Frequent readers of this blog know they’re in good company. There have been over 1000 comments in but a few months and, without any qualification, they have all been valuable.

I’ve been delighted that contributing readers are not only civil and polite, but that they almost always move the intellectual level of the blog higher. That’s very gratifying because although one major consideration when publishing is creating a large audience, a high quality audience is much more important. Especially to a site dedicated to elevating analytical discourse.

So, being analytical, I wanted to find out how to characterize the audience and understand the attributes of the readers. Naturally, where appropriate I would like to share that information. I hope to share some stats, perhaps with some interesting highlight, every month.

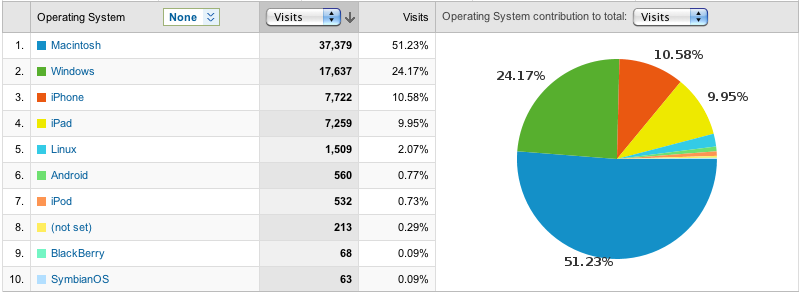

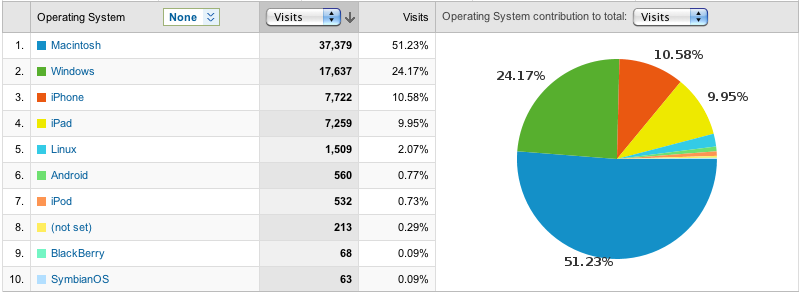

To kick off, here is a snapshot of one month’s worth of visits to www.asymco.com ranked by operating system.

What is perhaps unexpected is that mobile platforms (iPhone, iPad, Android etc.) generated more views than Windows. When comparing browsers, I also observed that Internet Explorer makes up only about 5% of views. (If that’s not a leading indicator of the intellect of the readers, I don’t know what is.)

Time will tell whether these ratios persist, but so far, it seems that Asymco readers are at least eating their own dogfood.