The App Store ecosystem crossed $1 Trillion in 2022.

To be precise, in a report published in May 2023 by the Analysis Group the ecosystem is estimated to have exceeded $1.1 trillion. This ecosystem is defined as the total transactional value of the sale or distribution of digital and physical goods and services through apps. It also includes in-app advertising. The analysts relied on a variety of data sources, including data from Apple, app analytics companies, market research firms, and individual companies.

Note that this includes Apple’s own services as well as App Store developers. Unlike Apple’s own reporting of payments to developers (and thus partially revealing its own App Store revenues) this data includes payments which are not captured by Apple directly. In the words of the authors, “More than 90% of this figure originated from transactions that did not happen through the App Store, meaning that these amounts accrued solely to developers and other third parties, and that Apple collected no commission on them.”

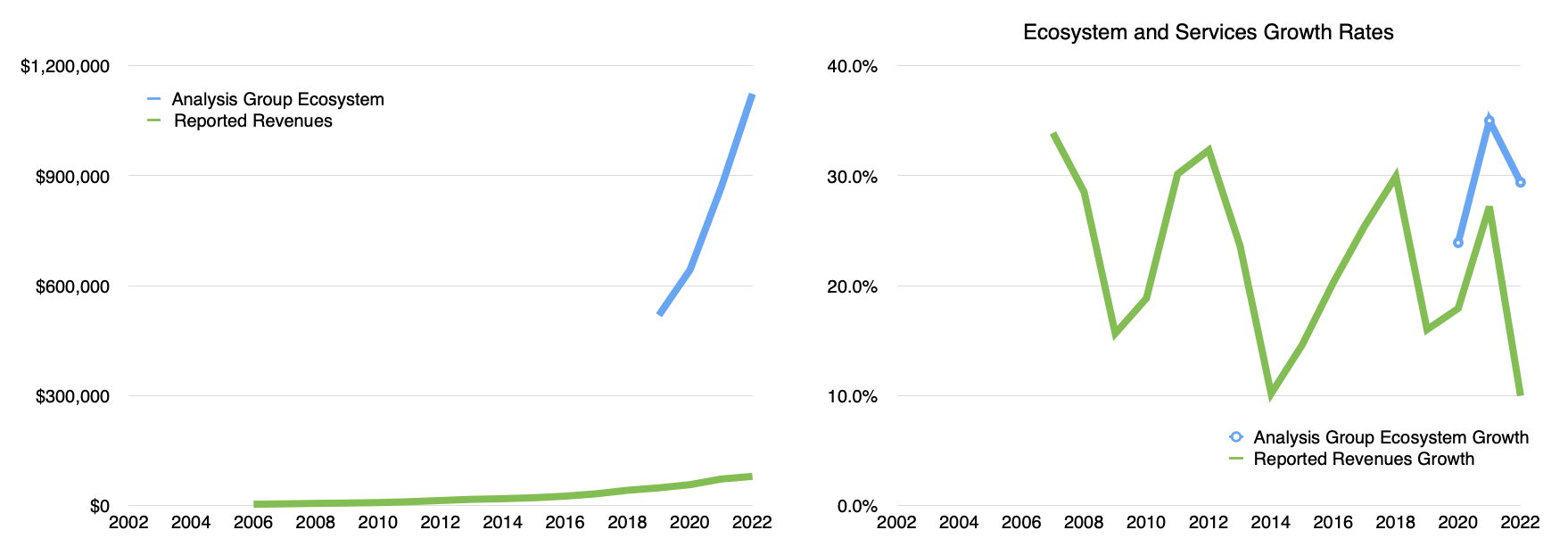

This $1.1 trillion figure is almost double the value from 2019. Ecosystem estimates were first provided in 2019 at $519 billion, with $643 billion in 2020, $868 billion in 2021 and $1,123 billion in 2023. These correspond to growth rates of 24% in 2020, 35% in 2021 and 29% in 2022. The compound growth rate has been 29.4% since 2019.

It would be ambitious to expect this CAGR to continue after the Covid boom but at the same time, it’s worth noting that this growth out-paces Apple’s own services growth rate. Services (reported) revenues grew at 18%, 27% and 10%. The actual figures and growth rates are shown below.

This Analysis Group report is very much worth reading and adds an important new metric of resilience and scope and scale of the platform and ecosystem that Apple has created.

