iPad sales were unexpectedly slow in Q1. Tim Cook explained it as follows:

iPad sales came in at the high end of our expectations, but we realized they were below analysts’ estimates and I would like to proactively address why we think there was a difference. We believe almost all of the difference can be explained by two factors.

First, in the March quarter last year we significantly increased iPad channel inventory, while this year we significantly reduced it.

Second, we ended the December quarter last year with a substantial backlog of iPad mini that was subsequently shipped in the March quarter whereas we ended the December quarter this year near supply demand balance.

We continue to believe that the tablet market will surpass the PC market in size within the next few years, and we believe that Apple will be a major beneficiary of this trend.

Tim Cook went on to say “over two-thirds of people registering an iPad in the last six months were new to iPad”

In a later discussion, Luca Maestri said:

As Tim explained earlier, our iPad results and the comparison to the March quarter last year were heavily influenced by channel inventory changes. Specifically, this year we sold 16.4 million iPad into our channel and sold through almost 17.5 million, reducing our channel inventory by 1.1 million units.

Last year, we sold over 19.4 million iPads into our channels and sold through 18 million, and therefore increased channel inventory by 1.4 million units. As a result, the year-over-year sell through decline was only 3% compared to the sell-in decline of 16%.

We exit the March quarter with 5.1 million of iPad channel inventory which left us within our target range of four to six weeks. iPad continues to lead all other tablet by far in terms of user engagement, size of ecosystem, customer satisfaction and e-commerce.

In a later Q&A:

Steven Milunovich – UBS Securities: Tim, I understand that the iPad is not as weak as it appears on a sell-through basis, but still it’s relatively flat over the last year in terms of sell-through. What are your thoughts in terms of why that is and can that accelerate with Office on the iPad going forward?

Tim Cook – CEO: It’s a good question. Let’s talk about iPad a little more than we did in the comments.

When I backup from iPad, here is what I see. It absolutely has been the fastest growing product in Apple’s history, and it’s been the only product that we’ve ever made that was instantly a hit in three of our key markets, from consumer to business including the enterprise and education.

And so, if you really look at it in just four years after we launched the very first iPad, we’ve sold over 210 million, which is more than we or I think anyone thought was possible at that period of time. It’s interesting to note that that’s almost twice as many iPhones that we’d sold in a comparable period of time, and over seven times as many iPods as we’d sold in the period of time.

So, I think it’s important to kind of to put that in perspective. We’ve come a long way very, very quickly. Looking at it by market a bit, which I think is important. I think Luca mentioned a little bit of this in his comments. In the education market in the U.S., we have a 95% share. So the focus in education is on penetration, is on getting more schools to buy and my belief is the match has been lit, and it’s very clear to the educators that have studied it is that student achievement is higher with iPad in the classroom than without it. So I’m confident we’ve got a really great start in education far beyond the U.S. now. This is happening in many, many parts of the world.

In the enterprise market, we’re seeing virtually all, 98% of the Fortune 500, they’re using iPad. We’re seeing – according to Good Technology who looks at activations of tablets – the latest data we have from them is that 91% of the activations of tablets in enterprise were iPads. So this is also an astonishing number and many of those enterprises are writing apps that are key proprietary apps for running that business, and this is great for that company because they’re more productive as a result of that. So once again, just like in education in a way, what we have to do in enterprise is focus on penetration, it has to be deeper and broader.

But in terms of having people begin the process, beginning writing apps, we’re doing a pretty good job of that. In the retail market, if you look at the U.S. as a proxy, the NPD numbers for March just came out a few days ago and we had 46% share and embedded in that 46%, there’s a lot of things in there that I personally wouldn’t put in the same category as iPad, and that are weighing the share down. It’s certainly a market we wouldn’t play in and in a type of product you would never see an Apple brand on. So, we feel like we’re doing well there.

Office; I believe does help. It’s very unclear to say how much. I believe if it would have been done earlier, it would have been even better for Microsoft frankly, there is a lots of alternatives out there from a productivity point of view, some of which we brought to the market, some of which many, many innovative companies have brought. But I do see that Office is still a very key franchise in the enterprise, in particular. I think having it on iPad is good, and I wholeheartedly welcome Microsoft to the App Store to sell Office. Our customers are clearly responding in a good way that it’s available. So, I do think it helps us particularly in the enterprise area.

The other things you look at on iPad that are just blow away its customer [satisfaction], is 98 [percent]. There is almost nothing in the world with a 98% customer sat and the intention-to-buy numbers look good with two-thirds of the people planning to buy a tablet or planning to buy an iPad. The usage numbers are off the chart, far and exceeding Android tablets, four times the web traffic of all Android tablets combined.

