It’s not unusual to see articles consisting of lists of reasons why Apple is facing an existential crisis. Agonizing and hand-wringing about Apple been a meme for decades, so much so that it had its own web site, The Apple Death Knell counter and the “Pray” for Apple imagery was a thing since the 90s. The original article from June 1997 offered 101 tips on saving the company starting with outsourcing hardware or scrapping it entirely.

Although the imminence of death has always been persistent, what’s changed over the years were the causes. There are far too many to recall or enumerate but I have through personal recollection and pattern recognition grouped them roughly into three categories:

- Irrelevance due to low market share, i.e. insufficient network effects for its platforms which will eventually drive users away. This is fundamentally a size problem.

- Insufficiency in capital/resources/talent/management. This includes the death of Steve Jobs, the departure of various other managers and historically the low spending on R&D. This is more qualitative but still fundamentally a problem of being too weak.

- Externalities including but not limited to: law suits, regulations, taxes, technology standards. This includes everything from the absence of the Beatles in the iTunes store to confiscation of assets or extortion by governments. Extreme versions are antitrust cases alleging monopoly status. This is a problem of being too big or too strong. (Contrast with the first two categories)

For instance, during the last Apple Investor Event, I highlighted a typical article citing a list of problems for Apple. It was Titled “5 problems facing Apple it won’t talk about at is April event”. Published in August 2024 it cited the following:

- Maintaining profitability. Citing a drop in operating margins in 2020(!) the problem was stated as a need to maintain momentum.

- Antitrust regulation. Citing EU and US investigations against Apple and other Big Tech companies. Money quote: “reports have surfaced that several tech companies in China are actively testing ways to circumvent Apple’s new privacy update”).

- Lawsuits in general, Epic trial in particular.

- A lack of diversity in the management team. Essentially, insufficient DEI.

- Competition. Google, Blackberry, Dell, Fujitsu, Microsoft and Samsung are cited.

When I read this I thought it must have been AI generated (hallucinated more likely). The dates did not make sense (August publication predicting an April event) and the competition cited was obsolete (Blackberry? Fujitsu?). It was a random list of Apple news framed as problems. Rather than try to refute them, I realized that it did not matter. The objective of the author was not to illuminate but to discharge something, anything, as long as it was negative.

Since last August a lot has happened. A new US administration, a new set of problems. Judging by the share price and news flow, Apple bashing is once again in vogue. (Incidentally, the stock price reached an all-time-high in December 2024 at nearly $260/share, a substantial increase from $170 or so six months earlier.) Today everyone and their editor is jumping into the scrum writing lists of Apple problems.

The pattern however seems a bit different this time. Almost all the catastrophes Apple has are externalities. Let’s try to enumerate them (inspired by Bloomberg.)

- Tariffs. Consequences include presumably negative impact to company’s operations, product development and device prices.

- Antitrust. A US Department of Justice lawsuit for allegedly anticompetitive practices. Similar actions by the European Union, South Korea, Japan, India, etc.

- Lawsuits. Apple must stop taking a commission on in-app purchases and subscriptions paid via the web. Epic again.

- Distribution deals (Google antitrust). The threat of losing a $20 billion-a-year deal with Google for default search placement.

- AI delays: the risk of falling even further behind its tech peers

- Competition in China.

What these examples seem to share is that, except for the AI execution, they are externalities and thus of the third category. They are therefore problems related to being too successful.

Tariffs are a problem because Apple relies on massive scale and thus requires integrated production which creates concentration in production centers which are difficult to redeploy. Antitrust is a problem because Apple is too big and thus dominates developer distribution. Lawsuits center on having too much control—related to antitrust. Google antitrust remedy forces a decline in distribution revenue for browser search—a predicament coming about Apple’s enormous leverage vis-a-vis Google. Being so big means there is only one way to go: down, hence Chinese competitors gaining share. Lastly, AI execution problem is more Category 2 problem but would not be an issue if Apple did not insist on Privacy for its customers, something which caused much of its success with customers that it got too big.

