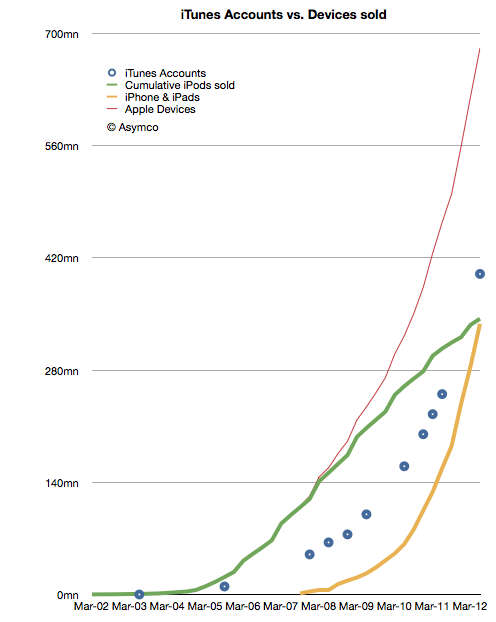

As previously noted, Apple has overtaken Microsoft (and Google) in operating margin percentage. This is an astonishing statistic as Apple is still largely perceived to be a “hardware company” while Microsoft is a “software company” and Google is a “services company.”

To suggest that “hardware” could be more operationally profitable than either software or services is akin to heresy in technology analysis. This reversal is newsworthy indeed. However, even the most casual observer would note that Apple does not derive its market power from hardware alone. It is, in fact, an integrated hardware, software and services company (with a few more roles besides.)

So the emergent successful business architecture in this technologically transitional period is of integration and completeness of solutions.

This shift explains at least at a conceptual level Microsoft’s tectonic Surface shift.

But what about another point of view? What does integration mean for Microsoft’s income, cost and profit structure? Is integration self-disruptive to Microsoft?

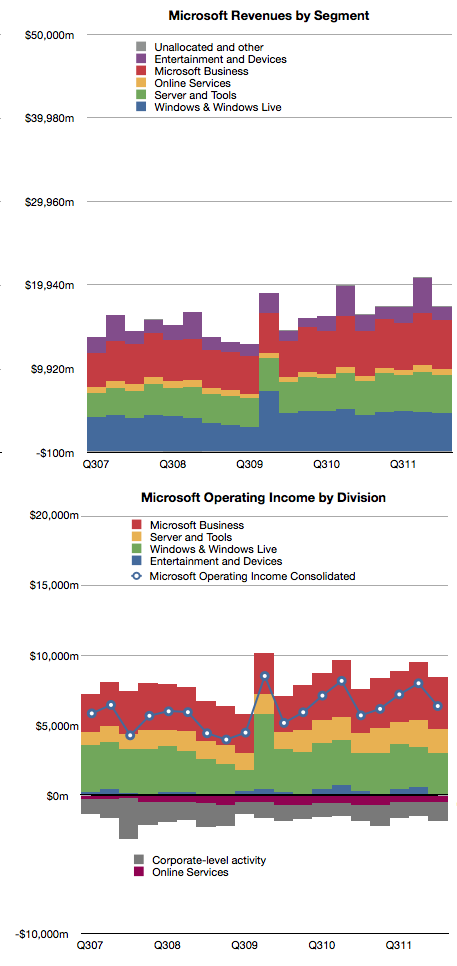

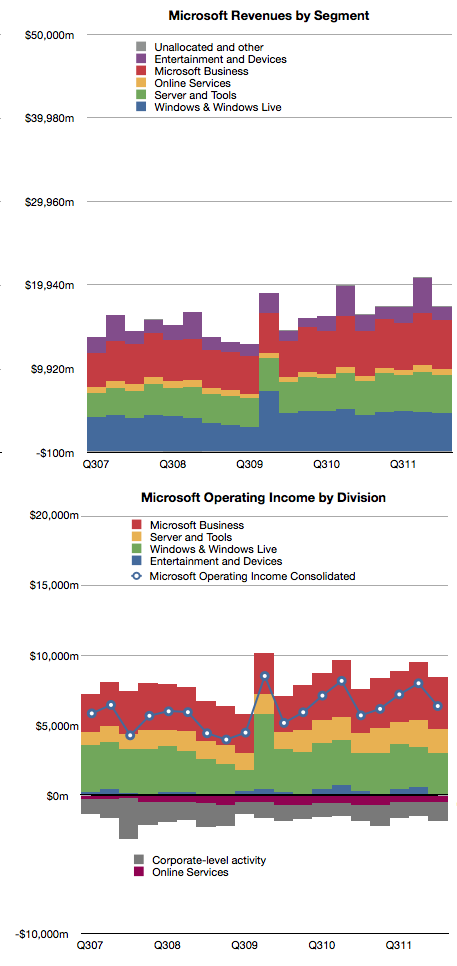

Here’s a reminder of Microsoft’s revenues and operating income by division:

The challenge of devices for Microsoft is that the licensing of software for devices is very difficult to sell. Continue reading “Who will be Microsoft's Tim Cook?”