at the corporate level, these guys are all going to be late adopters on that because the risk budget isn’t there. You need consensus within the company. And the thing about a crypto company is everybody is hired from the crypto country. Everybody’s hired and they already have that consensus.

It’s similar to the 1990s and early 2000s, and people thought open source was communism. Ballmer said something like that. If you remember that in the year 2000-ish. And this is hard to remember right now, but if you remember in the early 2000s, there was a cultural and ethical movement around tech, related to open source that was pro-Linux, anti-Microsoft, anti-corporate in some ways and so on. And that actually gave a lot of the early energy for people in technology thinking of themselves as the good guys.

And then over time the good guys became the big guys. And now they are sort of in play at safe corporate mode with lots of MBAs and spreadsheets and chiseling of customers and all the stuff that is hard to escape when you’ve got millions or billions of users and all this regulatory pressure. But it just changes your culture.

Then on top of that, they’ve got all of these political disputes internally at the company and leaks and all of this stuff. And so now crypto is like the next version of that, where it is not simply a technology, it has an ethical component to it. It has that philosophy, that community aspect, where it is returning power to the user, it is pro-privacy. It is decentralization as opposed to these centralized tech companies. That by the way, as a user —

Horace: I would even take it a step further. It has an ethical component, which may be a bit squishy, but I’d say it has even a political component. And I think by political here, I mean it’s divisive in some ways. And you have to accept the premise that as a participant, you have essentially a partisan point of view.

And that itself is a giant leap because I think the neutrality of, the implicit neutrality, of a company’s governance is like, ‘You know, we play both sides of the aisle where we’re going to be.’ And I don’t mean this in the sort of left-right sense. But this is a new dimension.

Balaji: Absolutely.

Horace: And if you want to participate, you have to be willing to put yourself in that state. I sensed this myself because I find myself being drawn into this world. And that’s been uncomfortable for me because I do not wish to be partisan. I do not wish to be political.

I do not wish to make a statement with my support for a currency or whatnot. But this discomfort also attracts me in the sense that, intellectually I’d say, ‘Well, that’s interesting.’ We call the show Asymetric – as an asymmetry, it’s fascinating, right? That you have to be in that dimension now. And that’s what I think fundamentally would be the root of the disruption. In the true sense.

Balaji: That’s right. I think I was able to articulate this in a recent post. That’s the difference between Web 1, Web 2 and Web 3.

So Web 1, roughly, was about technology risk. Can we even build it? Can we make packet switched networks? Can we make web browsers, all of that stuff? Can we make operating systems? Okay. Web 2, it wasn’t that tech risk went away completely, but much more of it shifted to market risk. Now that you had open source databases and you had all of this open source tooling, a lot of it was, ‘Hey, we know we can build it.We can snap together this web app or later this mobile app, but will people buy it?’

Will this consumer behavior be adopted? Will they use, you know, Snapchat versus FrontBack? If you remember FrontBack, there were a lot of these fruit fly type experiments with consumer internet, in particular, where the risk was not so much, ‘Will the app work?’ It is, ‘Will people actually buy it, will they use it?’

And now we’re in the third stage, which is Web 3. With crypto [related] things, we know we can build it. The tooling has now become mature enough that it’s not, again, there is still technical risk, but you can launch a token or a coin and we know people will buy it.

It’s actually kind of interesting that there’s almost always going to be some demand for the thing, at least, you know you can get it off the ground. But the question is now will people ban it? So in other words, Web 1 was about tech risk. Web 2 was about market risk, but Web 3 is about regulatory risk.

Horace: Yeah, that’s what I mean by political. I think I’ve used this word in maybe my own way because regulatory ultimately gets into the question of politics and that isn’t, again, the classical left-right divide, but more like, ‘What is your philosophy? What do you believe in?’ What matters is your point of view and, and that you’re forcing people to have that.

That’s the thing here. I think it’s forcing people and you cannot separate them any more, saying, ‘I’m neutral. I just believe in tech.’ It’s forcing you to make a stand and that’s a very uncomfortable position for any corporate entity. It forces them to become partisan, in a way, on this dimension.

And that is what they will resist. I’m sort of taking your point here. And I’m trying to, myself, think of how this becomes disruptive

Balaji: You’re right. You’re right. When you’re serving a billion people, they have an Innovator’s Dilemma-like thing. The problem for them is that this is a, whether you want to call it political belief or partisan belief, or what have you, ethical belief, in decentralization, which is growing exponentially.

If you think about the number of crypto adopters as just one metric, it’s like a hundred million today. And it was certainly not that in 2010. Sub 1,000,000, probably, sub10,000, probably sub 1,000, even in 2010. So that’s massive, massive growth, but it’s growth that they feel that, probably correctly, that it would be challenging for them to tap into without taking a significant messaging and risk budget hit.

