Dan Benjamin is joined by Marco Arment of Instapaper.com and Horace Dediu of Asymco.com to discuss the just-announced Apple iPad 3rd Generation.

via 5by5 | 5by5 Specials #5: Fat Wireless: iPad 3rd Generation.

Dan Benjamin is joined by Marco Arment of Instapaper.com and Horace Dediu of Asymco.com to discuss the just-announced Apple iPad 3rd Generation.

via 5by5 | 5by5 Specials #5: Fat Wireless: iPad 3rd Generation.

Horace interviews writer/producer Dan Abrams. Dan talks us through the budgets and cost structures of independent movies as well as the obstacles to innovation presented by the current industry structure. We talk about some of the new concepts that are emerging as means to overcome these obstacles. We also talk about new forms of distribution and financing that enable long-tail film and TV content. Dan also talks about his upcoming mockumentary about the Global Financial Crisis (www.falseprofitthemovie.com).

The latest comScore US mobile subscriber monthly data is in: comScore Reports January 2012 U.S. Mobile Subscriber Market Share – comScore, Inc.

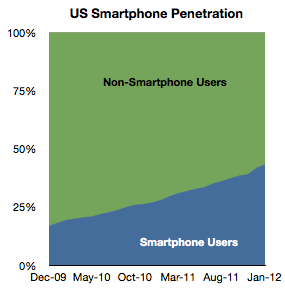

January saw a return to trend line growth in US smartphone add rates. The 767k/week rate is within the band after November’s below- and December’s above-the-line outliers. The weekly add rates are shown (with projection of trend) below:

The pattern shows a likely 1 million new smartphone users per week being added consistently by the fourth quarter of this year.

Overall, penetration of the sampled population (above age of 13, primary phone and excluding business purchases in the US) reached Continue reading “The unrelenting trends in the US smartphone market”

Overall, penetration of the sampled population (above age of 13, primary phone and excluding business purchases in the US) reached Continue reading “The unrelenting trends in the US smartphone market”

This is a reminder that I will be speaking at the Apple Investor Summit on March 15th at the Los Angeles Convention Center. My topic will be Apple’s capital expenditure structure and how that foretells strategy. I will present previously unpublished data and review the likely scenarios for 2012 iOS device production. As I prepared it I realized that with only 45 minutes there is a limited amount of detail I can provide.

To remedy that and to offer an opportunity to have a detailed question and answer session on related topics, I decided to offer a workshop-like reception at the end of the day. The time would be around 6:30 PM on the 15th and last at most two hours. The location will be in the vicinity of the LA Convention Center.

If you are interested in participating, please let me know so I can decide the type of venue to rent. Please also note that there will be a cost involved and pricing will depend on the number of participants. My current estimate is that the price will be $150 per person.

We’ve been very, very focused on China. China, we’ve had incredible success with iPhone. Over the past few years, we’ve gone from a few hundred million dollars of revenue in greater China, to last year $13 billion. So we really’ve been focused on trying to understand the market there and then taking those learnings to other markets. As it turns out–and not very many people agree with me on this, probably–but what I see is that there’s a lot of commonality in what people around the world want.

Transcript: Apple CEO Tim Cook at Goldman Sachs – Apple 2.0 – Fortune Tech

People do want the same things globally, but due to various constraints they typically don’t get the same things at the same time.

One of the most important constraints on the purchase of iPhones is the state of 3G (or, more broadly, mobile broadband) networks. An iPhone is a mobile computer whose primary value is derived from high bandwidth data communication. Because this bandwidth is not universally available, the iPhone faces a restricted addressable market.

The good news is that 3G networks are being adopted very quickly. The International Telecommunications Union reports that 20% of mobile users have “active subscriptions to mobile broadband” (1.2 billion out of 6 billion). That’s encouraging but the subscription rate varies widely by country. Ideally we should look at the data on a country-by-country basis.

To start, I took a look at two countries which may form an interesting sample: the US and China. The following chart shows the subscriber structure in the two countries grouped by 2G/3G subscription and by operator.

The two left-most columns represent nominally addressable iPhone markets. The two right-most columns represent currently unaddressable markets. Note that

What will iPads grow up to be?

We talk about how measurements of the market show an unprecedented growth in mobile computing and how that leads to a new context for computing along axes of non-consumption. That could result in devices becoming powerful enough to allow most people to be creative and reach self-realization.

I truly believe, and many others in the company believe, that there will come a day that the tablet market in units is larger than the PC market.

Tim Cook Discusses Q1 2012 Results – Earnings Call Transcript – Seeking Alpha

Question is when?

I began by projecting growth rates of various market participants including the leading Windows PC makers (HP, Acer, Dell, Lenovo and Asus), the combined “others” and the Mac. I also added the iPad, Samsung’s tablets, other Google sanctioned Android tablets and Amazon. I also projected a split between traditional and tablet Windows shipments.

The underlying assumptions are:

Building the platforms combined growth bottom-up gives the following forecast for the next two years (and historic growth shown for perspective.) Continue reading “When will tablets outsell traditional PCs?”

When cellular phones emerged in the 1980’s wireline phone service was excellent. Penetration was at 99 percent in the United States and prices had never been cheaper. The industry was deregulated and phone companies were competing fiercely over long distance calling plans. In contrast, the new cellular phones were not “good enough” on the basis of what was considered necessary for making critically important phone calls.

Sound quality was poor, coverage was spotty and battery life measured in minutes. But they allowed a whole new consumption model of communication to emerge. They allowed a caller to call a person not just a place. Over time, this simple value proposition caused a powerful profit formula to emerge. That formula led to extremely rapid improvement in the quality of the network and devices that connected to it.

It caused such a cataclysmic change that twenty years hence it became possible (even natural) for consumers to “cut the cord” and abandon wireline communications altogether. The “excellent quality” wireline industry was dead to be replaced by the “good enough” wireless industry.

One consequence of mobile telephony was increased consumption. Voice call minutes increased dramatically because calling could happen anytime from any place. While overall consumption increased, landline use decreased. Then came messaging of various types. Forms of communication enabled by cellular networks that simply did not exist before with landlines.

As a result there were vast pools of profits available to telcos that seemed to appear out of nowhere. SMS and data plan income was beyond anyone’s ability to forecast in the 1980s.

The same phenomenon is happening with smartphones. Consider a proxy measure: operating profits from mobile phones since the iPhone launched, illustrated below.

The latest data from Google shows that the Android activation rate is increasing at a relatively steady rate (i.e. acceleration is constant). The data provided so far is in the blue circles below. The green line is the interpolation and extrapolation of that data.

As the graph is projected forward we get an activation rate of one million per day by mid August of this year. If it continues then we could see 1.5 million per day by end of 2013. Continue reading “When will Android reach one billion users?”