Horace interviews James Allworth, author, Fellow at the Forum for Growth and Innovation at Harvard Business School, and a former Apple employee. James describes what it’s like working with Clayton Christensen and takes us on a journey through the latest academic and applied research being conducted on the theories of disruptive innovation.

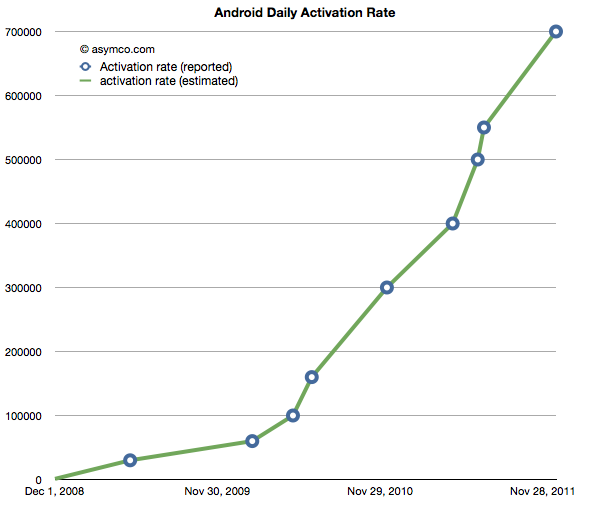

How many Android phones have been activated? (Updated)

The following chart shows the reported (circled points) and estimated (lines) for Android activations. The resolution of the sampling is every seven days.

If we take these estimates and then compile a cumulative total of activations we get the green line in the chart below. Continue reading “How many Android phones have been activated? (Updated)”

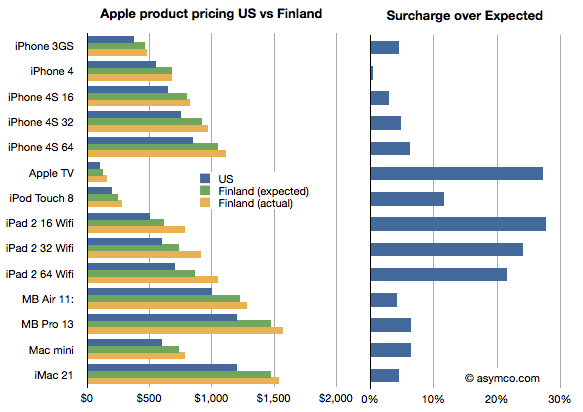

The big Mac (and iPad and iPhone) index (Updated)

Apple’s products are globally consistent. They sell the same exact[1] product in all countries. An unlocked iPhone is the same everywhere. It makes the products “liquid” in that they can be easily bought and sold across borders.

However, laws do not permit the import and friction-free trading of electronic products. In addition to regulations there are duties levied and there are sales or consumption taxes levied on the purchase.

However, knowing the retail price of an Apple product in a particular location, and knowing the tax and duties levied, can we work out if the price is consistent?

Here is an example:

I illustrated the price of a basket of Apple products in the US online Apple store Continue reading “The big Mac (and iPad and iPhone) index (Updated)”

The parable of RIM

Here are the highlights from RIM’s latest quarter:

- 14.1 million BlackBerry smartphones shipped, 13 million sold through

- 150k PlayBook shipped with sell-through slightly higher. 800k PlayBooks shipped so far.

- BlackBerry subscriber base up to 75 million

- High growth cited for U.K., France, South Africa, Mexico and Argentina, Indonesia, Saudi Arabia and South Africa. RIM is the #1 smartphone vendor in the Latin America and Caribbean region. Sales outside the US, UK and Canada were 61% of revenues. US is now 20% of sales, UK 11%.

- Hardware growth outside the US was 56%

- There are 630 carriers

- 50k apps in App World with 5 million downloads per day

- Forecasting 11 to 12 million smartphones next quarter

Given the channel fill with a new product, the device business was marginal at best. The company obtained -1% growth y/y in units but 31% sequential growth from a transitional quarter. The average selling price (inclusive of service revenues) is $354 and about $280 excluding service revenues. I estimate that operating margins have dropped to about 11%. Not a good story, but one we have been warned to expect.

But a crucial new twist to the story is that RIM announced that they don’t expect new BlackBerry 10 devices until late next year. That came as a surprise and the stock sold off significantly, valuing the company at well below book value.

Stepping back, the biggest surprise is that the company seems to have had no plan for sustaining itself.