Now, again, can they do it? I mean, as I said, Dorsey has managed it. I think Facebook could have, rather than doing Libra or Diem, they could have just built Bitcoin and Ethereum into their Messenger app and started with that. And that would have been smart. And they could still do that in VR, potentially. They’re at least further ahead.

They’ve actually taken some of the hits internally on getting there. They’ve got some engineers, but the biggest companies that want to be all things to all people and do inoffensive things… You know, the thing which people tell startups, they tell them focus, focus, focus, focus, focus.

You almost can’t focus too much on some micro demographic. You win there and then you level up, and you win there and you level up again. And the big company is not going to be able to focus because they’re all things to all people. And that’s now something which is no longer simply a market thing, but it’s also a political / ethical thing, where you have to essentially bet on decentralization.

Horace: I’m starting to get it. Do you want to get into some of the others – we’ve done messaging, do you want to get into some of the others?

Balaji: So we talked about FinTech. We talked about messaging and, by the way, messaging is not simply, just like you go from email to group mail to Facebook threads.

Messaging starts with one-to-one messages, but every single messaging app will be rebuilt with verifiable end-to-end encryption, where you’ll use your, probably your Ethereum name, but you could do one to one messages. You could do one to N, you could do N to N. You could do blogs, you could do blogs behind encryption walls.

You can do Slacks. All of these things are being built around so-called DAOs (Decentralized Autonomous Organizations) today, which combined sort of messaging plus corporate governance plus communities. So, relate to that login.

So right now, a huge moat for these big tech companies is log-in. With Apple login, with Facebook login, with Google login, with Twitter, where they’ve got hundreds of millions of users and you can use their APIs and implement logging onto your site, but you’re also subject to them.

They can cut you off. That’s no longer the case with something like ENS (Ethereal Name Service), where you can log in as Horace.eth. Just your local private keys are determined, not a password that can be reset, not account that you can be deplatformed from. That is a fundamental change where the solution to that equation, the private key, is held locally on your computer and that’s the sufficient and necessary condition to log in.

If you have that you can log in. And if not, you can’t. So that completely changes login where it means that for example, you can’t be deplatformed from social networks. It means you can authenticate also without people necessarily knowing who you are besides the fact that you have that key.

It’s a structural shift in how you actually even log into systems and it’s sort of like phone numbers or emails. Where, if I have a collection of your phone numbers or your emails, like on a sub stack, or in a set of numbers that have opted into text messaging, I can contact you. But even better than that, because nobody can even intermediate with the phone number the telcos could in theory, stop you. But with this kind of messaging login combination, they can’t really stop me from messaging somebody on ENS.

So that disrupts Facebook login, Twitter login, Google login, LinkedIn login, all those – and it’s already happening with applications like Uniswap, for example, you could log in with ENS.

Number four: Social. So when you’ve talked about messaging and login, you get to social and social is basically just sending lots of different kinds of messages back and forth to each other.

Decentralized social networks are now actually out there and early and working. Just technologically – Mirror, Bitclout, Capsule Social, many others. A lot of the DAO chat-style networks are out there. I’ve invested in a bunch of these. I’m going to invest in more, no particular endorsement of any one of them, but decentralized social networks are now actually out there where every like and post equivalent is actually on chain versus simply in a centralized database. And the way of thinking about what a big deal that is is you do not have root access to Twitter’s database or Facebook’s database. But with a decentralized social network, a developer can hit enter and print out every tweet equivalent from the beginning. They can print out the social graph, they can index a social graph and they can search the social graph.

So there’s applications, so-called block explorers. This gets us from Social into Search. One thing that is not very much thought about, because this battle happened almost 10 years ago, is how Google strive mightily try to buy Facebook. They were really annoyed at the emergence of Facebook and LinkedIn and Twitter because they were dark to them.

These are graphs that they couldn’t search and they knew how big it was going to be. And they were like, ‘Oh, we’re only gonna be able to index the open web, this is closed.’ The only thing that really came out of open social was the open graph standard. But they weren’t able to get these social networks to open up their databases because, of course, they could make more money with them closed than open because if the database were open and anybody could read and write to them, well, they would not be any more the monopoly provider of advertising on their platform.

That’s why Twitter shut down Tweetdeck and deplatformed all these companies that were initially building on its open protocol, it made more money with advertising vs having an open protocol. The critical thing that decentralized social networks have solved is the alignment of interests between the developers and the users and the platform creators where everybody just benefits from the token’s appreciation. And now you can build on this decentralized social network in a way that you could not do so on Twitter, because they’ll deplatform you. You can’t build on Facebook’s API, they’ll deplatform you if you get successful enough.

