Apple’s “Back to the Mac” was a clever play on words. Everyone expected it to mean that the event was going to focus back on new Mac products. As we had been so steeped in iDevice news the Mac was feeling neglected. It was time to take the discussion “back to the Mac.”

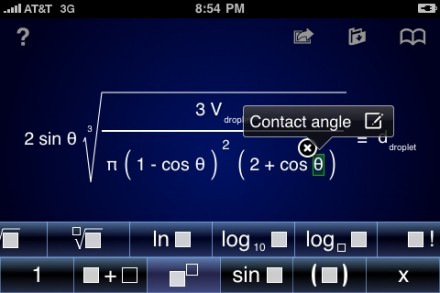

Instead Apple told us that the Mac and OSX were going to become more like Devices and iOS. iOS innovations were what’s going “back to the Mac”

So it wasn’t “back to talk about the Mac” it was “OSX went to iOS and iOS is going back to OSX.” The strategic upshot of it is that “the Mac is an extension of the device portfolio.” Heady stuff. We’ll need to chew on this for a while.

But some implications are easy to foresee. For example, the consequences for competitors. When Apple launched the iPhone, competitors followed suit, powering their phones with a variety of “open” operating systems. When Apple launched the iPad, competitors followed suit, powering their devices with a variety of “open” operating systems. These reactions to Apple’s initiatives by dozens of “open-wielding” competitors are all being touted as the inevitably winning strategies.

So, as we’ve observed all of Apple’s strategies being copied, I can’t wait to see the competitors follow its “back to the Mac” strategy:

- It won’t be long before Dell takes UI and hardware design elements from the Streak “back to the PC.” Think of the magic that will happen when Android Froyo “hooks up” with Windows 7. Both Android and Windows being “open”, if I squint hard enough I can just visualize the tweet from Andy Rubin of the command line to build a new Windows 8 with Android mojo. The Android Market selling Windows Apps. It will be beautiful.

- Or perhaps we’ll soon see “back to the Blackberry” as RIM takes QNX interface elements back to their core business. Not so sure about the command line make statement there.

- Or maybe Nokia will announce “back to Symbian” as they take gestures from the ultra-open MeeGo to do an evolution of their majestically open Symbian.

These initiative will surely be helped by the vast community of open developers surging to support the great open merged PC/tablet/device future.

As a clue to the sarcasm challenged: The power of Apple’s integrated approach across its product lines goes deeper than the user experience.