So, when I backup from all of these, I feel great. That doesn’t mean that every quarter, every 90 days is going to be a number that everybody is thrilled with. But what it means to me is that the trend over time – over the arc of time, that things look very, very good, that iPad has a great future. And of course the thing that drives us more than any of this are the next iPads if you will, the things that are in the pipeline, the things that we can do to make the product even better, and there is no shortage of work going in on that nor any shortage of ideas.

So when I backup from all of this, I can’t help but still be extremely excited about where we are. I think we did a reasonable job of explaining what we think the disconnect was between what we had expected, which we hit it at the high end of our expectation and the street’s view of this one. I believe the vast majority of it is that first thing was just channel inventory that maybe we should have been even clearer on last quarter to take into account. But I’m very bullish on iPad.

That’s quite a long set of explanations for was essentially was a flat quarter for the iPad. I can’t add more to this, but I do want to focus on the bold part of the quote above. “But what it means to me is the trend over time – over the arc of time, that things look very, very good”.

How can we see the long arc of time?

The tool I’ve used for this is the measure of penetration. Historically products which become “mainstream” or widely adopted follow an S-curve during that adoption. The curve is remarkably predictable given a limited set of points. I’ve discussed how the adoption of smartphones is predictable in the US, EU51 and how even particular platforms might be predictable in the context of rates of adoption.

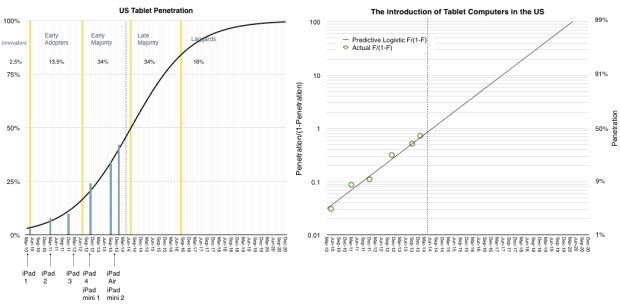

We are fortunate that data also exists for tablets. The Pew Research Center’s Internet & American Life Project has published a short history of tablet adoption in the US. I’ve plotted this data and imposed an S-curve on the data which fits it rather closely.

The results are shown below:

In the graph on the left, the blue bars represent actual measurements of penetration (18+) while the black curve represents a best fit for the adoption rate.

In the graph on the left, the blue bars represent actual measurements of penetration (18+) while the black curve represents a best fit for the adoption rate.

Note that I’ve added the launch dates of all the iPad models and sectioned the curve into adopter categorization on the basis of their willingness to adopt.

I’ve also drawn a dotted line on the point where we are in the present.

In the graph on the right I’ve also duplicated the data using the transform of penetration to log scale penetration/(1-penetration). This shows the relative fit of the data in a more visually comfortable way.

The usual caveats apply:

- This is US only

- These are adults only

- The iPad is not the only competing product

Nevertheless, this is a fairly strong proxy for the market. First, because the US has been leading adoption of almost all consumer product categories in history. Second because adults are a representative sample of users and third because iPad is market share leader.

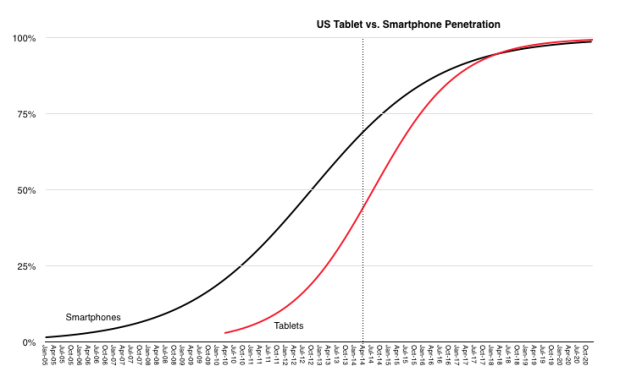

What the penetration data shows is an extremely rapid rate of penetration. In comparison with the smartphone, the tablet is rising much faster. This is shown below:

They are likely to saturate at around the same time but the tablet started much later.

So how does this explain the slowing iPad sales?

It’s possible that saturation for tablets could come well below 100% and that we are on a different curve than the model above. However, the ubiquity of the product and broadness of appeal, even within non-consumer (i.e. education and enterprise) makes it difficult to reconcile. In addition, the penetration data is self-evident. It’s improbable that penetration goes to 42% as it just did, and then stops suddenly. These decelerations of adoption have been observed historically but they are usually explained by cataclysms such as wars and economic contractions, neither of which are affecting the US right now. If a product solves an important “job to be done” then it gets adopted in a predictable way by a given population.

The anecdotal evidence provided by the company and others coupled with the survey data collected for the population of US users implies that the iPad is solving numerous important jobs and is therefore continuing on a predictable trajectory and that a discontinuity has not occurred.

Management started by saying the iPad sales volume was not surprising to them and that they have not changed their long-term expectations. The penetration data seems to support their confidence.

- And UK specifically and several broader global regions [↩]