In the last article I described growth vs. P/E and price change for the largest “ultra-large cap” companies, of which Apple features prominent.

In this article I take the same analysis to the top ten largest technology companies (by market cap, see table at bottom).

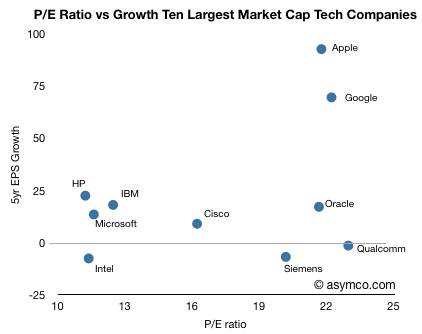

In this comparison, Apple no longer has the largest P/E ratio. Qualcomm, Google and Oracle are all at similar levels of valuation relative to earnings, however Apple’s growth outstrips them, only with Google in the same quadrant.

Note the “Wintel” cohort consisting of Intel, Microsoft, HP clustered around the Low growth, low valuation quadrant in the lower left (coincidentally co-located with IBM). Oracle, Qualcomm and Siemens show high valuation with low long-term EPS growth. Cisco is somewhat on the fence.

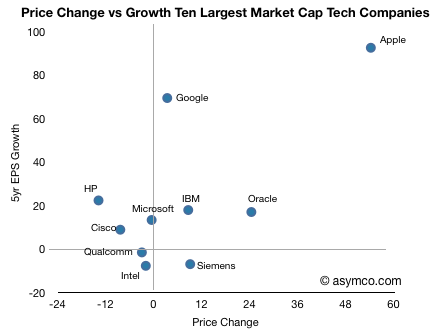

When comparing how the market has rewarded growth through share price appreciation, the correlation to growth is much better. Google seems under-rewarded.

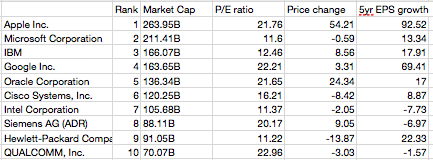

Data follows:

Discover more from Asymco

Subscribe to get the latest posts sent to your email.