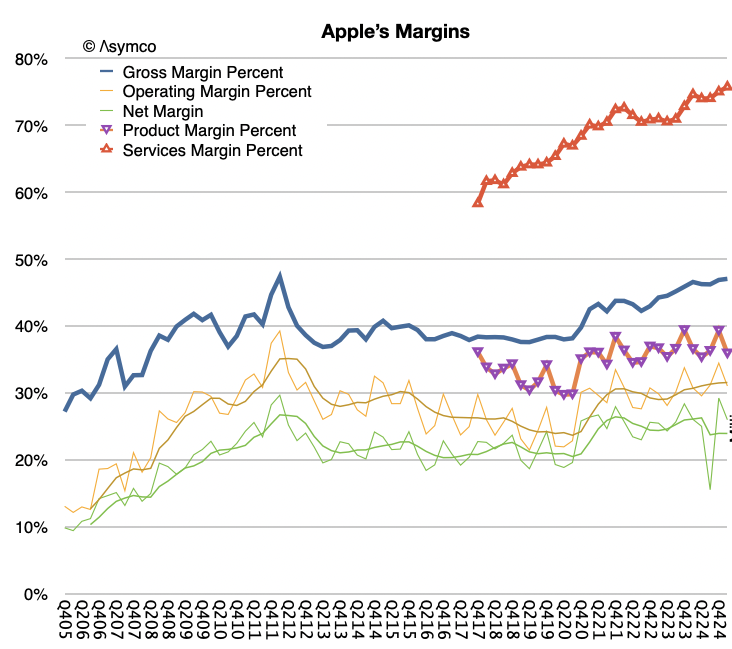

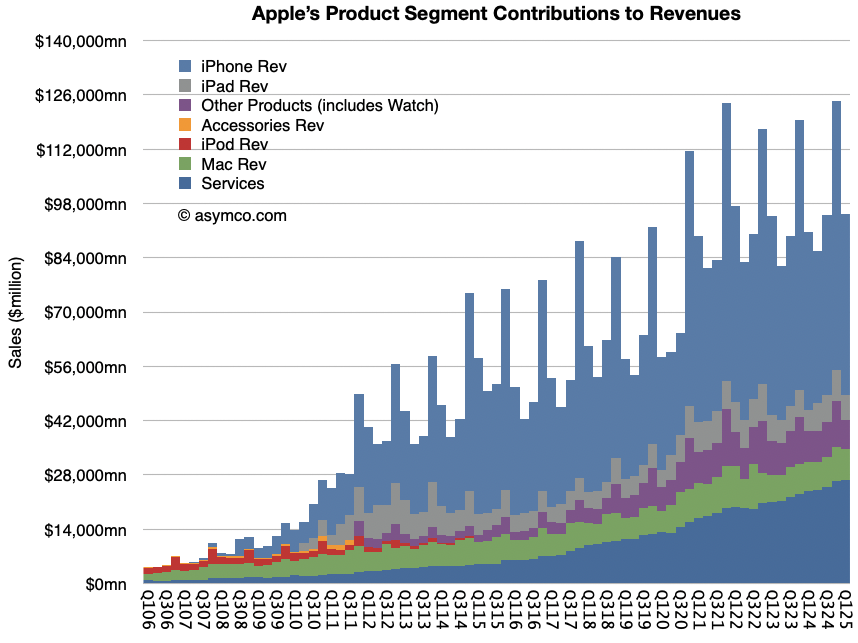

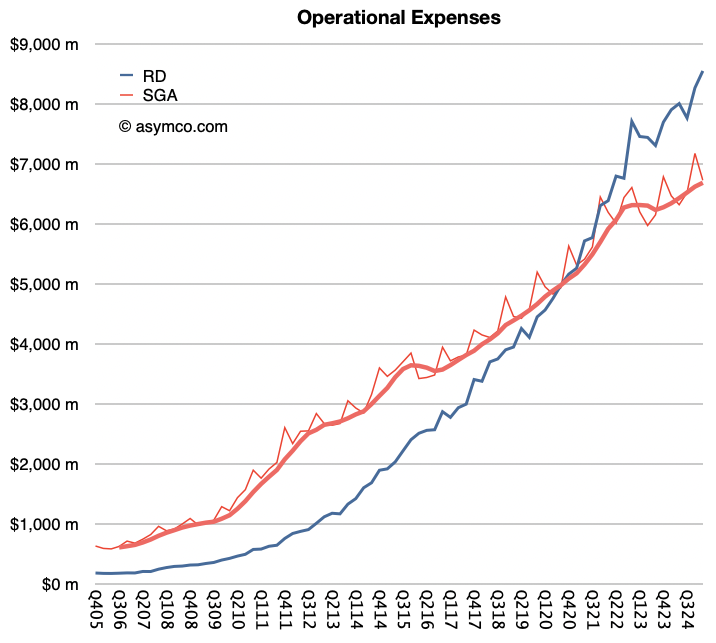

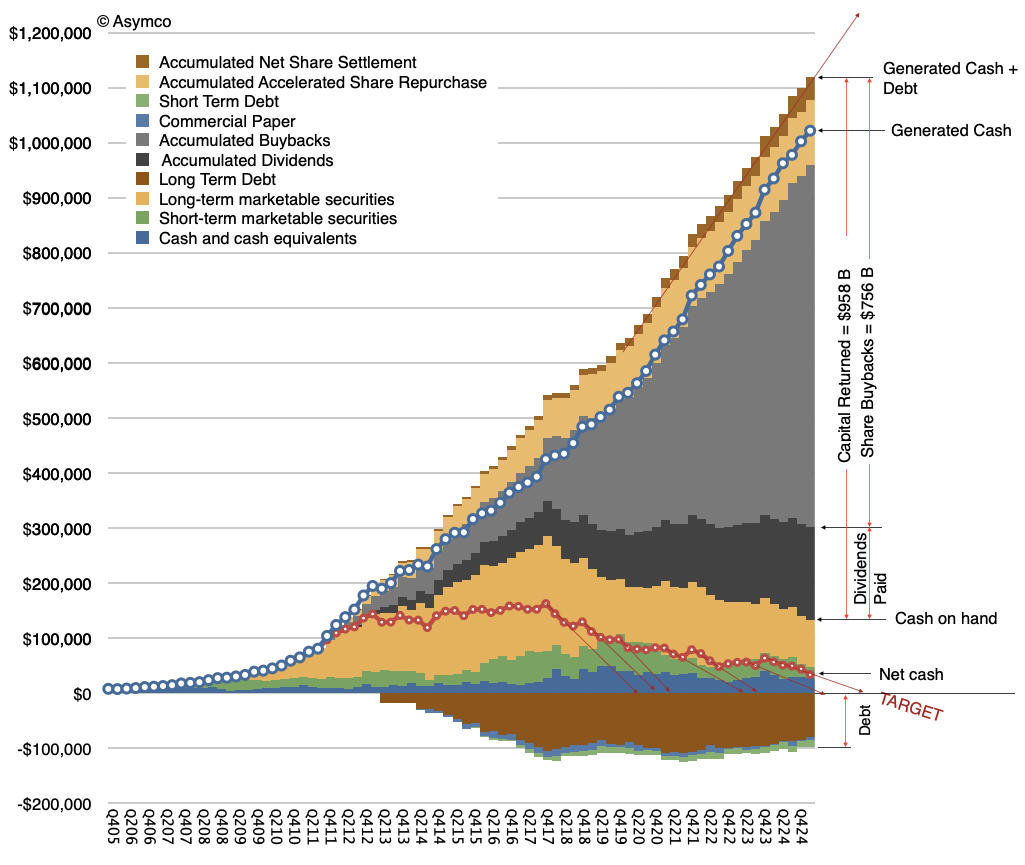

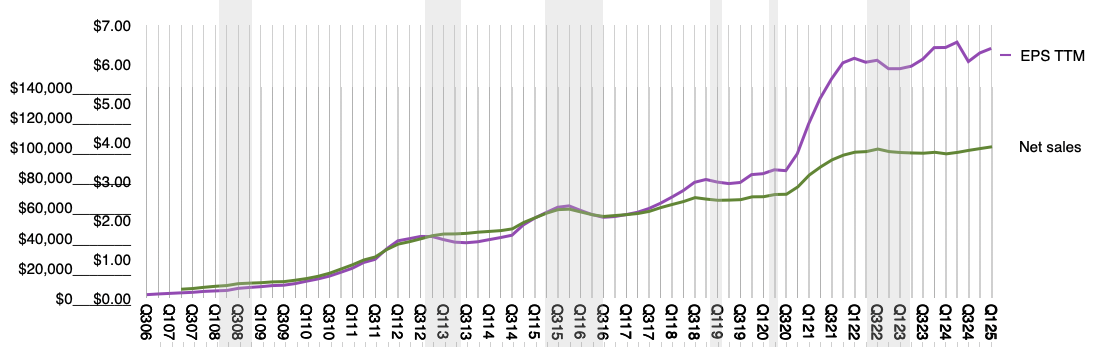

Incidentally, profitability is now higher than ever, top line growth is consistent, bottom-line growth is even faster, the company is guiding growth in-line with current trajectory, the number of customers is at a new record, churn into the platforms continues, Apple is winning against non-consumption, capital is pouring into shareholder pockets and R&D spending is soaring. Cue the charts.

What the casual observer might note missing from the Doomed listicles is any mention of customer satisfaction, loyalty, acquisition and retention. The things the company actually talks about on earnings conference calls.

Do these externalities of tariffs, antitrust remedies, distribution dissatisfaction and non-iOS competition make any impact on how customers perceive the company?

We’ll discuss this in the next few posts, as the lead up to presentations at ACTIVE: The Apple Investor Conference on Tuesday June 10th, the day after the WWDC25 keynote.

Leave a Reply