Charles Arthur of The Guardian writes that PC sales “may have passed their peak“. That’s a powerful, concise statement. It’s backed up by a quote from Gartner’s Mikako Kitagawa:

“This was the third consecutive quarter of mobile PC shipment declines in the US”

IDC even lays part of the blame to something called “media tablets”[1]:

“While it’s tempting to blame [PC] decline completely on the growth of media tablets we believe other factors […] played equally significant roles.”

But there are several problems with both IDC and Gartner’s analysis of the market. It’s hard to make out causality from their data. There is separation by vendor but not by operating system and there is exclusion of devices hired to do the same jobs as PCs.

For this reason, I need to do my own analysis. I retrieved Gartner’s public statements on the overall market and layered actual Mac and iPad units sold. I also added my estimates for the Q1 2011 quarter just ended to complete the picture.

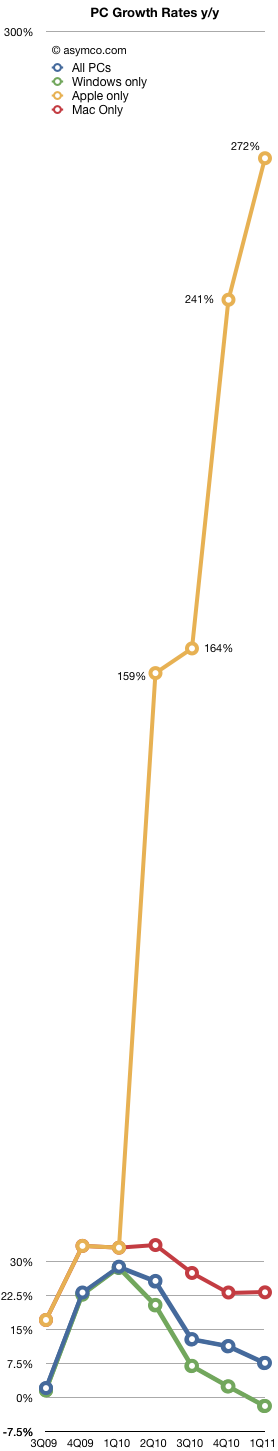

We can now get an understanding of how the industry behaves with and without various platforms. The chart at the left gives the various growth rates of the market with platforms isolated from each other. I apologize for the shape of the chart but the scale does not permit a concise visual.

Including the iPad, the total PC growth is shown by the blue line. It shows that the market peaked during the recovery but is now slowing considerably.

The green line shows the PC industry excluding both the Mac and the iPad. Although it might include Linux or computers sold without an OS, the label “Windows PC” is a fairly close approximation. It shows that the market excluding Apple entered contraction this quarter and is out of sync with overall economic recovery and growth.

The red line shows the behavior of the Mac franchise. It’s well ahead of the overall market with 2x to 3x the growth. This has been a pattern for over 18 quarters. I had some thoughts on this in a November 2010 hypothesis.

But the most telling line is the orange line which includes both the Mac and the iPad. In an industry where growth is usually measured in single digits, the iPad business brings growth in three digits.

This near tripling of unit sales is symptomatic of fundamental change that cannot be ignored. Although some analysts contend that the iPad is not causal to the decline in other PC sales, teasing out platforms data seems to show a divergent view.

The bottom line is that Windows-only computer units are down 2.0% while OSX-based computer units are up 272% (this excludes both the iPhone and iPod touch).

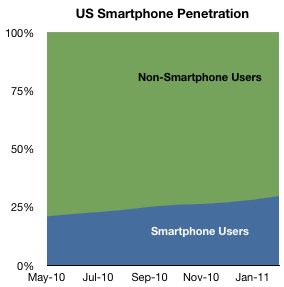

Correlation is not causation but tests or surveys where substitution can be proven do exist. For example, a recent survey shows that 77% of users reported that their PC usage decreased after getting a tablet. It also showed that 28% considered their iPad as their primary computer.

So coupling the sales data with the usage data does point an accusatory finger for the decline on the iPad.

In addition, some vendors are being hit harder than others which also hints at where substitution is happening. For example, IDC reports that Acer US unit shipments fell 42% in the first quarter and 16% globally (Gartner’s numbers are less dramatic but in the same direction). Since Acer is known for its netbook computers it’s another telling sign of possible substitution (Acer’s own management has indicated as much.)

So the weight of evidence is beginning to be conclusive: the iPad is the new PC. It should be clear by now that the iPad moves computing into new contexts so it does not yet substitute the PC market but extends it and increases consumption. Substitution is happening in low-end grazing type of usage, a place where the PC was ill-fitting anyway. Incumbent vendors might actually be relieved that the lower margin netbook is finally being supplanted and they can concentrate on the higher end.

—

Notes:

- Analysts like to call the iPad a “media tablet” but the same AdMob survey shows media consumption to be one of its least popular uses.