Horace and Farshad discuss Apple’s recent milestone of one billion iPhones shipped. They also answer a slew of #CriticalQuestions.

Source: The Critical Path #183

Horace and Farshad discuss Apple’s recent milestone of one billion iPhones shipped. They also answer a slew of #CriticalQuestions.

Source: The Critical Path #183

The following is a list of the best-selling products across several categories:

Car model: VW Beetle 21.5 million

Car brand: Toyota Corolla 43 million

Music Album: Thriller 70 million

Vehicle: Honda Super Cub 87 million

Book Title: Lord of the Rings 150 million

Toy: Rubik’s Cube 350 million

Game console: Playstation 382 million

Book series: Harry Potter Series 450 million

Mobile Phone: iPhone 1 billion

The iPhone is not only the best selling mobile phone but also the best selling music player, the best selling camera, the best selling video screen and the best selling computer of all time.

It is, quite simply, the best selling product of all time.

It is that because it is so much more than a product. It is an enabler for change. It unleashed forces which we are barely able to perceive, let alone control. It changed the world because it changed us.

And it did all that in less than nine years. One has to wonder what it will enable in the next nine.

If these questions are of interest to you, join the conversation at DisruptiveInnovation.org.

Horace and Anders discuss the numbers from WWDC, what didn’t come from WWDC. And cars!

Source: The Critical Path #180

A merger is the result of two entities in the same business joining forces. It is usually justified through “synergy”, a euphemism for removing redundancies from their unity. Arithmetically, the desired outcome is that the resulting organization should be smaller than the individual parts (which is desired if the available market is shrinking.)

An Integration is the answer to the question of “Why two companies in different businesses are better off together.” Arithmetically, it suggests that the proposed sum is greater than the individual parts.

The spin-off is the response to a situation where one company houses two unrelated businesses.

For completeness, we can define an acquisition as the purchase of an unequal entity in order to improve the value of the acquirer.

The logic of any of these is that there is a disequilibrium which offers an opportunity to those who can exploit it. What the analysis fundamentally assumes is that the status quo of firm boundaries is not optimal.

Much of the measurement of the balance in the equations assumes that the overall industry is stable and that the problems (technical or market) are largely understood and that there is no learning that needs to happen. Boundaries need to be re-drawn because they are imperfect. Boundaries may have grown imperfect for many reasons: founders/owners were separate, markets and technologies evolve at different rates, resources are inflexible, processes are entrenched and values are outdated.

However, all this arithmetic can be safely thrown out of the window if there is a new industry in the making. If there is no balance to begin with because there is an entirely new problem being posited. That is, not only do we not know the answers to technical or market questions, we don’t even know what the right questions are.

When looking at the history of industry creation, the breakthroughs were always about the discovery of the right questions to ask. The early automobile industry was a scramble for solutions to a huge number of technical and market questions: technology, business model, infrastructure, usability, customer segmentation. From 1886 until 1915 there were many grand experiments with thousands of automobile firms springing up.1

Early computing, internet, mobile and consumer durables industries went through similar periods of grand experimentation. But the breakthroughs occurred when someone was able to ask (and subsequently answer) a question that nobody had asked before.

Henry Ford asked, “What would enable everyone to have a car”. The result was not a better car but a better production system.

Steve Jobs asked, “What would enable everyone to have a computer”. The result was not a faster computer, but a more approachable computer.

Akio Morita asked, “What would enable young people to have their own music”. The result was not a better audio quality but a smaller audio player.

Kiichiro Toyoda asked, “How can a car be built without faults”. The result was not a bigger factory but many smaller ones.

Jeff Bezos asked, “What would cause people to do their shopping online”. The result was not a lot of unique sites but one infinite one coupled to a logistics and computing service.

Having great taste in questions turns out to be the principal quality of the successful industrialist: The creation of economic value and power well beyond the boundary of the firm itself.

