HTC is the world’s fourth largest smartphone company. It ships 80% of all Windows Mobile and probably a similar proportion of Android devices. Like Microsoft in 2003, Google turned to HTC for its first smartphone, the G1 and its latest, the co-branded Nexus One. The company shipped a total of 11.7 million mobile phones in 2009.

HTC is the world’s fourth largest smartphone company. It ships 80% of all Windows Mobile and probably a similar proportion of Android devices. Like Microsoft in 2003, Google turned to HTC for its first smartphone, the G1 and its latest, the co-branded Nexus One. The company shipped a total of 11.7 million mobile phones in 2009.

It would appear that HTC is very well positioned in what amounts to be the best industry in technology.

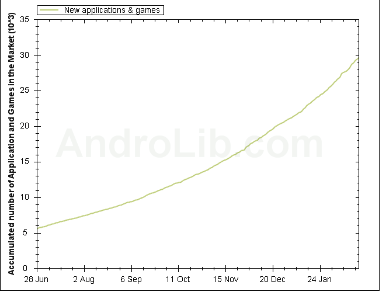

However, not all is well. A few days ago HTC issued revenue guidance below analyst estimates and its stock price is at 2005 levels, 70% off its peak (see graph–source: Google finance).

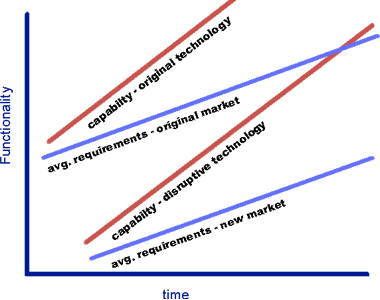

Part of this could be explained by its continuing reliance on Windows Mobile which is fading fast, but also it’s because, as management acknowledged, there is significant price pressure.

HTC prides itself with having a “premier” product with typically high-end feature sets and positioning. HTC invested in its own UI to differentiate its products and has mounted a branding campaign to move away from being a white-label ODM.

It seems all for nought. The rules of the smartphone market do not favor modular component players. As HTC does not front its own OS, it still struggles to stand out in the eyes of the consumer.

Looking at the list of top 3 vendors: Nokia, RIM and Apple, we see hardware companies that field an integrated OS/service bundle.

It’s hard to compete against this.