At time of writing (December 12, 2019) AirPods Pro delivery wait time is over 4 weeks. It’s been like this since they shipped. I tried stores in several countries and although units can make an appearance on a shelf, they sell out immediately.

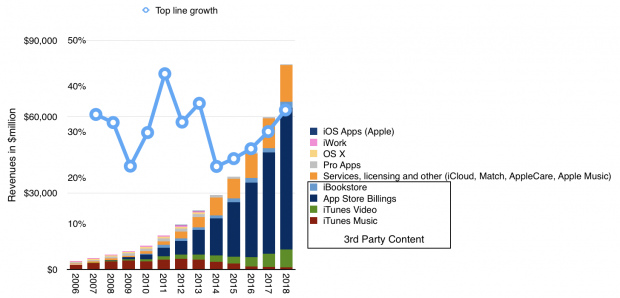

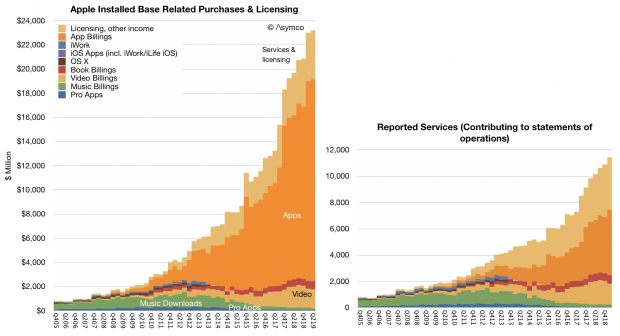

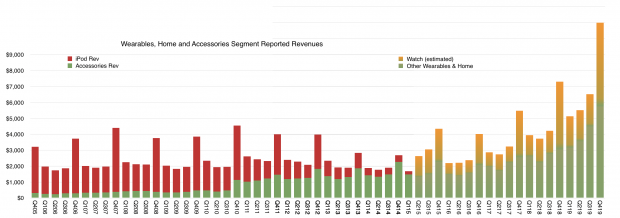

AirPods are part of the “Wearables & Home” category for Apple which used to be called Other Products and include also the Watch, iPod, Apple TV, Beats and HomePod (among other items.) iPod revenues were broken out as recently as 2015 but as the graph below shows, there have been no specifics on any product in “Wearables & Home” since then.

It therefore falls upon us to estimate how much of the entire category is any one product. It’s been very difficult as the only clues lie in growth rates, sometimes cited for the Apple Watch and sometimes for “Wearables” alone. As far as I can tell from the available clues, the split is roughly as shown between the Orange and Green areas. Orange reflects estimate for Watch and Green everything else.

This analysis helped me conclude the Apple Watch overtook the historic “peak iPod” which occurred in the fourth quarter of 2007 at $4 billion. My Watch revenue estimate was $4.2 billion in the fourth quarter of 2018. This conclusion was confirmed by statements from the Company.

The problem lately has been that AirPods have become huge unto themselves. There is literally no information about AirPods sales as a product category. The only option is to guess Watch and subtract it from Wearables and then guess again the portion of “non-Watch Wearables & Home” that is AirPods.

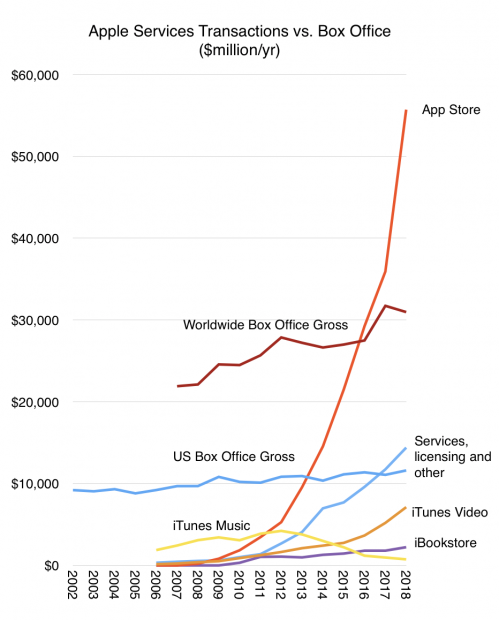

Looking forward to the next quarter, I am expecting a 51% increase y/y for Wearables and 24% growth in Watch. This results in a Watch revenues about $5.2 billion and non-Watch $5.7 billion. Now if we assume $1.7 billion for non-Watch-non-AirPods (i.e. Apple TV, HomePod, Beats, iPod, other) then this quarter AirPods will have overtaken peak iPod.

Remember that iPod was the phenomenon which reset all expectations for Apple. It caused Apple to cease calling itself Apple Computer. It (at least psychologically) laid the foundation for iPhone and everything else that followed. In 2005 and through 2007 Apple was “the iPod company”. I remember people working in a large search engine company calling Apple “that media company” as a result of over-intellectualizing iTunes.

(One more footnote on the AirPods Pro is that at $250 a pair and $300 for Apple Watch, throwing in a case puts these attached accessories for an iPhone at roughly the same average selling price for the iPhone of a few years ago.)

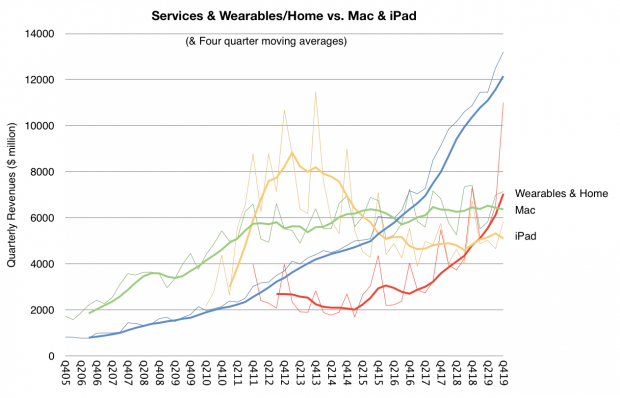

For the AirPods to overtake the iPod highlights just what a phenomenal category Wearables has become. In combination with Home and other accessories the category is going to decidedly overtake the Mac, having already passed the iPad.

And so it goes, something dismissed as inconsequential–”does not move the needle”–ends up becoming a massive force of change. The iPod was that, the original Apple II, the Mac and yes, also the iPhone. It’s the asymmetry of humility that this happens over and over again.

To hear more about the profundities of AirPods Pro tune in to the next Critical Path podcast.