It’s time to re-evaluate the categorization of smartphones. The term has always been problematic. It loosely means a phone that runs an advanced operating system and has third party SDKs. There is no industry standard definition and some call it a converged device or a multimedia device. One analyst famously said that the iPhone did not count as a smartphone on launch because it was not open to developers.

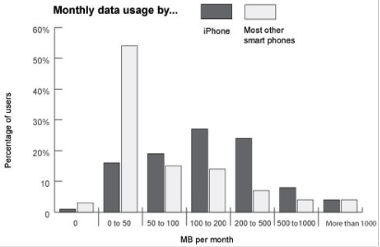

I’d propose a different definition, not based on the attributes of the device, but the jobs that the device is hired to do. This is in a way, the same distinction between Facebook and MySpace. They are clearly hired to do different things by their users and as a result don’t directly compete. When you do this job-based segmentation, you realize that iPhones, Android devices and Windows Mobile and Palm are fairly similarly used. Blackberry, however, does not match the profile. (Neither do most recent Symbian devices, though for different reasons.)

The most common jobs I can see in use with the first cohort of devices is (Comscore data exists to back this up)

- browsing

- social networking

- applications/games

- email

- media consumption

- navigation

The Blackberry has relatively poor utilization of any function except for email and perhaps social networking (though the latter is not likely in company-sourced devices). The focus on a large number of jobs to be done is what distinguishes smartphones from the more limited “feature phones”. By this logic Blackberry is hired as a “feature phone”.

It’s also instructive to follow commentary among enthusiasts. It’s fairly clear that this segmentation exists implicitly: Android, iPhone, Palm and WinMo are comparable while Blackberries are for a different demographic, different user, different usage.

Finally, there is the gut check. It’s become clear to me that what users do with Blackberries is similar to what they do with voice phones: voice and messaging. Although additional functionality is available, it hardly gets used because it’s hard to use.

But you may ask: so what? The reason this is significant is that smartphones are embryonic mobile computers with a clear trajectory for improvement. Feature phones are overshot voice phones which are likely to be disrupted by data-centric entrants.

On a different level, it also means that growth stats for the two product types are not comparable. Saying that the Blackberry is outgrowing the iPhone (or vice versa) is meaningless.

It also means that Blackberries, being an evolution of voice products, still have a huge growth potential with those customers which are looking for messaging as an improvement for their good enough voice products and for whom smartphones are over-serving.