When the correct question is asked, resources can be efficiently marshaled to answer it. The wrong or incomplete question leads to inefficient resource allocation. And so the architecture of the solution can be built. If the new problem statement is a technical one then an integrated implementation is required. If the new question identifies non-consumption then a modular implementation is required. Each of these approaches suggests different customer sequencing strategies and different application of resources and processes.

There is no right architecture for industry creation. What matters is asking the right question.

So is Elon Musk, today, asking the right question? Continue reading “Tesla and SolarCity: Straddling the modular/integrated divide”

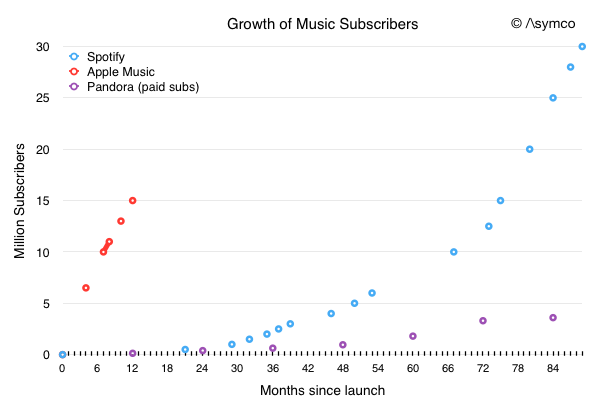

When Spotify and Pandora were starting their streaming services many were quick to point out that Apple was about to be disrupted. The future, they said, was streaming because (young) people could not be bothered with ownership of music and the limitations of a personal collection. Who would want to pay for a few hundred songs when they could listen to millions for free?

This perception continued and became more vocal over the years. Seven years in fact. Spotify collected 20 million paying subscribers while Apple did nothing. Pandora grabbed 80 million active listeners and possibly 4 million paying subscribers while Apple did nothing. The boat had sailed and Apple was not only not on it but oblivious that there was a boat in the first place.

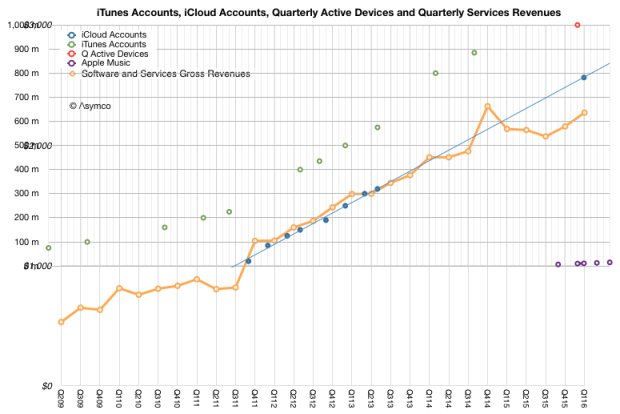

At first Apple launched a half-hearted streaming service and then a paid service finally showed up with Apple Music in mid 2015. Since then the company managed to add 15 million subscribers. A tiny number compared to the 900 million iTunes accounts it had reported a year earlier. Pathetic. The number of music subscriptions relative to iCloud accounts, iTunes accounts and active devices is shown the the graph below.

It may be paltry compared to the count of users Apple may have in total, but how does a 15 million user base in 1 year compare with the growth rate for the incumbents Spotify and Pandora?

The following graph shows the ramps for Spotify, Pandora and Apple Music since their moments of market entry. The accumulation of users by Apple looks to be the fastest yet.

This is, of course, due to a maturing use case. Apple did not have to educate people to the notion of music as a subscription. It could just announce it and users would discover it and just sign up, especially if they were already iCloud subscribers and had a credit card attached to their iTunes account.

But that’s the whole point. Apple did not have to move first in music subscriptions. It did not even have to move second or third. When it did move it could just skim the market and add to its already healthy Services revenue (orange line in the first graph above.) Missing the boat in music in this case meant capturing all the value quickly and with minimal expense.

Fundamentally, Apple’s entry into music subscriptions was a sustaining effort. Streaming sustained Apple rather than disrupting it. The difference may seem merely one of semantics, but it is also the difference between life and death for a challenger. Meaning matters.