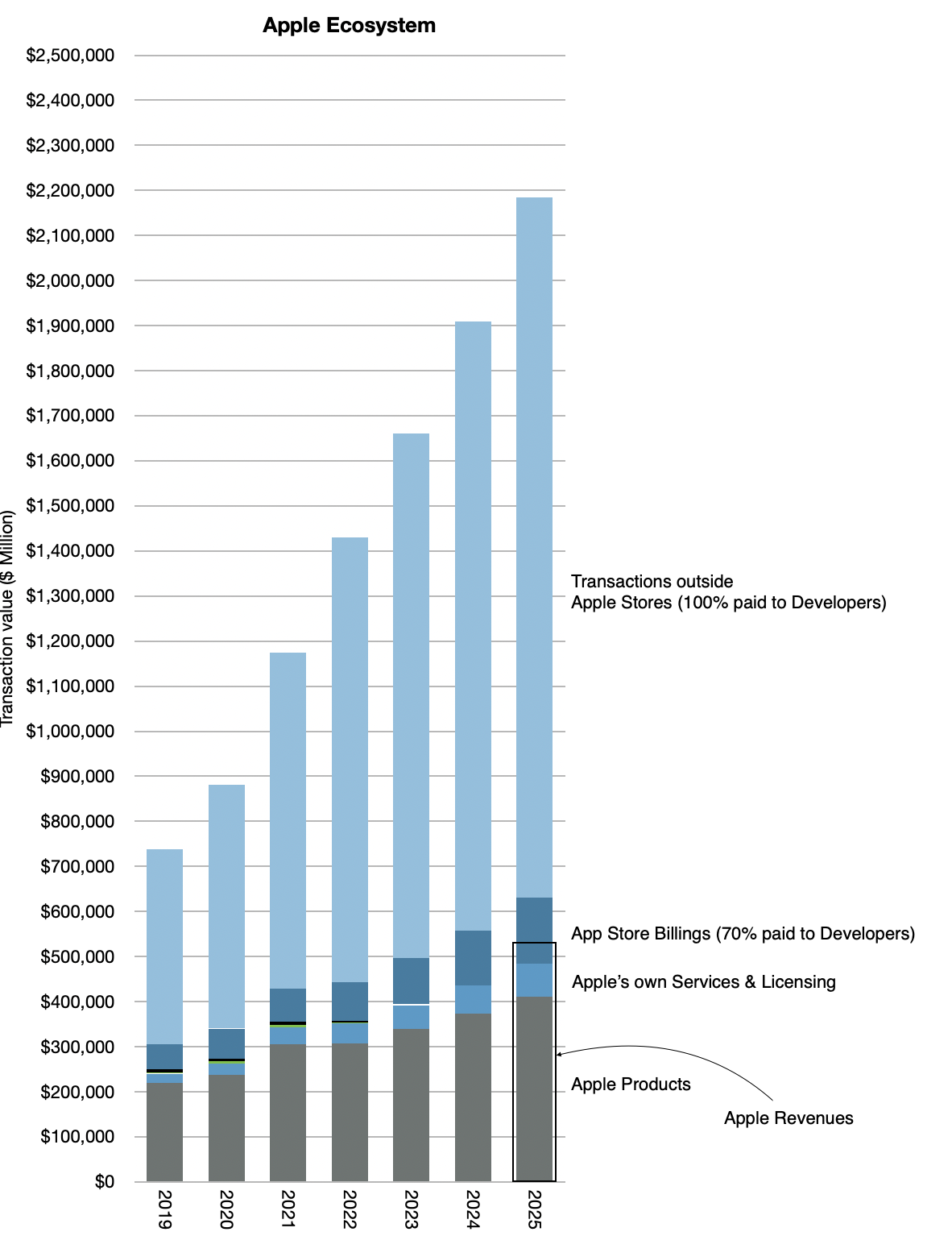

However it is also not the complete picture. I strive to see the larger picture of what I call the Apple Economy. This includes the ecosystem as well as the direct revenues Apple obtains from products and services. [Of these revenues, roughly 60% is then passed on to Apple’s suppliers, with less than 20% retained as earnings].

Therefore, the combination of ecosystem and revenues is shown in the following diagram.

Note that the “Economy” size was over $1.4 trillion when the ecosystem alone was $1.1 trillion. Note also that I’m also suggesting that it’s likely to be $1.6 Trillion this year. This diagram shows the story since 2019 but also makes a forecast to 2025.

I’m expecting the ecosystem to grow more modestly at 18% in 2023 (down from 29%) and 16% in 2024 and 15% in 2025. Apple’s own product and services sales are also subject to estimation error.

Nevertheless, it’s not unreasonable to believe the forecast above where the Apple Economy expands to over $2 Trillion by 2025. This is an acceleration from previous forecasts.

It’s difficult to write about the implications of this. Any value in the trillions is hard to put in context. Certainly, Apple’s market capitalization is in the trillions. For fun, we can calculate that Apple is trading at a multiple of 1.74 of its economy.

But rather than trying to assess valuation directly, Apple’s Economy is more like a GDP figure: I think it’s helps to understand the overall scale and resilience. You might even ask what would happen if it were to cease to exist. The number of people who are employed in a $2 trillion economy is in the millions; perhaps 10s of millions of people.

In 2023, global GDP is expected to reach $105 trillion. It’s nice to think that Apple could soon be about 2% of the world.