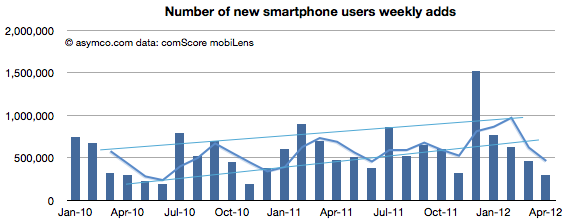

The latest data from comScore showed a few surprises:

New smartphone users dropped to a very low level, below the trend line.

Slightly less than 300k new smartphone users abandoned their feature phones every week during the month. Compared with the 1.5 million per week in November, it’s quite a slowdown.

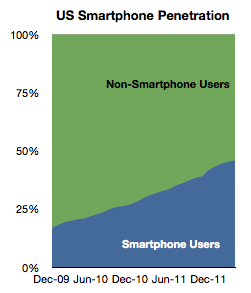

Penetration growth slowed as a result as well. Only 1.3 points of share were gained by smartphones.

It’s still likely that the penetration will reach 50% by the end of summer this year (as was predicted in 2010).

When looking at the picture above broken out by platforms, we see signs that the slowing in smartphone growth seems to be attributable to a slowing in Android adoption: Continue reading “Trouble with the robot?”