Although discussions related to how Apple will “use its cash” center on acquisitions of companies, Apple’s has been busy acquiring, just not companies. It has been buying capital equipment. Capital meaning (in the original sense of the word[1]) the means of production.

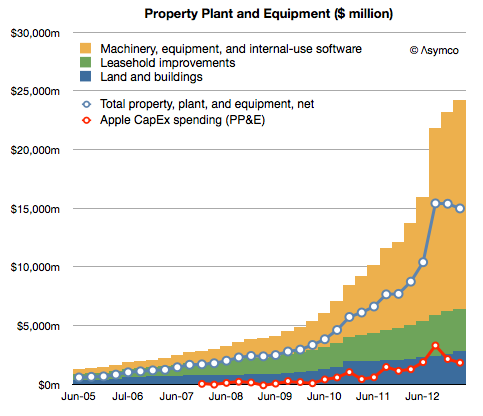

Since the launch of the iPhone Apple has spent $21.1 billion on the acquisition of property, plant and equipment. The company has already stated that they will spend another $10 billion or so for the current fiscal year. This has been mostly machinery and equipment used in manufacturing.

The result in asset value is shown below:

[The Net value, shown as a blue line, is after accumulated depreciation. The red line represents spending as reported on the cash flow statement.)

The change in spending year/year (fiscal) is shown in the following graph: Continue reading “In the weeds”