Prices provide accurate, independent signals about where, when, and how to create and deploy value-creating innovations. The mechanism of free markets signals what should be rewarded and what shouldn’t. When comparing competitors, prices are the best indicators of differentiable positioning.

However, prices are sometimes anomalous and subject to transient market conditions. It’s therefore important to observe pricing over a long time frame.

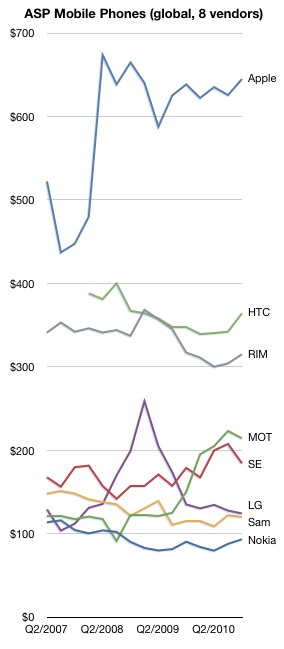

This chart shows the average selling prices for all phones sold by the eight publicly traded phone vendors (covering approximately 70% of the market) since mid-2007.

There is remarkable stability in the pricing of the competitors. One could argue that only Motorola and LG saw significant swings in price. (Apple’s instability in 2007 was due to the revenue sharing deal for the 2G iPhone on AT&T).

Motorola pared down its portfolio (and its market share) and as a result has seen a doubling in ASP. LG had a rapid rise and rapid fall as its feature phone business boomed and busted.

But otherwise, pricing trends are subtle: down from Nokia and Samsung. Slight decrease for RIM and HTC and stable for Apple. In a future post I’ll dive into the relationship between pricing power and share.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.