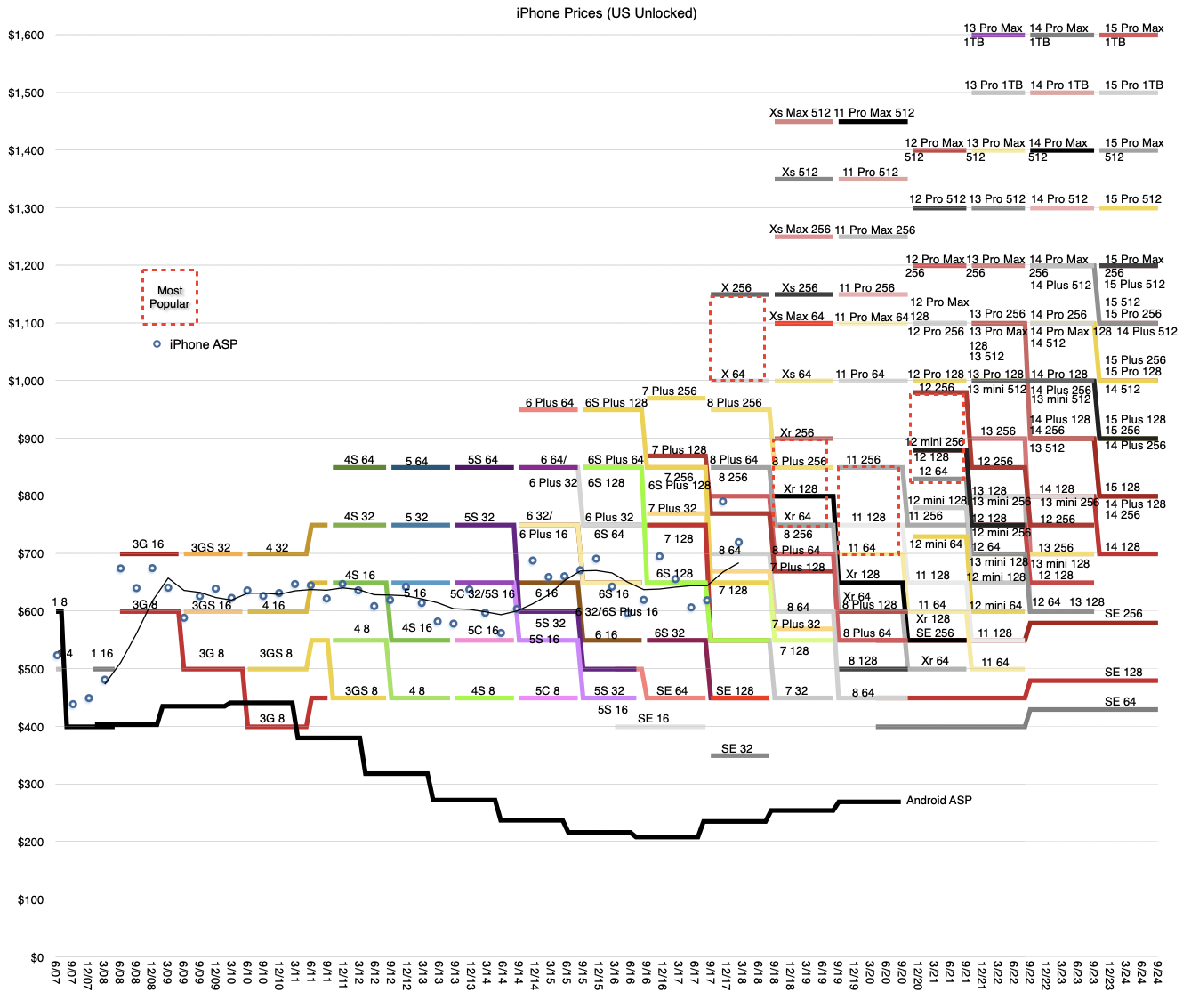

iPhone 15 has just been released and, as usual, all the products in the iPhone line-up have received new prices. The following graph shows the current product line-up (US prices before tax) and the historic price points for all the previous versions of iPhones since inception.

It was amusing before the launch to see reports that the iPhone 15 would see a price increase. If I were a betting man I would have bet against it. The reason is that, as the graph shows, pricing changes are regularly made every three years and the last one was in 2021, two years ago. It would be an extraordinary claim to expect a price increase this year.

Also, as you can see, price increases only occur when there is a new “top-of-the-line” model introduced. This new highest spec, usually, but not only, in memory, justifies the new top of the range. For instance, the top of the range in 2015 was the 6S Plus with 128GB of storage. Three years later is was the Xs Max 512GB. Three years later it was 14 Pro Max 1 TB. In nine years the top memory increased by an order of magnitude but the top size also increased as did the number of cameras. Naturally, the price increased by about $650.

Therefore we can predict with some comfort that the next “highest price” point will be $1699 for the iPhone 16 Pro Max 2TB, or equivalent. The possibility exists that the iPhone 16 Pro will also include a leap higher in optics and have more technological tie-ins with Spatial Computing.

But this highest price point is not necessarily the most common price point. Indeed, we can guess that the most common point is visible in our graph above. The density of product choices increases toward the middle of the range. The highest and lowest price points are populated with one product. The middle price points from $800 to $1,100 are populated with\ three products each. Therefore a good guess is that the $900 is likely most popular and that the average selling price is also very near there.

Note that the average sales price (ASP) has not been available from Apple since 2018. At that time the ASP was $790 (holiday quarter of 2017). A gradual increase to $900 over five years is not unreasonable. In fact, it probably should be higher given inflationary pressures. We can only guess.

We have to understand that Apple does not set pricing in response to competitive pressures, commodity pricing, inflation, currency exchange rates or internal sales or margin targets.

Pricing is sacred and is a decision made based on consumer understanding.

The anecdotes of Steve Jobs preferring certain price points because of their poetic value are legendary. 99c for a song sounds right and looks good. The iPod was priced in lovely, alliterative $100 increments. Same logic applies to services.

Pricing is an art and when you see the spectrum above you also see how the increments nudge the decision process. Pricing is a signal. It’s a conversation between seller and buyer containing information that both parties will exchange. On the part of the seller it suggests both the cost of the offering and the value it provides. Buyers are inclined to see if they can stretch to the next higher increment given the increased value proposition. Once their decisions in the collective are tallied, the seller knows well what buyers prefer.

Apple has been having this conversation for decades and it shows.