So decentralized social networks, don’t just enable decentralized social they also enable decentralized search because an underappreciated aspect of Google… First, a lot more searches are done on Twitter these days than people realize. I think it’s, it’s crept up quite a lot relative to Google. I’m not sure if you have this behavior, are there days where you search on Twitter more than on Google?

Horace: Not more, but there are days. And when I do, it’s frustrating because I don’t find searching on Twitter easy.

Balaji: It’s not that easy, but —

Horace: But I sense what you’re saying. Also with the Facebook problem that the shift to social from web was, I think Google dropped the ball there. I think that’s one of the greatest failures that they didn’t manage to transition to social in any way.

Balaji: Yeah, they got YouTube. That’s their big one that they did get.

Horace: YouTube was, yeah, it’s the best thing they’ve done actually since search.

Balaji: So alright, so extending this point, a very important technical point where you’re thinking about search is [that] closed social network databases are harder to index in the open web, but blockchains are easier to index in the open web. And, this actually is something which most people don’t realize, blockchains, until really the last year or so, were for the most part used to contain financial data.

And so block explorers like Blockchain.com or btc.com, that are indexes of the Bitcoin blockchain, or Etherscan.io [which] indexes the Ethereum blockchain. Those don’t look like search engines to people, really, because the data structures they were indexing were things that weren’t really things you thought of as being on Google.

You’re looking for Bitcoin addresses and transactions and later on smart contracts and tokens, but these are very high volume search engines. And to show how behind the eight ball Google is, Google hasn’t built a block explorer for Bitcoin, even. Or any of the major crypto chains. Forget even Ethereum, they haven’t done Bitcoin. And that’s so within their core competency, it has zero regulatory risk, but just shows how behind they are, that they haven’t done that in 2021. The reason that’s important is what we’ve just proven over the last year, which is a huge milestone, is something like Bitclout or Mirror shows that you can host social networking data on a blockchain. There are others like Hive and Steam that have also shown this. And once it’s all on chain, it becomes so much easier to index for the purposes of search.

People for example, stood up a thing, cloutavista.com to index Bitclout. This is a demo, I’m not saying any particular decentralized social network will win, but in 10 days they were able to stand up the search engine.

How long would it take you to stand up a search engine for Twitter? It would take basically forever because you need access to their API. They’re not going to give you access to the API. And if they do, it’s going to be very throttled and very expensive, and you’ll have to raise venture just to pay for that. They can cut you off or change it at a moment’s notice. They don’t care about your business. And even if you give them a hundred percent of the company, they might not care.

Search will be transformed by block explorers. There’s so many different ways from a technology standpoint that blockchains are easier to index.

Just one example, there are entire PhD dissertations that are written on freshness indexing. You’ve got a million websites, you’ve got a limited crawl budget. You can’t crawl all of them every second. It’ll make the servers mad, but it’ll also use up your own bandwidth. And they don’t update every second.

So how do you actually crawl them? Well, you have to have some statistical model of when they’re likely to get updated and you have to go back to the website when it’s predicted to have been updated and you have to have some provision for them going from one update a week to one update a day when you see a lot more changes than they used to have, and you’re updating your parameters… It’s this huge mathematically complicated thing.

And that’s just one aspect of search indexing. And all that goes away with blockchains because you just subscribe and you get a block every 10 minutes or one minute, and it’s got all the changes there. So, just the architecture obviates that entire —

Horace: It’s self indexing.

Balaji: It’s self indexing. You get a change set. You know, this is also related to the broader move towards, log structured databases and so forth, which, if you’ve got listeners who know about what’s been happening in data science, that’s been a big deal. But it all kind of comes together where you have Kafka and so on.

These change sets that are coming in, you can just subscribe to them as opposed to having to go out and get them. You don’t have to crawl. So that simplifies fundamentally – that alone makes search easier.

Okay. Going a little bit further. The Crypto Phone, you know what’s happened recently with Apple and the CSAM thing?

The reason that it’s bad for Apple to be searching your phone like that is today they’re searching for photos with incredible possible levels of false positives, because people can put these adversarial machine learning images on somebody’s phone and frame them for a very serious crime.

Tomorrow, though, they can use the same technology to scan for cryptowallets on phones. And it may be ordered to do so by governments. So that alone is going to mean, and there’s already pushes for a crypto phone out there. Foundation Devices, for example, there are people who are building it. But a crypto phone is also important because of other things like payments. You have all this pressure on Google and Apple for payments.

The fact that you’ve got login, payments and identity, getting decentralized and app developers making more money and users having their funds secure. These are the kinds of pressures that could actually lead to a new mobile operating system. And actually that gets to the next point, which is Crypto OSes.

So that’s actually where, unbeknownst to most people, the operating system innovation today is happening in crypto. The reason is, a blockchain like Ethereum has a compiler and a database and a built-in programming language, and is as complicated as a web browser in many ways. Because you can write programs on it.