Let me explain. Continue reading “The parable of RIM”

On being reasonable

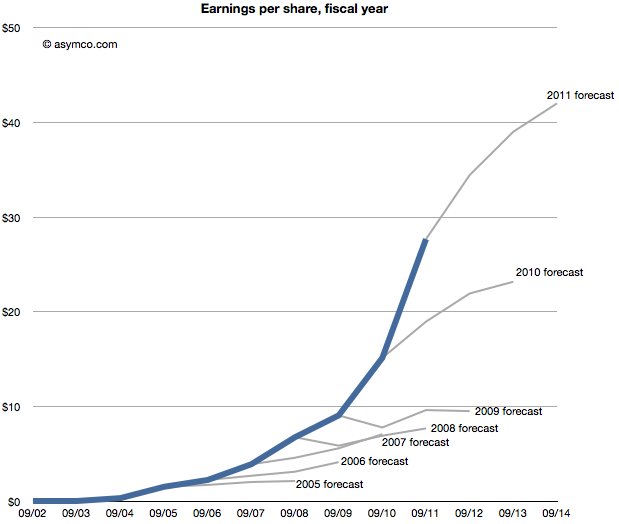

The discussion on why Apple is cheap was very useful. The debate brought into focus the possible causes for pessimism in the face of overwhelming evidence to the contrary. But maybe there is yet another explanation. The way the data was presented was as a difference between historic and projected growth rates. Is this the way analysts actually think?

Perhaps they don’t project growth based on historic growth, but project earnings given historic earnings. In other words they don’t look at the first derivative (change in earnings) but the shape of the actual data.

The following chart shows that data, i.e. forecasts as an extension of a sales trajectory. The blue area are actuals and the grey branches show projections at a given end of fiscal year.

Seen this way, we can imagine how the projections can be considered Continue reading “On being reasonable”

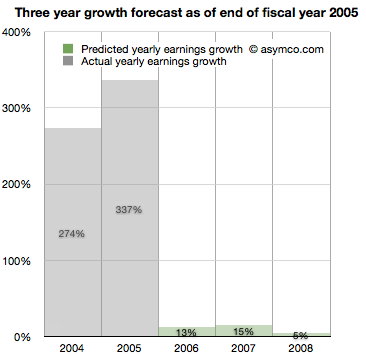

Why Apple is cheap

Imagine it’s late 2005. Apple’s fiscal year just ended and they reported their performance. You’re an analyst whose job includes forecasting the company’s performance for next year. This is a weighty responsibility. Your forecast will be blended with those of your peers and used as a “consensus” average. That consensus for the next year will be used to measure the current value of the shares in a ratio called the forward PEG or Price/Earnings/annual earnings Growth. You are supplying the earnings and hence growth forecast while the market offers a price. As a stock is meant to measure future earnings, your forecast is a crucial and frequently cited figure about whether a stock is priced fairly.

There is some comfort in knowing that there will be many others who will offer such a forecast and your contribution is thus not the only way investors can calibrate the price. However, you should think hard about what you are predicting as it also will reflect your skill in predicting such a visible company.

Apple just had a tremendous two years. 2004 and 2005 saw EPS grow at 274% and 337%. This is largely due to the runaway hit iPod. Given all that is known about the company, what will you put forward? While you’re at it can you also forecast two years forward, namely provide a growth forecast for 2006, 2007 and 2008?

Here is what you and your cohorts publish as a consensus:

You go with a 13% growth for 2006, 15% for 2007 and 5% for 2008. The chances are, you reason, that the iPod will not carry the company’s growth much longer. The competition is sprouting all over and Microsoft is rumored to be launching its own music player.

You go with a 13% growth for 2006, 15% for 2007 and 5% for 2008. The chances are, you reason, that the iPod will not carry the company’s growth much longer. The competition is sprouting all over and Microsoft is rumored to be launching its own music player.

It makes sense to be conservative and offer a modest growth of 13%. At the same time you can rate the stock a buy as it is still growing. The stock just doubled in the last 12 months and the law of large numbers says that growth cannot last at the same rate as we’ve just seen.

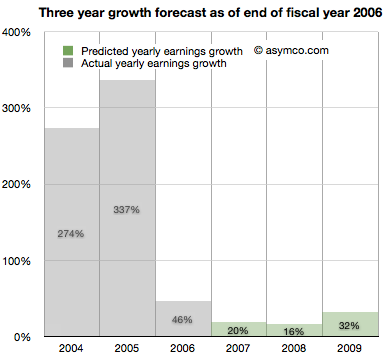

It’s now late 2006. Apple just closed out another big year. Contrary to your forecast last year, the company grew at a rate of 46%, more than three times faster than you expected.

It turns out the iPod still has some legs and the company’s Mac business seems to be growing. Looking forward you take your 15% growth for 2007 and increase it to 20% and suggest 16% for 2008 and 32% for 2009.

