- 300 Apple Stores

- 10 countries with Apple Stores

- >1 million store visitors some days

- 80k 1:1 sessions/week

- 120 million iOS devices sold to date

- 230k new iOS activations per day

- 6.5 Billion apps downloaded

- 200 apps downloaded every second

- 250k apps available on App Store

- 25k iPad apps available on App Store

- 275 million iPods sold

- #1 portable game player: iPod touch

- 50%+ of portable game device share US and world-wide

- 1.5 billion game and entertainment titles downloaded to iPod touch

- 11.7 billion songs downloaded from iTunes

- 450 million TV episodes downloaded from iTunes

- 100 million movies downloaded from iTunes

- 35 million books downloaded from iTunes

- 160 million iTunes accounts

- 23 countries for iTunes music downloads

- 12 million song library

Author: Horace Dediu

Quarterly Earnings Multiples: The new normal?

Based on the new iOS units numbers released I revised at the numbers for next quarter and it’s very probable that EPS will be over $5.25.

As recently as 2007 Apple was priced 50x one year’s earnings.

Now it’s priced 47x one quarter’s earnings.

Should we consider applying old yearly earnings multiples to quarterly earnings as the new valuation normal?

20 Million iOS devices sold in about 2.5 months

On June 7th, 2010, at WWDC, Apple announced that they will have sold 100 million iOS devices some time during June 2010. Today, September 1st, Apple announced that 120 million iOS devices have been sold.

Assuming that 100 million was crossed half-way through June, then the additional 20 million units must have been sold during half of June, and all of July and August. That’s approximately 20 million over 75 days or 267k units per day.

Apple also announced that there are 230k new iOS activations per day which seems consistent given that they classify these as “new” activations.

There is one huge implication of this figure: Forecasts for iPhone, iPad and iPods may be too low. I had forecast 20 million units for the entire quarter (12.1 million iPhones, 4 million iPads and about 4 million iPod touch). The iPhone figure assumed 65% y/y growth at that looks way too low. There is still another month in the quarter meaning that the total could be 30% too low.

I will be updating the forecast accordingly.

Apple unable to keep up with iPhone 4 demand

$50 billion in cash and Apple execs bawling that they can’t ship enough product.

“iPhone 4 demand remains very robust and despite efforts to close the supply-demand imbalance and the continued supply ramp, Apple still cannot meet iPhone demand,”

via Apple unable to keep up with iPhone 4 demand, say execs | MacNN.

22 Million iPads in F2011

Ghai now estimates that Apple will sell 5.75 million iPads in the quarter that ends Sept. 25, up from an earlier estimate of 5 million, and 22 million in fiscal 2011, up from 19.5 million.

via The iPad as Trojan horse – Apple 2.0 – Fortune Tech.

That’s very close to my estimate of 21 million, though I might add that my estimate is unrevised since US supply met demand. There are still markets which don’t have iPad distribution however, so we’ll see if global demand can be met before year end.

By the way, the estimate of 5.75 million for this quarter is higher than all but three of 14 analysts estimates on iPad unit forecasts *for the first year*.

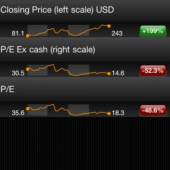

ADD this: Apple's P/E punishment

Apple’s continuing valuation struggle continues to fascinate. While underperforming on a multiple basis both the S&P 500 and its own historic value, Apple is nearing bargain bin pricing.

To illustrate this further, get the new Asymco Data Download for the iPhone.

You can now use an iPhone to visualize how the owners of the company that created it are being punished.

Apple devices take 41% of mobile traffic in Finland

In first half of 2010, iPhone and iPod touch traffic increased from 33.9% to 41% in Finland. Apple’s devices account for a very small percent of the total phones in use in Nokia’s home country.[1] The analysis was performed by QAim on a sample of 64 million “mobile downloads”.

Original article in Finnish.

“A wave of iPhone and iPod owners behave differently than others.”

Weird bunch, those iPhone owners…

[1] Installed base of iPhone is small but share of smartphones in recent quarters is above 20%. See: YLE: Nokia’s smartphone share crumbles in Finland

Apple trading at a discount to the S&P 500

Flush with $45 billion in cash and investments ($50 per share) and no debt, Apple sports an enterprise value of about $190 per share. Compare that to $15 of earnings this year and enough catalysts to make next year’s estimate of $18 seem easily attainable, and you have a stock that actually trades at a discount to the S&P 500.

via Why Apple’s Stock Actually Looks Cheap — Seeking Alpha.

This is not news around here…

Seven confirmed Windows Phone 7 phones

Seven confirmed Windows Phone devices getting readied for launch. Four more being rumored:

Devices – Windows Phone 7 Central.

To be built by HTC, Samsung and LG with Dell and Asus rumored.

Vendor love for Android runs as deep as Operator love of Android.

Breaking Android: How Google's lack of control affects their value chain

A few years ago I read a book called “Breaking Windows” which was the story of the DOJ investigation into Microsoft’s abuse of monopoly. The book was written by a journalist who tried to summarize some of the findings from the published internal emails.

One of the takeaways was the logic of Microsoft’s entry into the Office market. The main internal justification was not that it would be a hugely lucrative new business, but that it was a necessity to the maintenance of the Windows business.

The story was that Lotus, having a huge installed base, could (and did) arbitrarily refuse to upgrade their software to the latest Windows version and in so doing, could kill the franchise. Lotus owned the “killer app” and Continue reading “Breaking Android: How Google's lack of control affects their value chain”