Like a siren, it calls.

The Auto Industry is significant. With gross revenues of over $2 trillion, production of over 66 million vehicles and growing it seems to be a big, juicy target. It employs 9 million people directly and 50 million indirectly and politically it must rank among the top three industries worthy of government subsidy (or interference). Indeed, in many countries–the US included–government interference makes it practically impossible for a producer to go out of business, no matter how poorly it’s managed or how untenable the market conditions.

But this might be the tell-tale sign that danger lurks. Theory suggests that incumbents going out of business is an essential indicator of industry health. Without their exit, entrants are never allowed to bring disruptive ideas to bear and innovation simply stops. Is this interference with mortality the only indication of entrant obstacles? Are things about to change? Is there pressure for innovation? Can we spot other indications of a crisis in this industry?

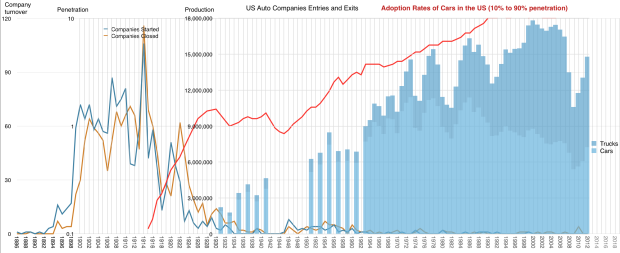

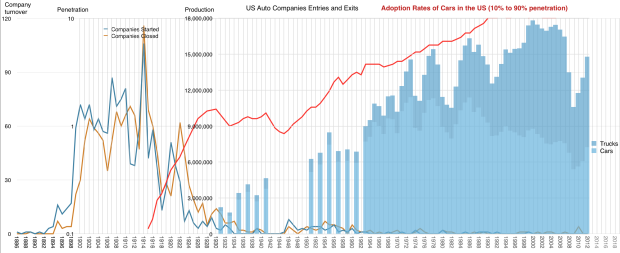

Taking the US as a proxy, here is a graph of the number of new car firm entries (and exits):

The total number of firms that entered the US market is 1,556. The blue line graph shows the entries and the orange line shows the exits. This sounds impressive, but note that the year when the peak of entries took place was 1914, exactly 100 years ago. Continue reading “The Entrant’s Guide to The Automobile Industry”