There are rumors of Apple getting into the phone business.

5by5 | The Critical Path #16: The Existence Proof

Horace interviews Dan Benjamin on the motivation, basis of competition and trajectory of the 5by5 network. By studying where podcasting came from and where it’s going we provide proof of existence of disruption in “big media”.

via 5by5 | The Critical Path #16: The Existence Proof.

Turning the tables in more ways than one.

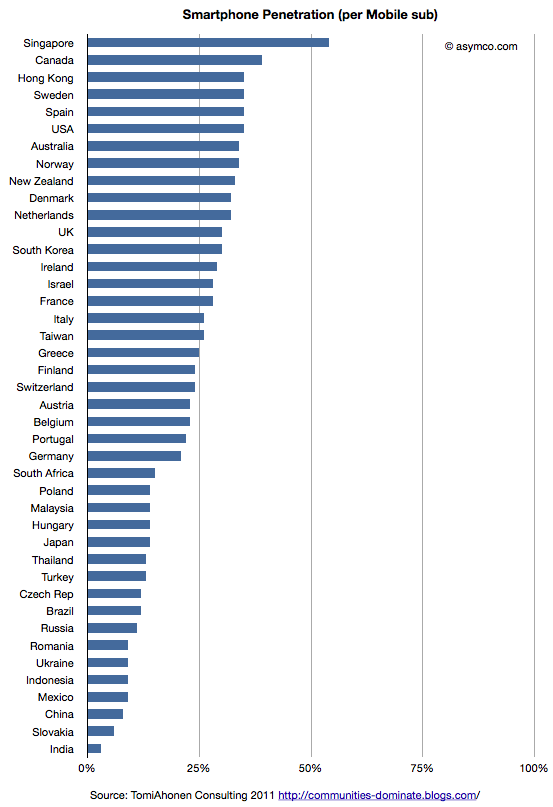

Global smartphone penetration nearing 10%

Tomi Ahonen has compiled a fascinating data set on 42 major countries’ smartphone penetration rates. The compilation is based on Netsize Guide, Informa, Google and Ipsos data. It is a complex sample with multiple possible sources of error (read the post for the caveats.) However, this is a breakthrough. It’s the first time I’ve seen this level of detail at a country level in the public domain.

I maintain visualizations of ITU data which shows overall mobile consumption and broadband consumption and penetration. In order to maintain a consistent basis of comparison, I prefer to use ITU’s measure of consumption which is “subscriptions” rather than “population”. The ITU derives this measure because mobile operators think of points of connection (subs) rather than people as the measure of consumption. This makes some sense because connections are what are monetized–not people.

So the first piece of analysis is to show this measure of penetration (smartphones as a percent of subscriptions) for the 42 sampled countries.

This view shows which countries “lead” adoption in terms of penetration. It shows that the US is quite high in the ranking and the most penetrated “large” country.

This is highlighted by the following chart which shows penetration of smartphones vs. total subscriptions with bubble size representing population size. Continue reading “Global smartphone penetration nearing 10%”

5by5 | The Critical Path #15: The Theater of Disruption

With this interview, we begin a journey into the world of entertainment and the forces that are re-shaping what most of the world hires daily for recreation. We will talk to actors, writers, producers, distributors, and media execs. We’ll get perspective on what I expect will be a big year for television in 2012 and prepare for the new era to follow.

In this episode I talk to actor Hoon Lee[1] about the challenges of disruption in the creative arts, and theater in particular.

5by5 | The Critical Path #15: The Theater of Disruption.

- Soon to be the voice of Master Splinter on the to-be-re-released Teenage Mutant Ninja Turtles TV series. More about Hoon here: IMDb.

- Read more here: Building identity – Hoon Lee: a black sheep because he was artistically inclined

Hiding in plain sight

Guessing the next Apple product has become the parlor game of choice for a whole generation of technology journalists and analysts. The premise of the game is that given a track record of breakthrough products, there is always another one just around the corner. Being the one to predict this next breakthrough product creates credibility and demonstrates the domain knowledge of the predictor. If the prediction fails to materialize there is consolation in dismissing the actual announced product as disappointing, unsophisticated or, worst of all, uninteresting.

Most often, these guesses are as much a reflection of the analyst as they are an analysis of the company. Too many predictions are designed to impress or demonstrate the imagination or knowledge of the predictor. They typically anticipate a giant leap of functionality, power or market re-structuring. They envision revolution not evolution; a cutting of the Gordian knot not a polishing of ugly rocks.

Yet nearly all of Apple’s launches have been sustaining improvements in existing products, technologies or platforms. To name just a few: Continue reading “Hiding in plain sight”