This is a cautionary tale for those who would pronounce every new idea as “disruptive” to Apple or anyone else on the basis of novelty alone. The tests for disruptiveness are easy enough and it behooves the analyst to apply them before dropping the d-bomb.

At WWDC 2016 Apple offered a set of new data points to illustrate its ecosystem’s robustness.

First, the number of registered developers increased by 2 million in the last year to a total of 13 million. That is a growth rate of 18%. To compare this total consider that Oracle claimed in 2014 9 million Java developers and IDC claimed in 2014 there were 18.5 million software developers in the world, of which 11 million were professional software developers and 7.5 million were hobbyist developers. It’s therefore possible that Apple’s “market share” among developers is close to 70%.

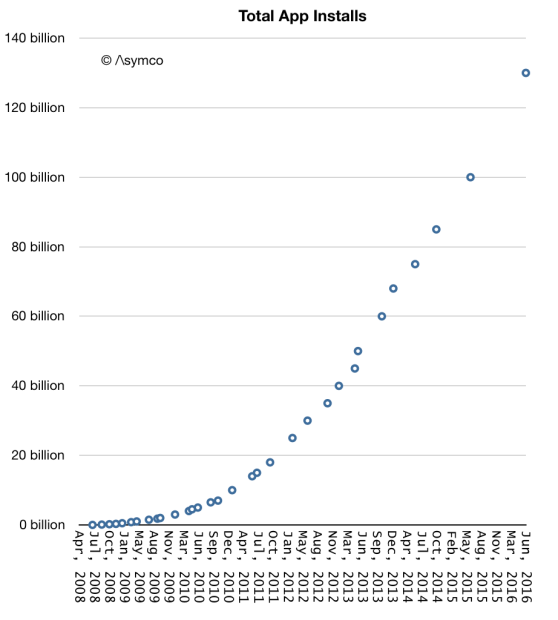

Second, App installs have now reached 130 billion. The cumulative growth is shown in the graph below:

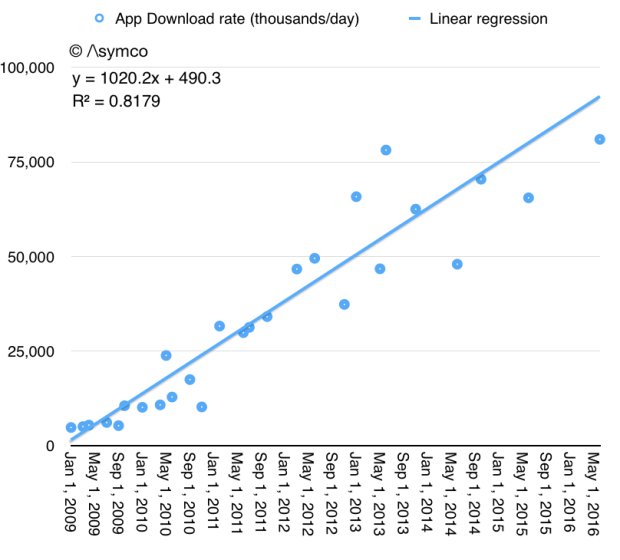

The rate of growth is also shown in the following graph:

Note that the rate of growth continues to increase and is now above 30 billion/yr. It turns out that apps continue to be a popular download item. The size of the audience continues to grow (see graph below) and it’s therefore understandable that activity in the store continues to grow. Continue reading “State of the Ecosystem”

Horace and special co-host Farshad Nayeri discuss Log Log Scale, the iPhone SE and Artificial Intelligence.

Source: The Critical Path #178

Horace talks about developments in Disruption theory. A fairly long and deep discourse on the state-of-the-art in innovation theory development.

Source: The Critical Path #176

Sam Abuelsamid reflects on the origins of BMW’s i program, today’s economics and the application of lessons learned.

We veer into supply chain details and consider the path that the legacy automakers have chosen.

The show closes with a discussion of Apple’s entry assets, supply chain power and business model evolution.

Source: Asymcar #33