As we move ahead into the September quarter, I’d like to review our outlook, which includes the types of forward-looking information that Saori referred to at the beginning of the call. We expect our September quarter year-over-year revenue performance to be similar to the June quarter, assuming that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter. Foreign exchange will continue to be a headwind, and we expect a negative year-over-year revenue impact of over 2 percentage points.

We expect iPhone and Services year-over-year performance to accelerate from the June quarter. Also, we expect the revenue for both Mac and iPad to decline by double digits year-over-year due to difficult compares, particularly on the Mac. For both products, we experienced supply disruptions from factory shutdowns in the June quarter a year ago and were able to fulfill significant pent-up demand in the year ago September quarter.

We expect gross margin to be between 44% and 45%. We expect OpEx to be between $13.5 billion and $13.7 billion. We expect OI&E to be around negative $250 million, excluding any potential impact from the mark-to-market of minority investments, and our tax rate to be around 16%.

Luca Maestri, CFO Apple Inc., Aug. 03, 2023

In August Apple reported Net sales growth of -1% and EPS growth of 5.4%. My expectation is a 1% sales growth with EPS growth of 11.4%. This might be slightly optimistic but it’s based on the following assumptions:

- iPhone unit growth of -1.4% (y/y) but revenue growth of 2% (as per guidance, up from -2% previous quarter’s growth).

- Mac unit and revenue growth of -12% (this might be optimistic, low confidence)

- iPad unit growth of -2% but revenue growth of -12%.

- Services revenue growth of 12% (acceleration from 8% q/q)

- Wearables 2% revenue growth (consistent q/q, down from 10% y/y)

I estimate the gross margin to remain at 44.5%, open to be $13.5 billion (low-end of guidance), OI&E at -$250 million (per guidance) and tax rate at 16%.

The number of shares I estimated at 15.666 billion (down 109 million, below 126 million average drop for last 8 quarters.)

To summarize, for the fiscal fourth quarter 2023:

- Total revenue: $91.1 billion

- EPS: $1.43

Revenue by segment:

- iPhone: $43.5 billion

- iPad: $6.2 billion

- Mac: $10.0 billion

- Services: $21.5 billion

- Wearables/Home/Accessories: $9.8 billion

- Gross margin on total revenue: 44.5%

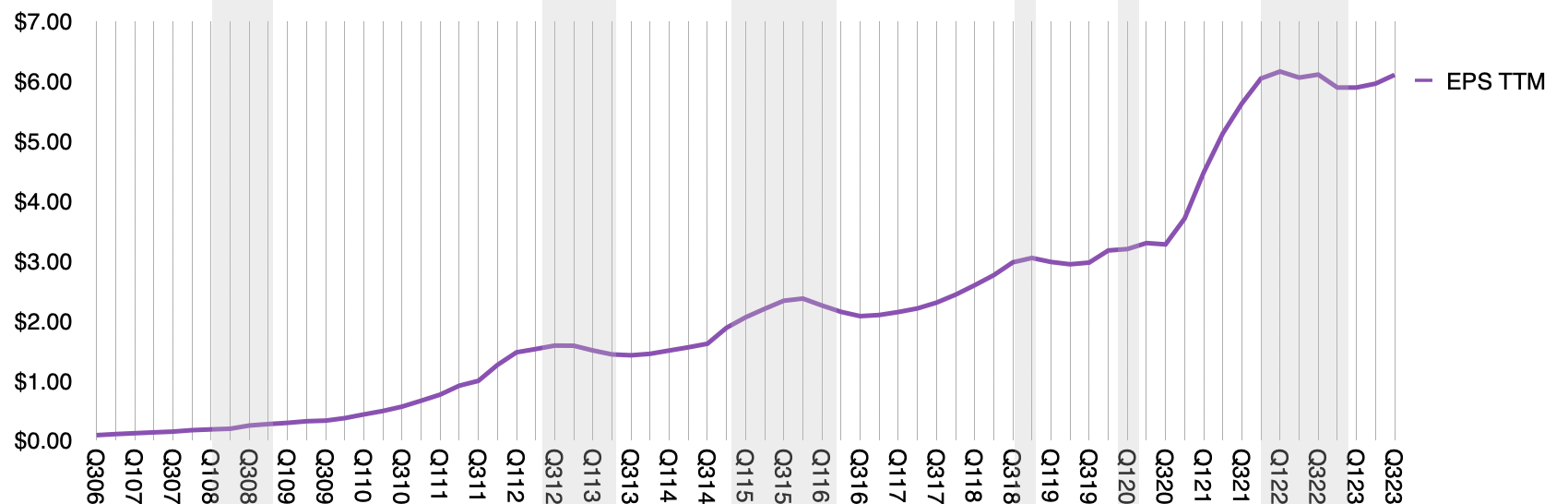

As can be seen in the following graph, my expectation is that the company will return to a pre-Covid growth trajectory (on a TTM EPS basis) after a transient surge and recovery due to the phenomenon of work-from-home and reduced travel. The uncertainty related to Covid is subsiding but macro and geopolitical uncertainties remain and the company continues to provide limited guidance.